- Wrapped Bitcoin dominates the DeFi ecosystem with a powerful foothold.

- Per AMBCrypto, AAVE has strategically maximized its advantages from the rising WBTC publicity.

Wrapped Bitcoin [WBTC] stays the dominant Bitcoin by-product in DeFi, commanding over $9 billion in TVL. In reality, WBTC provided on AAVE has reached a document excessive, surpassing $2B.

This surge displays the broader pattern in DeFi, the place bullish Bitcoin sentiment fuels elevated WBTC exercise.

Advantages of Wrapped Bitcoin

Curiously, builders created WBTC to bridge the hole between Bitcoin and Ethereum, permitting customers to leverage the advantages of each networks.

Nonetheless, AAVE, a Layer 2 DeFi platform on the Ethereum blockchain, has reaped essentially the most advantages, holding 37,000 WBTC valued at over $2B.

In essence, Wrapped Bitcoin stays a well-liked alternative amongst traders. Moreover, elements like elevated liquidity and the will for BTC publicity in DeFi might need contributed to this surge.

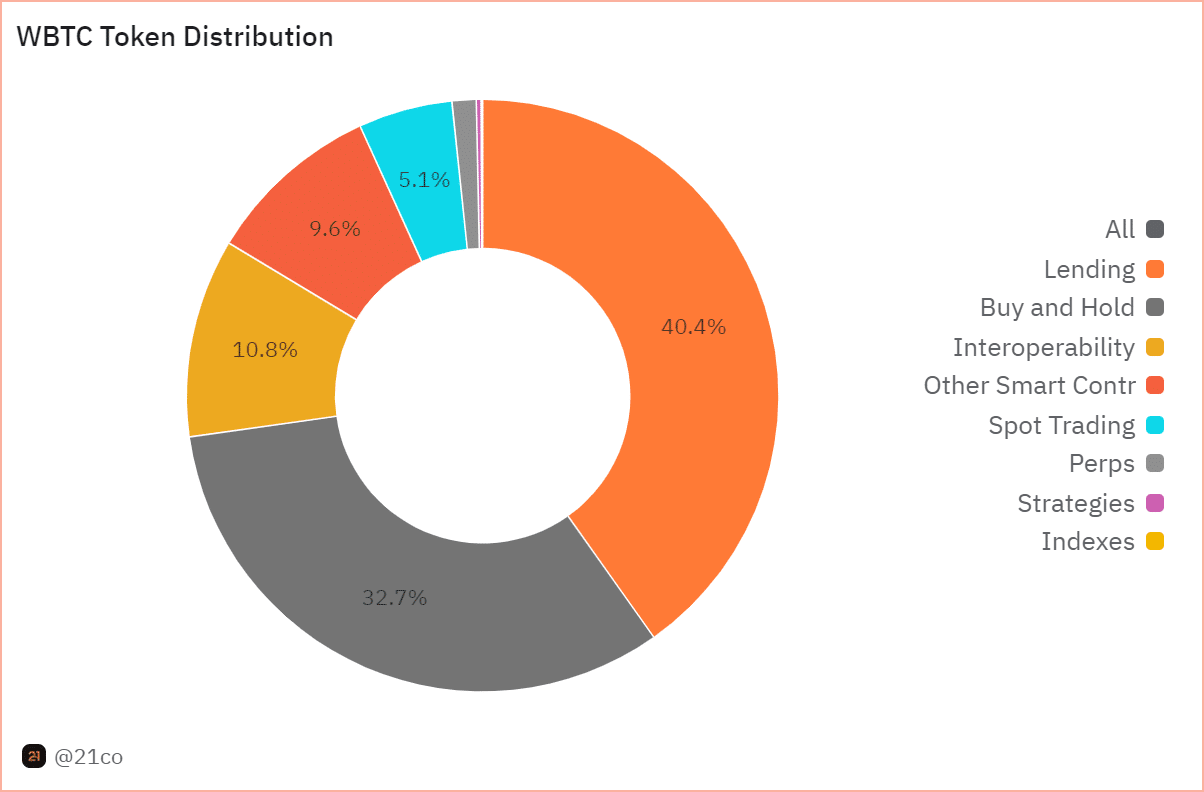

Given AAVE is a lending platform, the 40.4% dominance of WBTC within the lending sector justifies the document provide of Wrapped Bitcoin on the platform.

