- ETH’s alternate outflows totaled $4 billion in Q1 of 2024

- MVRV ratio advised the coin was buying and selling barely under its realized worth

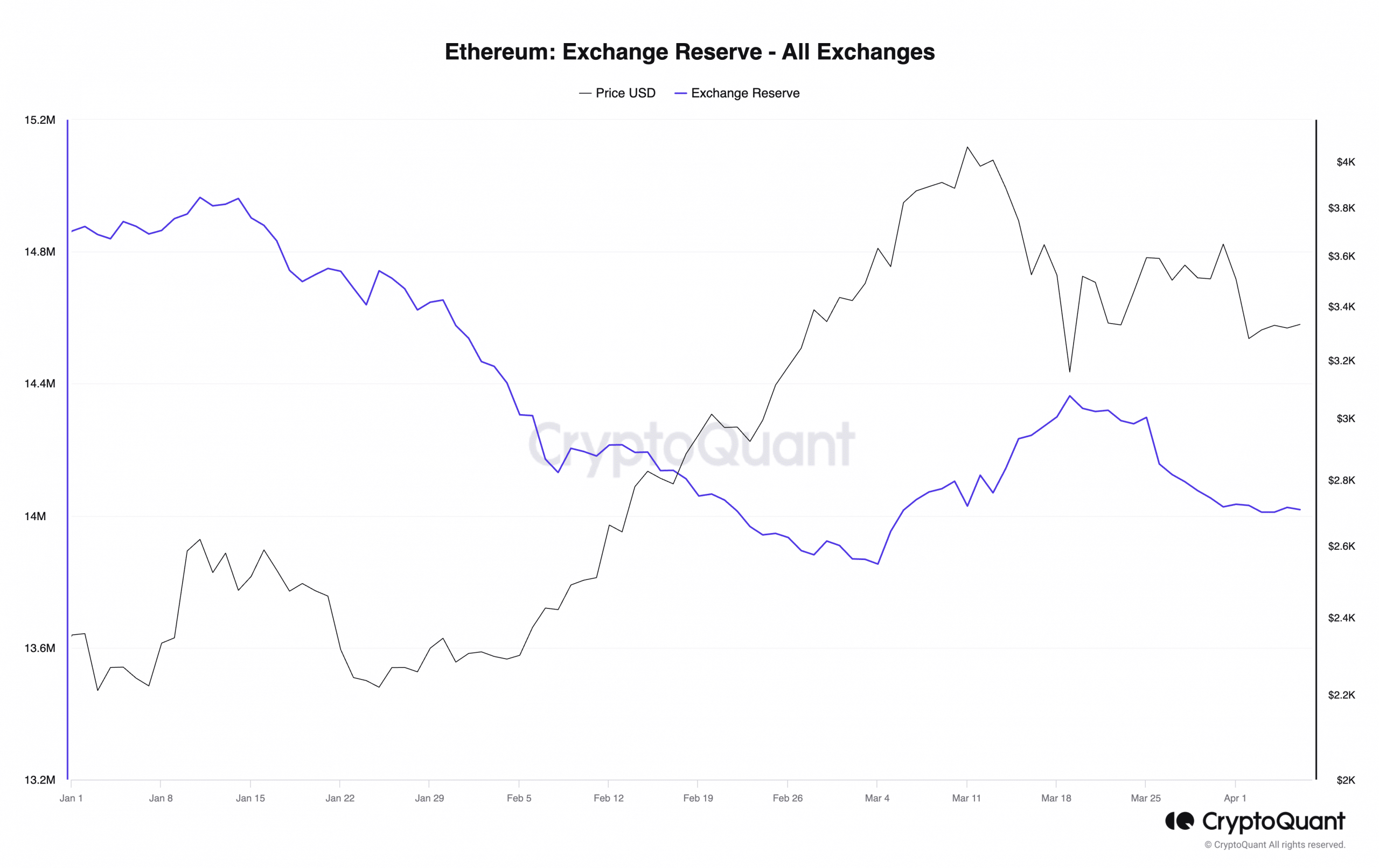

Based on data launched by IntoTheBlock, Ethereum [ETH] outflows from cryptocurrency exchanges totaled $4 billion within the first quarter of the yr. This indicators a surge in coin accumulation by market contributors over the 90-day interval, regardless of the ten% decline in ETH’s worth after it peaked at $4065 on 11 March.

The altcoin’s rally above $3500 in the direction of $4000 between 4 and 19 March triggered a wave of sell-offs. This contributed to a hike in its alternate reserves, with a year-to-date (YTD) evaluation of the coin’s reserves revealing a 5% decline.

