- 60% of U.S. hedge funds purchased Bitcoin as BTC/USDT broke out.

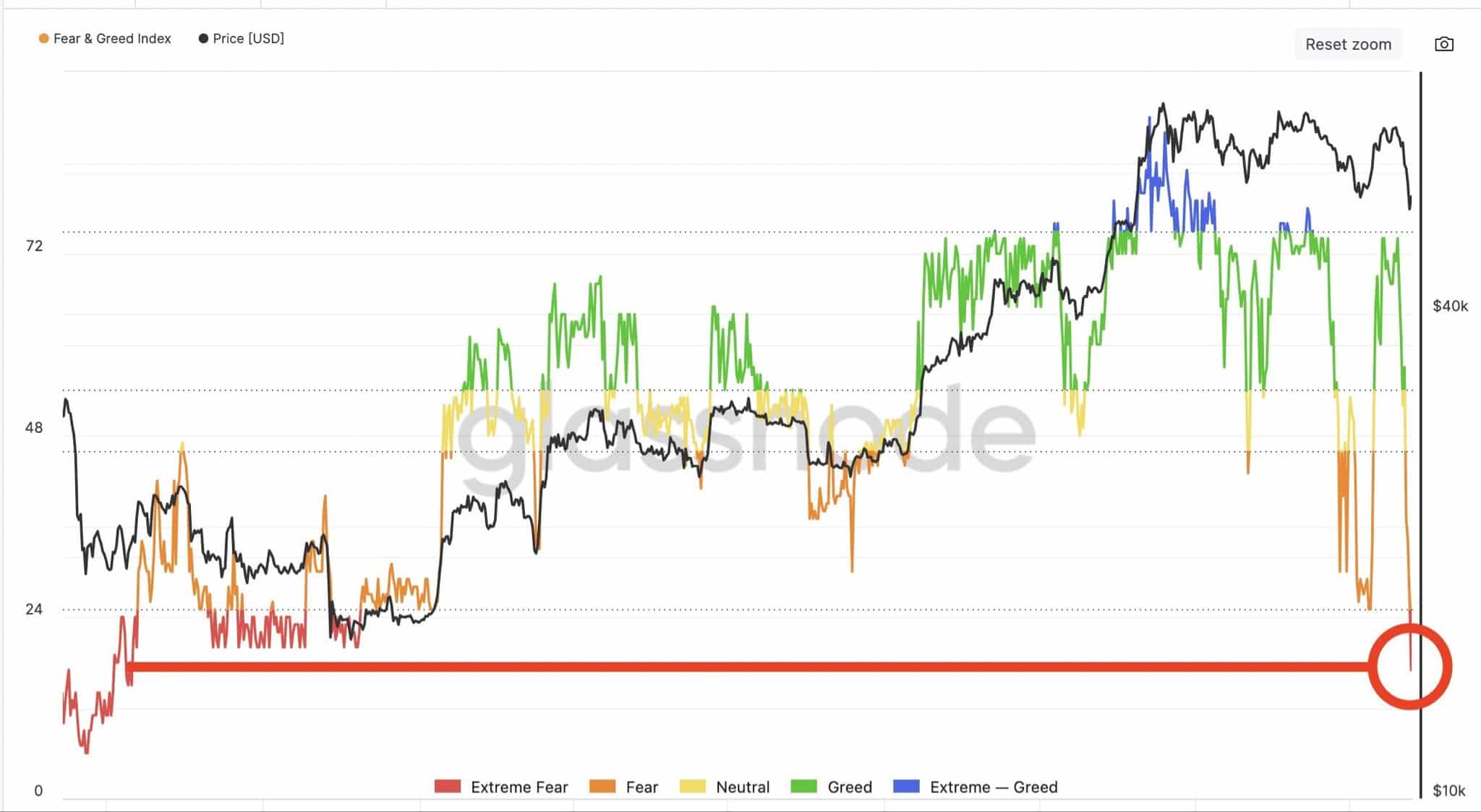

- Bitcoin ETFs possession surged because the Concern and Greed index matched sub-$30K ranges.

Bitcoin [BTC] has been gaining important traction from governments, main monetary establishments, and enormous merchants generally known as whales.

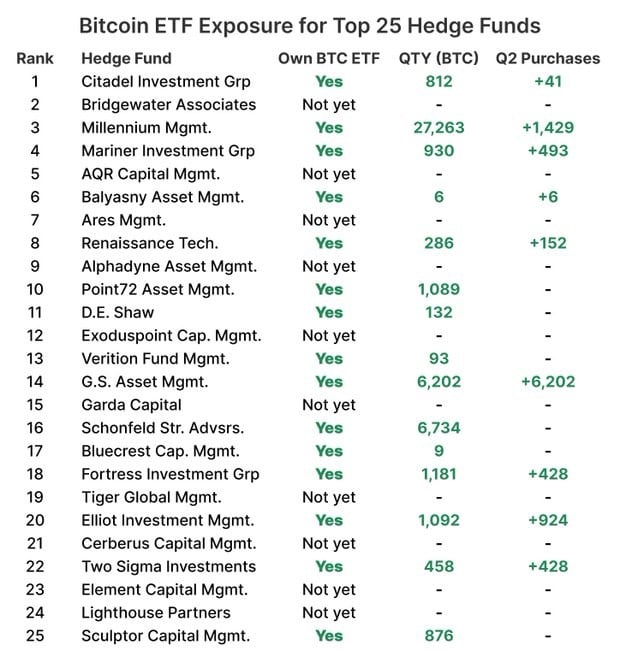

This rising acceptance is additional supported by China’s potential transfer to carry its cryptocurrency ban. Globally, 60% of the biggest US hedge funds have acquired Bitcoin publicity, as Quinten noted on X (previously Twitter).

