The Ethereum network, one of many main blockchain options has as soon as once more taken successful because the community’s common staker income over the previous few days has witnessed a pointy decline, indicating a lower in customers’ or stakers’ curiosity and engagement.

Ethereum’s Stakers Face Dimishied Returns

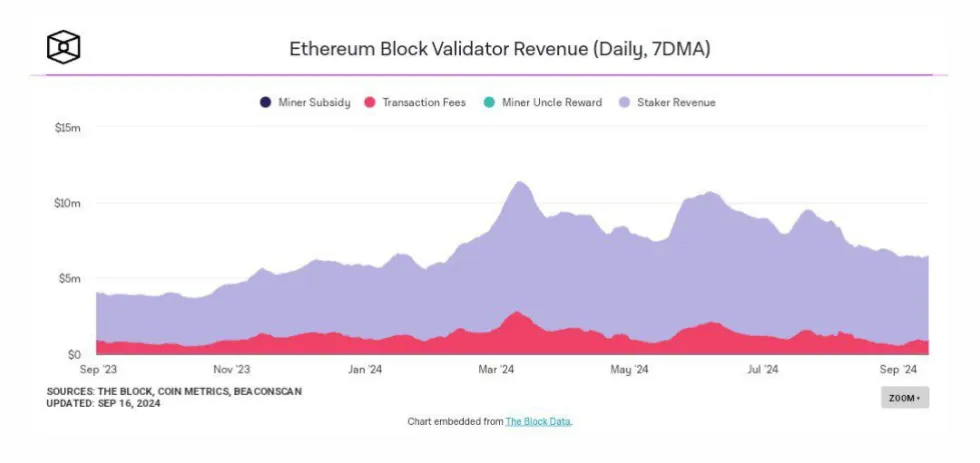

In a unfavorable growth, the common income of Ethereum’s stakes has dropped dramatically, reaching contemporary lows because the community exercise is experiencing a significant slowdown. Ethereum‘s proof-of-stake mechanism individuals have seen decrease rewards because of decreased demand and fewer transactions on the community, which has considerably impacted staking returns.

Kyle Doops, a well known market skilled and host of the Crypto Banter present shared the unfavorable growth on the X (previously Twitter) platform. The staking yields have declined as a result of a mix of things comparable to decrease transaction quantity, which coincides with a bigger drop out there.

In line with the skilled, Ethereum’s common staker income for the final 7 days fell sharply to a 6-month low. Particularly, on September 12, the income was recorded at about $5.44 million.

He famous that transaction fees additionally skilled a decline as a result of a drop in community exercise, which severely impacted staker earnings. Moreover, the transaction quantity and on-chain exercise plummeted, falling precipitously from March peaks and reflecting February 2024 ranges.

The typical staker income is considered one of many metrics that has fallen considerably up to now few days. Ethereum’s futures market funding charges have additionally skilled a lower to new lows.

Kyle Doops revealed that the futures market is at present hitting rock-bottom funding charges in 2024, indicating a persistent bearish pattern. As funding charges plummet to new ranges, merchants seem like taking additional warning, demonstrating a widening hole between lengthy and quick positions out there.

With the 50-day common funding fee exhibiting a constant bearish pattern, shopping for curiosity appears to be shrinking. Till perpetual futures or spot markets see a surge in demand, Kyle Doops is assured that the worth of ETH may stay low.

Do Latest Actions Counsel ETH Is Gearing Up For Good points?

Regardless of these unfavorable developments, Ethereum’s worth is slowly attracting beneficial properties as revealed by CoinMarketCap. On the time of writing, ETH stands at $2,326, reflecting a rise of about 0.61% up to now 24 hours. Nonetheless, this worth stage was recovered after ETH witnessed a powerful resistance on the $2,388 stage yesterday sending costs downward to $2,300.

Whereas ETH up to now day has been steadily growing, the weekly and month-to-month timeframe exhibits that the crypto asset has declined by over 0.50% and 11.14% respectively. ETH’s market cap and buying and selling quantity up to now have elevated by 0.60% and 14%, which signifies that buyers are betting on the digital asset’s renewed momentum.

Featured picture from Unsplash, chart from Tradingview.com