This decline confirmed that ETH accumulation considerably outpaced distribution throughout the quarter.

ETH on-chain in Q1

Between January and March, the variety of ETH pockets addresses holding between 100 and 100,000 cash fell by 2%, in accordance with Santiment. This underlined a decline in ETH holding by its investor cohort, identified to be market movers.

At press time, 45,623 pockets addresses held between 100 and 100,000 ETH. These addresses presently maintain 36% of ETH’s circulating provide.

Conversely, throughout the interval underneath evaluation, the variety of shrimp addresses holding between zero and 100 ETH cash climbed. As of 31 March, their quantity was 118.25 million, up 6% throughout the yr’s first quarter. On the time of writing, this class of ETH holders managed 10% of the coin’s provide.

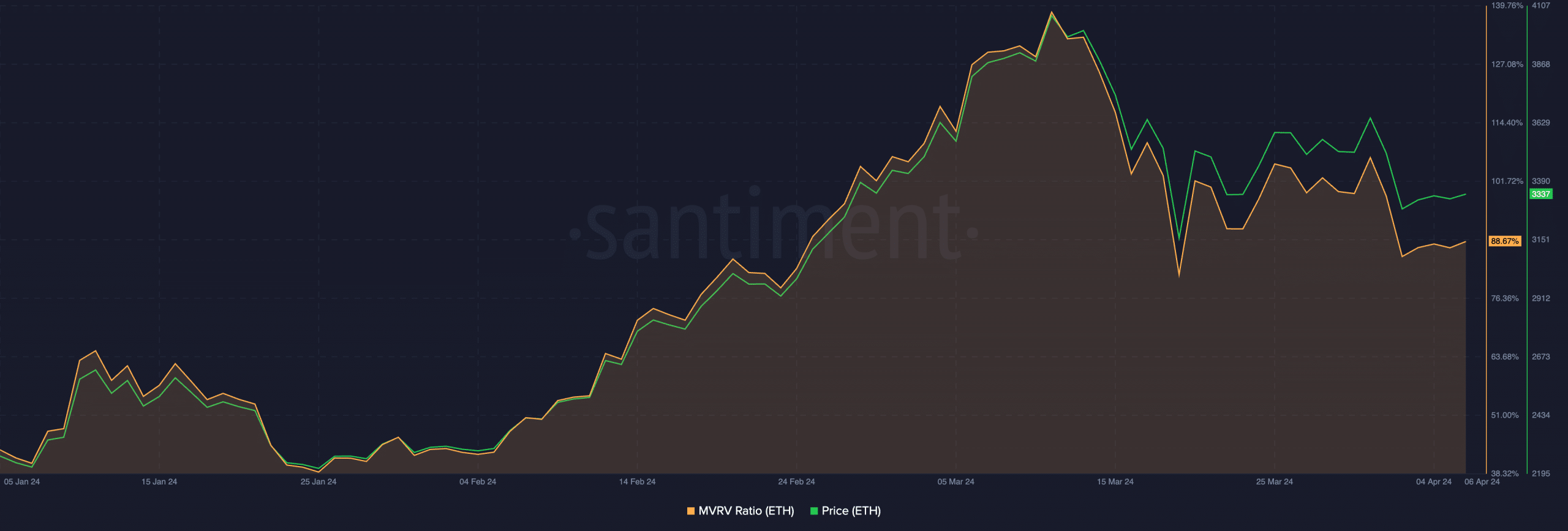

Additionally, the surge in ETH’s worth above $3500 in Q1 led to a spike in its Market Worth to Realised Worth (MVRV) ratio.

Learn Ethereum’s [ETH] Price Prediction 2024-25

This metric measures when an asset is overvalued or undervalued. When its ratio is excessive and on an uptrend, it means that an asset’s market worth has exceeded its realized worth. When this occurs, most asset holders will likely be in revenue.

Conversely, when an asset’s MVRV ratio declines, it’s deemed to be undervalued relative to its realized worth. Traders who select to promote their holdings at this level throughout the market cycle typically accomplish that at a loss.

ETH’s worth rally to $4000 on 11 March pushed its MVRV ratio to a YTD excessive of 138.38%.

Though ETH’s MVRV ratio additionally declined after its worth fell from its peak, it closed the quarter with a worth of 107%. Under 100% at press time, ETH’s MVRV ratio confirmed its worth was barely under the common worth at which all cash have been final moved on-chain