- Bitcoin, at $52,000, might signify the final golden alternative to buy.

- Giant merchants offloading their BTC holdings might drive the worth right down to this crucial assist degree.

Because the starting of the month, Bitcoin [BTC] has did not exhibit any important market actions. After reaching a peak of $59,844.10, it has declined to $56,855.25, a transparent indicator of the market’s rising bearish pattern.

The persistence of bearish pressures might in the end function a strategic benefit for traders seeking to accumulate at decrease costs.

Golden alternative at $52k

Crypto analyst Carl Runefelt has identified a crucial sample in BTC’s current buying and selling exercise. In accordance with his evaluation, BTC was oscillating inside a descending channel, characterised by a sideways and downward trajectory.

Traditionally, when an asset trades inside such a sample, an extra decline is anticipated.

True to type, BTC has recorded a 4.62% drop over the past week, with indications that it might proceed to slip to the channel’s decrease boundary.

What makes this situation significantly compelling is the convergence of the channel’s backside with a significant assist zone at $52k.

Ought to BTC’s value hit this degree, it might set off a big breakout from the descending channel and propel the asset towards new highs.

Runefelt views this situation as a crucial shopping for alternative, remarking,

“It might be our final golden alternative to build up it this low-cost.”

So, BTC is unlikely to revisit these ranges as soon as it begins its upward trajectory. This prompted AMBCrypto to look at the likelihood of BTC’s value dipping additional.

Buyers heed Bitcoin’s bearish name

AMBCrypto’s evaluation revealed that giant holders and institutional merchants have been anticipating an extra drop in BTC costs, as evidenced by important sell-offs out there.

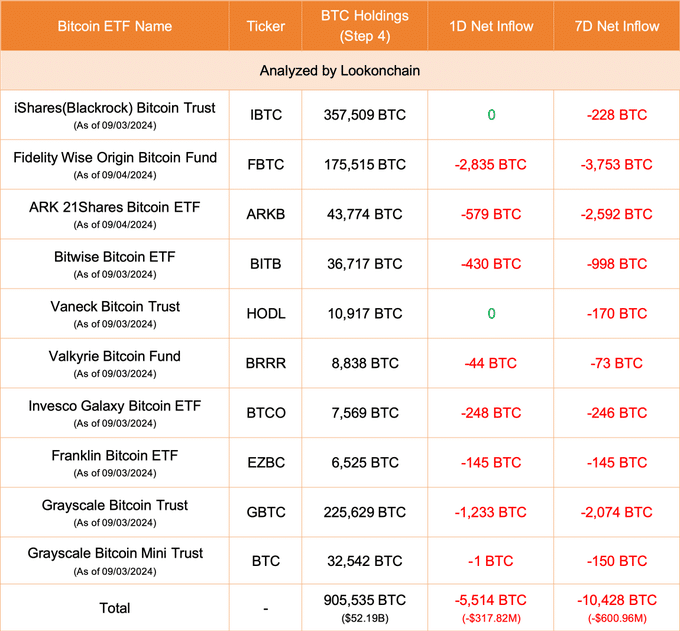

Data from Lookonchain indicated a considerable outflow from BTC spot ETF corporations—primarily catering to institutional traders—over the previous 24 hours and week.

Particularly, withdrawals totaled 5,514 BTC ($317.82 million) and 10,428 BTC ($600.96 million), respectively.

Additional reporting by Lookonchain highlights actions by Ceffu, a digital asset administration agency, which transferred 3,063 BTC price $182 million final week into Binance [BNB].

This prompt a method that endorses gross sales over long-term holdings.

Such strikes sign a shift in the direction of much less unstable belongings, like USD, as traders search to protect capital worth.

If these traits proceed, a dip for BTC to the crucial $52k degree, aligning with the underside of the buying and selling channel, seems more and more possible.

Bigger holders in a bearish outlook

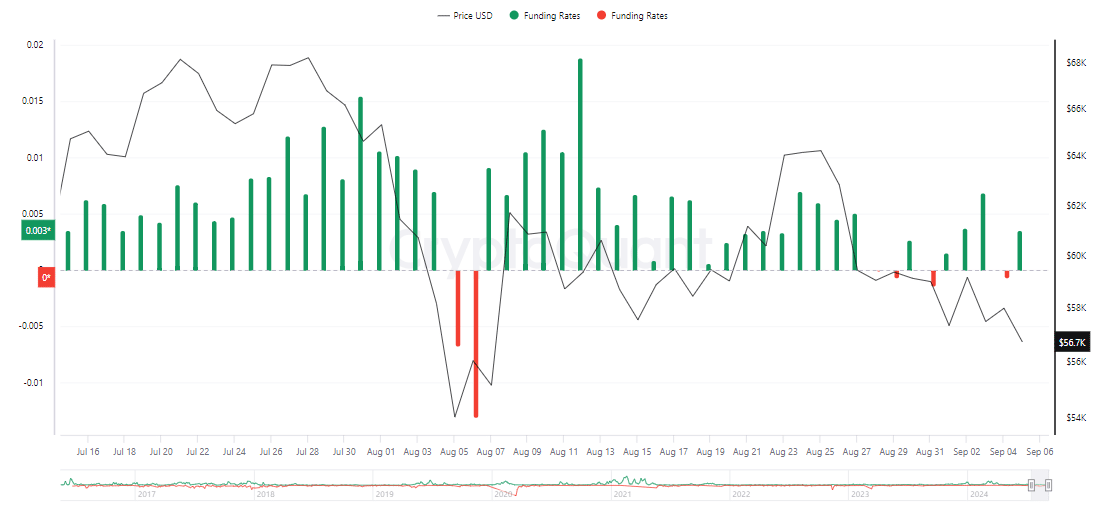

CryptoQuant reported a rising bearish sentiment amongst retail merchants. The Funding Price has steadily declined for the reason that third of September, dropping from 0.006839 to a press time studying of 0.004357.

If this pattern continues over consecutive days, it might sign an extra lower in BTC from its present degree.

Learn Bitcoin’s [BTC] Price Prediction 2024–2025

The Open Curiosity supported this attitude, exhibiting a decline towards the bottom level recorded on the first of September. According to Coinglass, at press time, there was a modest 0.58% drop up to now 24 hours.

Persistent bearish strain is more likely to cut back additional the Open Curiosity, which might straight influence BTC’s value, doubtlessly driving it decrease from its present place.