Ethereum is wavy when writing as bulls battle to construct momentum and push the coin above the rapid resistance ranges at round $2,400 and $2,800. Even so, most ETH holders are upbeat, anticipating costs to show across the nook and soar, even breaking above July highs of round $3,500.

61% Of ETH Holders In The Cash

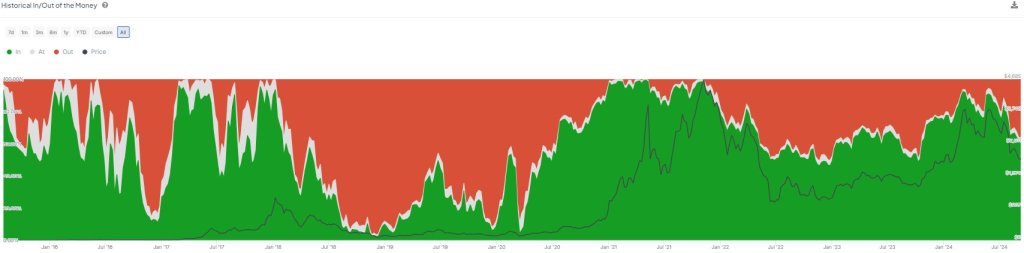

Amid this growth and the overall lull, IntoTheBlock knowledge shows that 61% of all ETH holders are within the cash. That over 50% of all ETH holders are in inexperienced regardless of the coin shedding practically 35% from July highs and practically 45% from 2024 highs factors to resilience, particularly within the face of decided bears.

Technically, the resilience amongst ETH holders signifies a wave of optimism sweeping by its ecosystem. In response to IntoTheBlock, this growth implies that at present ranges, extra ETH holders are being profitable, means greater than in bear market cycles. Then, profitability tends to fall drastically.

For context, IntoTheBlock analysts be aware that in the course of the 2019/2020 interval, when costs fell, the proportion of worthwhile holders at one level dropped to as little as 10%.

Moreover, within the final bear run, the proportion of ETH holders being profitable fell to 46%. Nevertheless, this was means greater than the three% when ETH costs dumped to as little as 3% within the depth of the 2018 bear run.

Ethereum Holders Assured, Help Lies At $2,290 And $2,360

ETH’s profitability share has developed through the years, pointing to a maturing market the place holders are nonetheless assured about what lies forward.

In response to Dune data, there are 128,804,395 ETH within the circulating provide. Out of this, the highest 1,000 addresses management over 49.1 million or 38.15%. If IntoTheBlock knowledge is something to go by, most of those whales are within the inexperienced, being profitable. Accordingly, they gained’t be incentivized to promote, growing stress on ETH.

Wanting nearer at on-chain knowledge, one analyst notes that ETH has a essential assist at between $2,290 and $2,360. On this zone, practically 1.9 million addresses had been purchased and at the moment maintain roughly 52.3 million ETH.

Tens of millions of ETH had been purchased at this stage, that means it’s a essential loading zone. If damaged, the analyst predicts sharp losses that can drop the coin beneath August lows to $1,800 in a bear pattern continuation formation.

Characteristic picture from DALLE, chart from TradingView