- ETH dropped beneath $3k amidst higher outflows from ETFs

- Some analysts at the moment are predicting a drop beneath $2k for the altcoin

On the again of nice crypto volatility amid Bitcoin’s personal instability, altcoins are getting hit. In the midst of this downtrend, ETH has suffered probably the most during the last 7 days after dropping beneath $3k on the charts. As anticipated, this decline has frightened analysts concerning the doable destructive impression of Spot ETFs on Ethereum since their launch two weeks in the past.

The sustained draw back has seen varied analysts predicting an additional decline. For starters, the founding father of Schiff Gold, Peter Schiff, believes that ETH will fall beneath $2k now. On his official X web page, he famous,

“Ethereum itself is now buying and selling beneath $3K. It received’t be lengthy earlier than it breaks $2K. #Gold rose 2% this week.”

This pessimism arose after ETH reported a ten.74% decline over the previous few months. The timing right here is very essential since many locally welcomed Spot ETH ETFs positively. Nevertheless, they appear to have had little constructive impression on the crypto’s value on the charts.

ETH ETFs’ excessive outflows

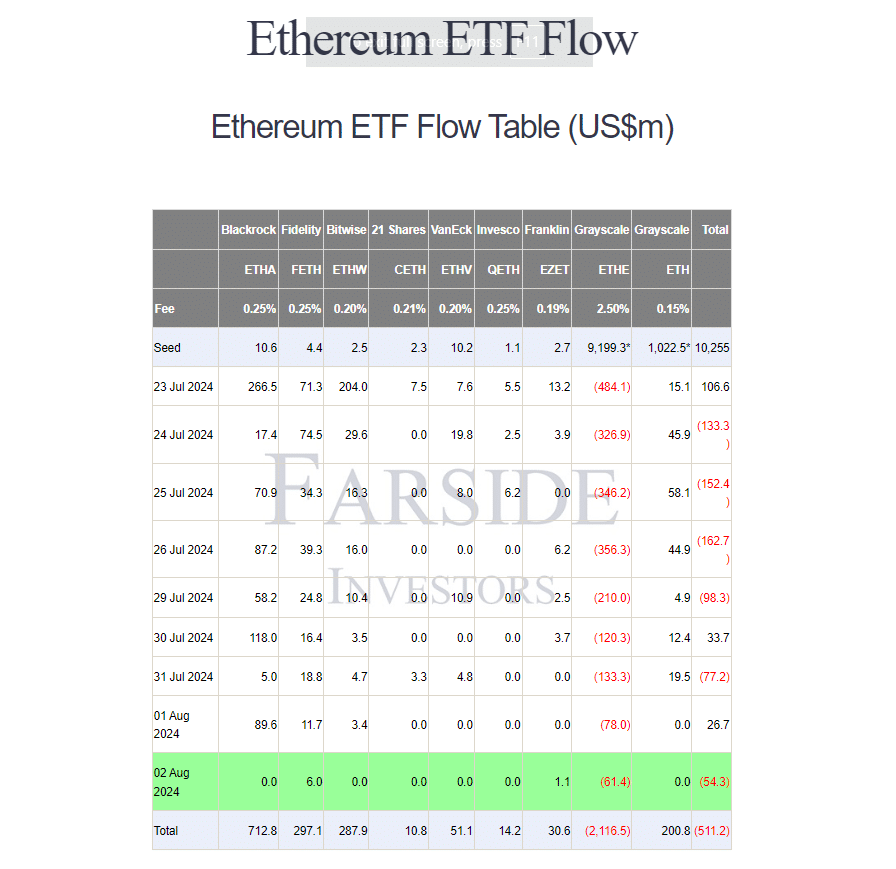

Notably, for the reason that launch of Spot ETFs ETFs on 25 July, they’ve seen huge outflows. Because the launch, ETHE has famous a document excessive of $2.1B in outflows.

Since 2 August alone, Ethereum spot ETFs recorded whole web outflows of over $54.3 million. This concerned varied ETFs, together with ETHE with a single day outflow of $61.4M, Constancy with $6M inflows, and EZET with $1M inflows. Merely put, for the reason that launch of those merchandise, outflows have repeatedly risen, facilitating investor warning and insecurity.

Peter Schiff, a recognized crypto-skeptic, was fast to level this out, including,

“Ethereum ETFs have been buying and selling for simply two weeks and are already down 15%. They closed the week on new lows#Bitcoin fell 10%.”

What do the worth charts say?

At press time, ETH was buying and selling at $2985.86 after a 5.29% decline on the every day chart. The altcoin additionally registered a fall of 8.88% on a month-to-month foundation. Quite the opposite although, the crypto’s buying and selling quantity rose by 20.10% during the last 24 hours.

AMBCrypto’s evaluation revealed that ETH is now on the finish of a powerful downtrend. At press time, the Chaikin Cash Circulate was beneath zero at -0.02 – An indication that ETH appeared to be closing within the decrease half of its vary on the every day charts. This, due to larger promoting stress than shopping for stress.

