- Ethereum dominance is declining regardless of total market cap being on the rise.

- ETH staying above all weekly shifting averages alerts energy.

Ethereum [ETH], the second-largest cryptocurrency by market cap, is going through challenges in sustaining its dominance within the broader crypto market.

Whereas the entire market cap of cryptocurrencies, excluding stablecoins, exhibits a long-term upward development, ETH’s share on this market is declining.

Presently, Ethereum’s market dominance sits barely above 15%, signaling that ETH may be at a vital level. With ETH’s market cap fluctuating from $546 billion to $316 billion at present, its wrestle to regain dominance raises questions.

An increase within the whole market cap whereas ETH’s share declines might point out a divergence, typically signaling a reversal or continuation of a development. The uncertainty about whether or not ETH will transfer larger or decrease stays a essential situation however what are different metrics saying!

ETH staying above weekly SMAs

Ethereum is holding robust on its weekly easy shifting averages (SMAs), offering a bullish outlook. ETH stays above key SMAs, together with the 8SMA and 20SMA, suggesting robust momentum.

That is an encouraging signal that Ethereum could proceed its restoration, because it has bounced again from a deep decline when its value reached $2,100.

ETH’s skill to remain above these SMAs signifies that each the short-term and long-term upward traits on the weekly stay intact. Nevertheless, merchants ought to stay cautious, because the upcoming This fall is anticipated to convey volatility.

Regardless of a dip in ETH’s market dominance, these indicators help the notion that Ethereum continues to be on a bullish path.

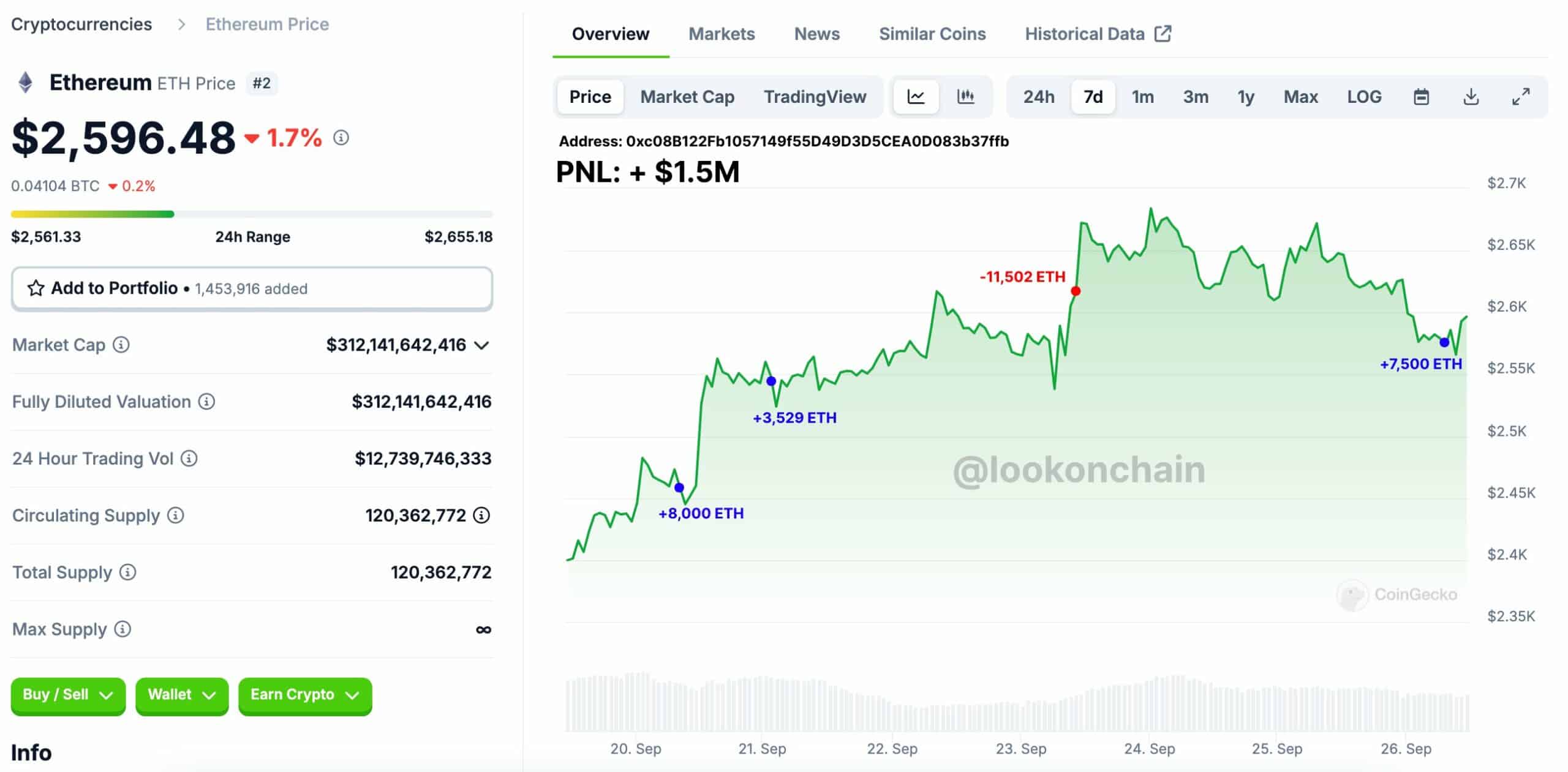

Good whales profiting

Good whales are capitalizing on these fluctuations, providing additional help for a bullish outlook. Some savvy merchants have made vital income by shopping for Ethereum throughout dips.