These companies included distinguished companies like Citadel Funding Group, Millennium Administration, Mariner Funding Group and Renaissance Applied sciences, all of which bought Bitcoin ETFs in Q2 2024.

This development highlighted the rising institutional assist for Bitcoin and the general crypto markets.

Bitcoin value motion evaluation

Bitcoin (BTC/USDT) has not too long ago damaged out of a symmetrical wedge on the 4-hour chart and is now buying and selling at $60,000.

The value rise following the downturn on the fifth of August is basically because of institutional involvement, which has helped assist this degree.

Whereas some short-term pullbacks are anticipated, the $60K mark is a major psychological degree. Regardless of potential fluctuations, Bitcoin is prone to proceed shifting towards its all-time excessive.

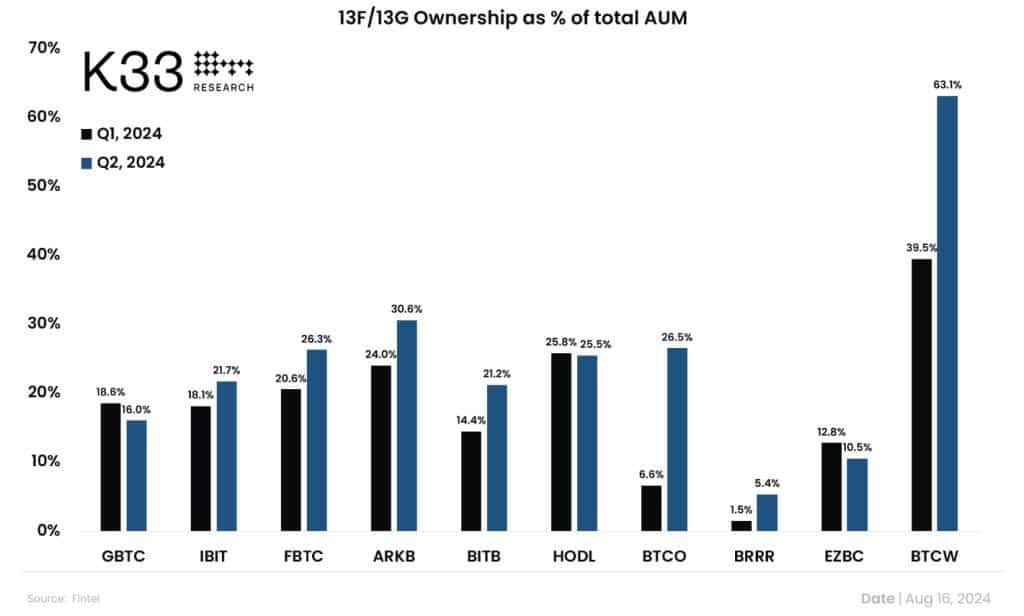

Bitcoin ETFs surge as mining issue reduces

In Q2 2024, institutional possession of Bitcoin ETFs surged by 27%. K33 Analysis reported that 262 new companies entered the U.S. spot Bitcoin ETF market, elevating the entire to 1,199 by the thirtieth of June.

This enhance mirrored rising institutional confidence in digital currencies. Consequently, Bitcoin is predicted to achieve a brand new all-time excessive by late 2024 or early 2025.

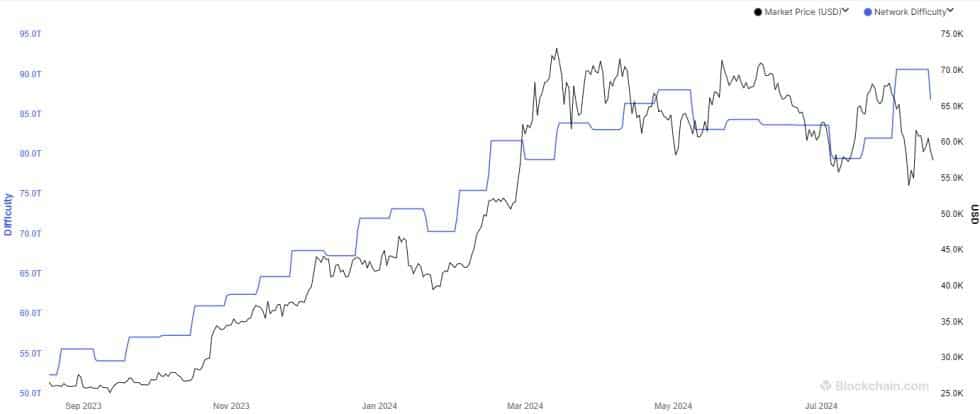

Not too long ago, Bitcoin mining issue decreased in its newest bi-weekly adjustment. This transformation impacts how shortly new blocks are created and regulates Bitcoin’s provide.

The discount in issue suggests a drop in general computing energy, permitting miners to maintain the block creation charge regular even with much less processing energy.

Market sentiment at identical degree when BTC was beneath $30K

The market sentiment was studying worry at press time, per the Concern and Greed Index.

Learn Bitcoin’s [BTC] Price Prediction 2024-25

The Concern & Greed index is on the identical degree as when Bitcoin was beneath $30,000, which led to a value rally as much as and past the $45K.

Within the occasion that different metrics stay progressive, the present value of BTC is a superb zone to load up your positions.