Moreover, the MACD was beneath zero at -62, indicating that the short-term EMA was beneath the long-term EMA.

Such findings recommend that the market could also be seeing robust downward momentum, with sellers dominating the market.

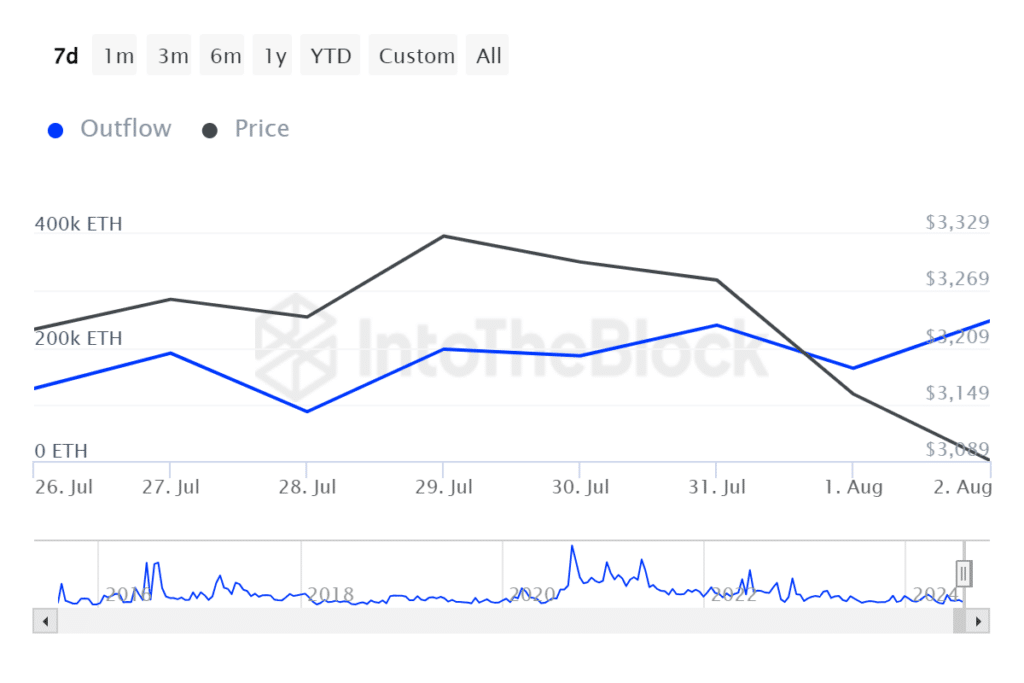

Wanting additional, knowledge from IntoTheBlock highlighted that enormous holders’ outflows have elevated over the previous few days. The outflows spiked from a low of 127.79k to 246k.

Merely put, massive buyers have been promoting their ETH tokens – Inflicting promoting stress whereas additional driving the worth down.

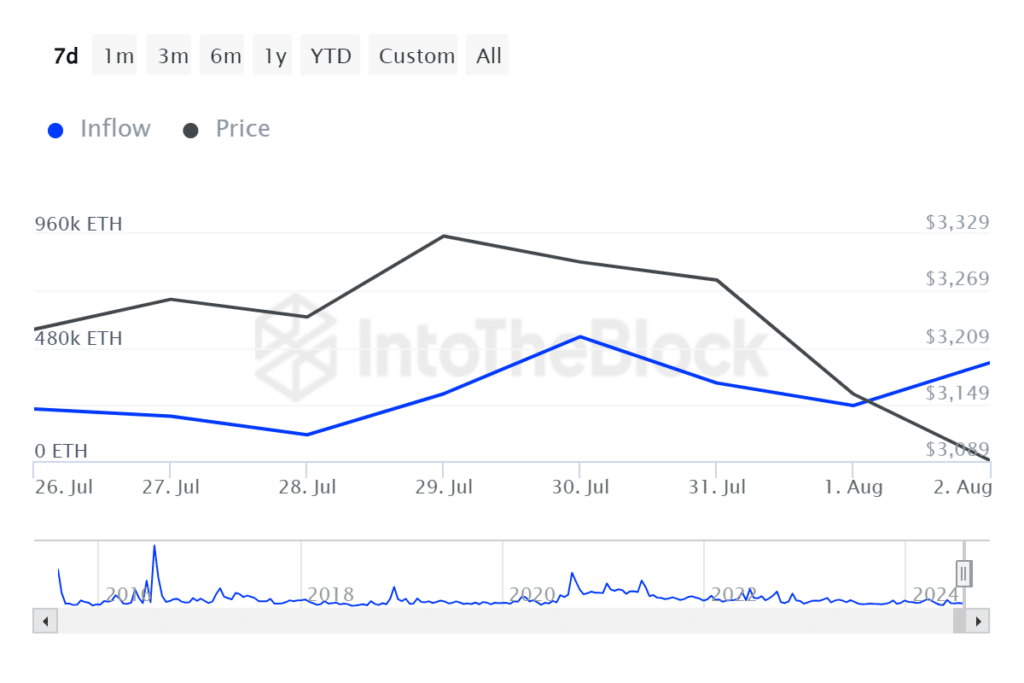

On the identical time, inflows fell from a excessive of 525.82k to a low of 234.62k. Decreased inflows indicate that sellers dominate the market – A bearish sign.