Right here, traders can earn curiosity, enabling Bitcoin holders to maximise returns on their belongings with out promoting their BTC, whereas additionally retaining direct publicity to Bitcoin when it assessments key resistance ranges.

Merely put, as Bitcoin’s worth rises, the collateral quantity in WBTC can even enhance, additional encouraging its use on platforms like AAVE. Moreover,

THIS is attracting WBTCs on AAVE

As talked about earlier, WBTC can be utilized in yield farming, the place customers stake their belongings in DeFi platforms to earn further rewards. This incentivizes customers to transform their Bitcoin into WBTC.

Per AMBCrypto, AAVE has strategically embraced elements that entice Wrapped Bitcoin holders to its platform.

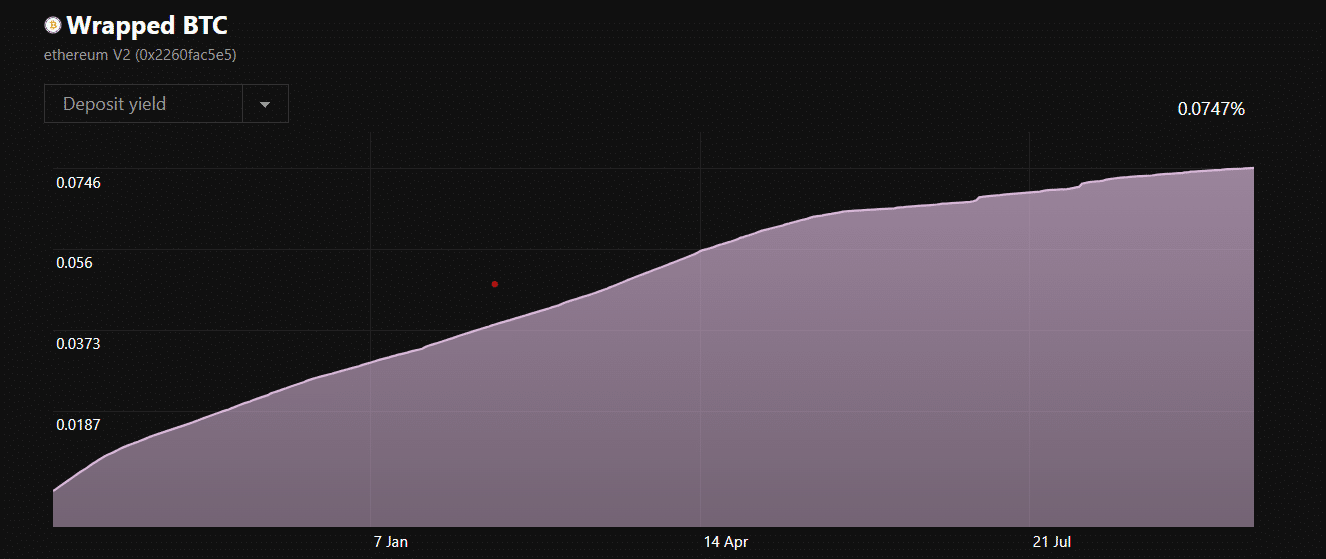

Curiously, a yr in the past, the yield earned on WBTC deposits was 0.000489%, which has surged to 0.0747% a yr later, marking a staggering 15,196% enhance.

Most significantly, every WBTC token backs one Bitcoin, which means customers can at all times redeem it for the equal quantity of Bitcoin.

Moreover, through the use of WBTC as collateral, customers can borrow different cryptocurrencies or stablecoins, permitting them to leverage their Bitcoin holdings in numerous methods.

Read Wrapped Bitcoin’s [WBTC] Price Prediction 2024 – 2025

In abstract, the uptick in WBTC provide on AAVE comes amid skepticism surrounding its custodial arrangements.

Despite these considerations, Wrapped Bitcoin stays a well-liked alternative amongst traders, and AAVE has actually reaped essentially the most advantages.