Crypto analyst Jelle has highlighted a bullish sample on the Bitcoin chart, which he predicts may ship its worth as excessive as $90,000. He additionally offered a timeline for when this parabolic rally may start. This comes amid a bullish outlook for the flagship crypto following the Fed rate cuts.

Descending Broadening Wedge May Ship Bitcoin To $90,000

In an X post, Jelle talked about a descending broadening wedge pattern that had fashioned on Bitcoin’s chart. He claimed that the sample has a worth goal of $90,000 and added that he expects the value breakout to this goal to start in October. The analyst additionally remarked that the fourth quarter of this 12 months needs to be “enjoyable” for Bitcoin.

Associated Studying

Certainly, based mostly on historical past, Bitcoin could enjoy significant returns all through October, November, and December of this 12 months. The flagship crypto has recorded optimistic month-to-month returns within the fourth quarter of the final two halving years. Furthermore, This autumn all the time yields the best returns of the 12 months for Bitcoin.

In the meantime, in one other X post, Jelle highlighted key worth ranges that Bitcoin wants to interrupt above to experience to a new all-time high (ATH) and this $90,000 worth goal. He remarked that claiming $62,000 shall be begin for the flagship crypto and that after the value breaks above $65,000, there shall be no stopping the practice to a brand new ATH.

Bitcoin’s present ATH stands at $73,000, a worth stage reached in March earlier this 12 months. Nonetheless, analysts like Jelle have continued to counsel that it’s nonetheless method beneath the crypto’s market peak in this bull run. There may be additionally the potential of Bitcoin rising above $100,000 on this bull run.

Standard Chartered predicts that BTC may attain this worth stage this 12 months. The financial institution has additionally predicted that Bitcoin may rise to as excessive as $150,000 if Donald Trump wins the election.

BTC’s Bull Case Simply Bought Stronger

Jelle additionally talked about that Bitcoin’s bull case grew stronger following the Fed price cuts. The US Federal Reserve announced a 50 foundation level (bps) rate of interest lower on September 18, a transfer extensively thought to be bullish for the flagship crypto. The crypto analyst talked about that expansionary coverage is on the horizon with looser financial again in place.

Associated Studying

More liquidity is anticipated to move into danger property like Bitcoin, sparking a worth surge within the crypto’s worth, which has remained stagnant for some time due to low demand. The bulls additionally look to be again following the speed cuts, which may sign a bullish reversal for BTC.

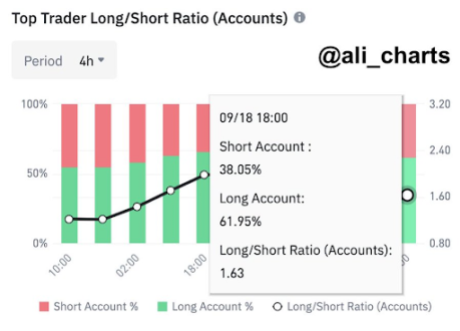

Crypto analyst Ali Martinez not too long ago revealed that 61.95% of prime merchants on Binance are going lengthy on the flagship crypto. Prior to now, there was a bearish sentiment amongst these merchants, as NewsBTC reported that 51.41% of them had been shorting Bitcoin.

On the time of writing, Bitcoin is buying and selling at round $61,900, up over 2% within the final 24 hours, in accordance with data from CoinMarketCap.

Featured picture created with Dall.E, chart from Tradingview.com