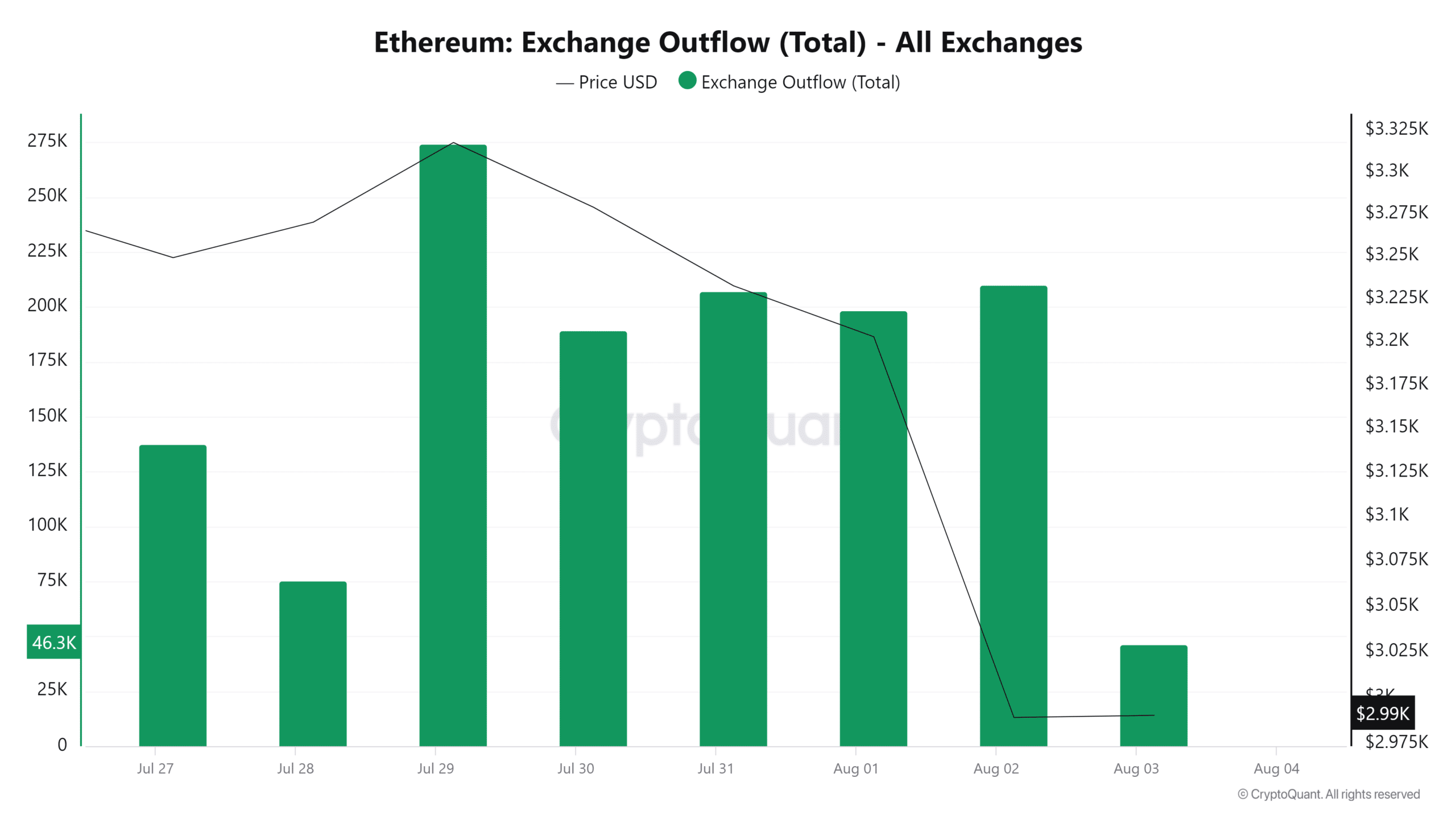

Lastly, the decline of ETH change outflows additional proves this because it reveals a scarcity of investor confidence in potential value hikes within the quick time period.

Due to this fact, if the continuing market sentiment and circumstances prevail, ETH will decline to the vital help degree of round $2810.87. A retest at this degree has traditionally pushed Ethereum’s value to $3560.

Thus, simply as Bitcoin declined in the course of the first few weeks of ETFs, ETH will seemingly replicate this sample and bounce again.