One whale, 0xe0b5, has constantly swing-traded ETH, with a 100% success price throughout eight trades since August 12. This whale purchased over 10,000 ETH price greater than $26 million and offered at larger costs, incomes over $1.56 million in revenue.

One other whale, 0xc08B, purchased 11,529 ETH price over $28 million at $2,485 and offered at $2,618 simply three days later, making a $1.5 million revenue.

These actions display that enormous merchants consider in Ethereum’s potential for larger beneficial properties regardless of its current dominance struggles.

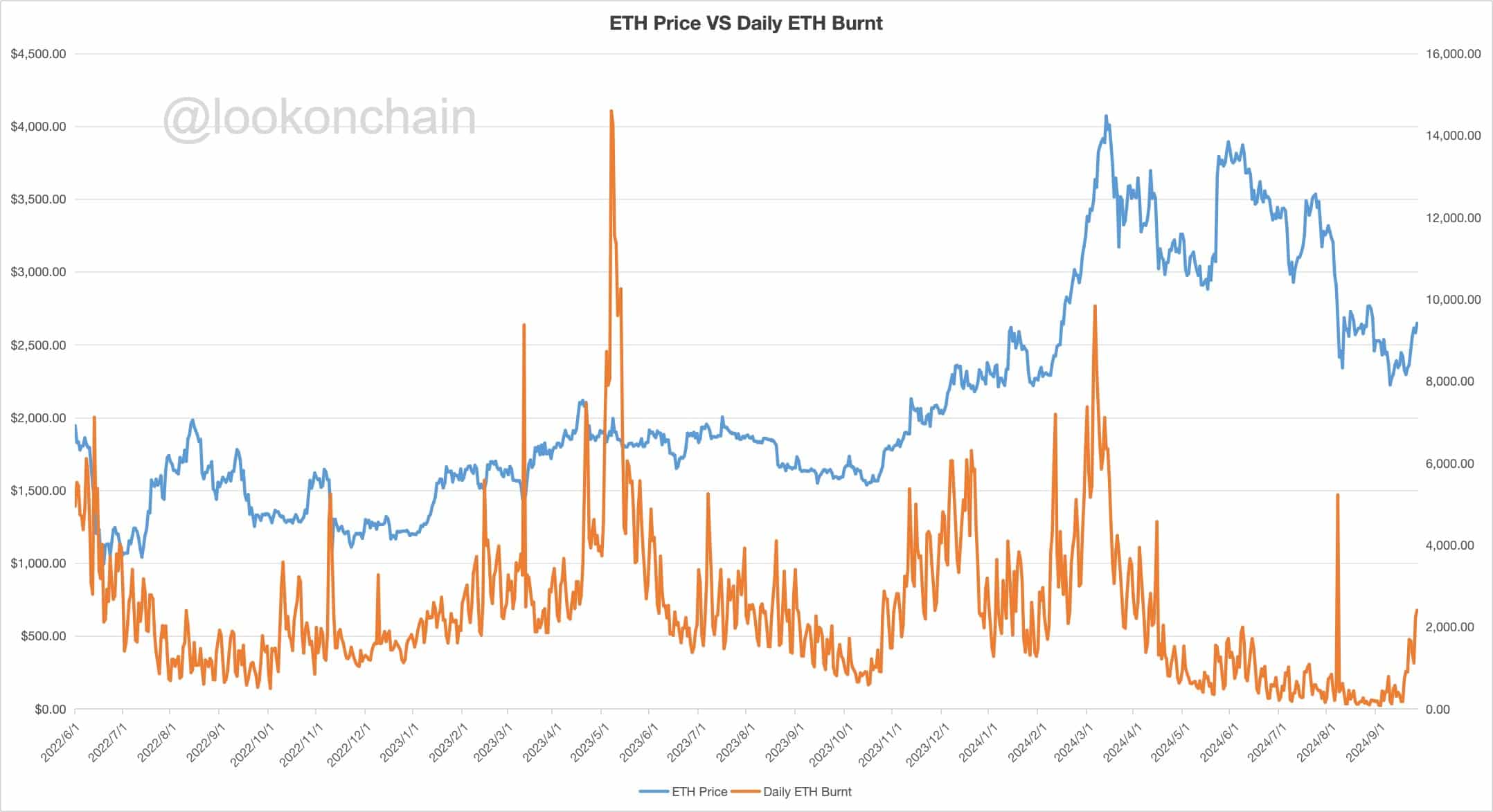

Day by day ETH burnt will increase

Moreover, the each day quantity of ETH being burned has elevated by 163% up to now week, offering one other optimistic sign for Ethereum’s future value.

The ETH value and each day ETH burnt chart present a transparent sample, with the quantity of ETH burnt rising earlier than value rises in January and October 2023.

This burning of ETH reduces the general provide, which may drive the worth larger if demand stays regular. Because the burn price rises, so too does the probability of ETH’s value rising.

Learn Ethereum’s [ETH] Price Prediction 2024–2025

Supply: Lookonchain

Regardless of the present challenges in market dominance, the robust efficiency of ETH on key technical ranges, whale exercise, and the rising burn price all counsel Ethereum’s value will proceed to rise.

These components level to a bullish future for ETH, although its dominance available in the market could also be in decline.