- Bitcoin was down by over 1% within the final 24 hours.

- Market indicators regarded bearish on the coin.

Whereas Bitcoin’s [BTC] worth gained upward momentum, the short-term holders acted apparently.

Due to this fact, AMBCrypto then deliberate to take a better have a look at the king of cryptos’ state to higher perceive the place it was headed.

Brief-term holders are accumulating

Crazzyblokk, an analyst and writer at CryptoQuant, not too long ago posted an analysis highlighting fascinating exercise. Notably, in current months, short-term holders have collected important quantities of Bitcoin.

The publish talked about,

“Based mostly on this metric, now 50% of the realized Bitcoin cap belongs to short-term holders, who have a tendency to carry onto their Bitcoins for longer intervals.”

Other than this description, the Bitcoin market, assessed by RC worth, was approaching a dangerous space akin to the 2019 worth cycle.

This could be troublesome because it suggests the elevated worth held by short-term holders might result in a bent to take earnings or exit, inflicting market volatility.

Bitcoin’s worth is dropping

The evaluation turned out to be true, as after a week-long bull rally, the king of cryptos’ worth witnessed a slight correction. In keeping with CoinMarketCap, BTC’s worth dropped by over 1% within the final 24 hours.

At press time, it was buying and selling at $70,015.84 with a market capitalization of over $1.38 trillion.

The drop in worth occurred at a time when the king of cryptos was anticipating its subsequent halving in just some weeks. To be exact, BTC’s subsequent halving is scheduled to occur in April 2024.

Regardless of the current drop in worth, traders appeared to have nonetheless been accumulating extra BTC.

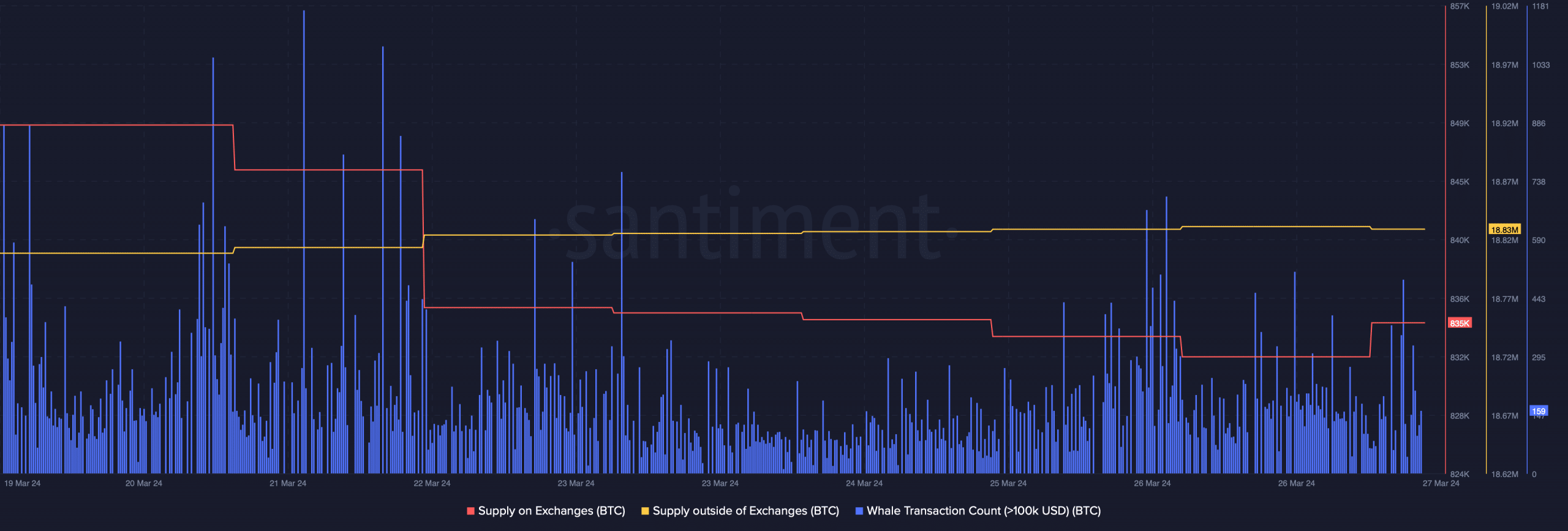

Our evaluation of Santiment’s knowledge revealed that BTC’s Provide on Exchanges dropped final week, whereas its Provide exterior of Exchanges rose barely.

Whale exercise across the coin was additionally comparatively excessive, which was evident from its Whale Transaction Rely.

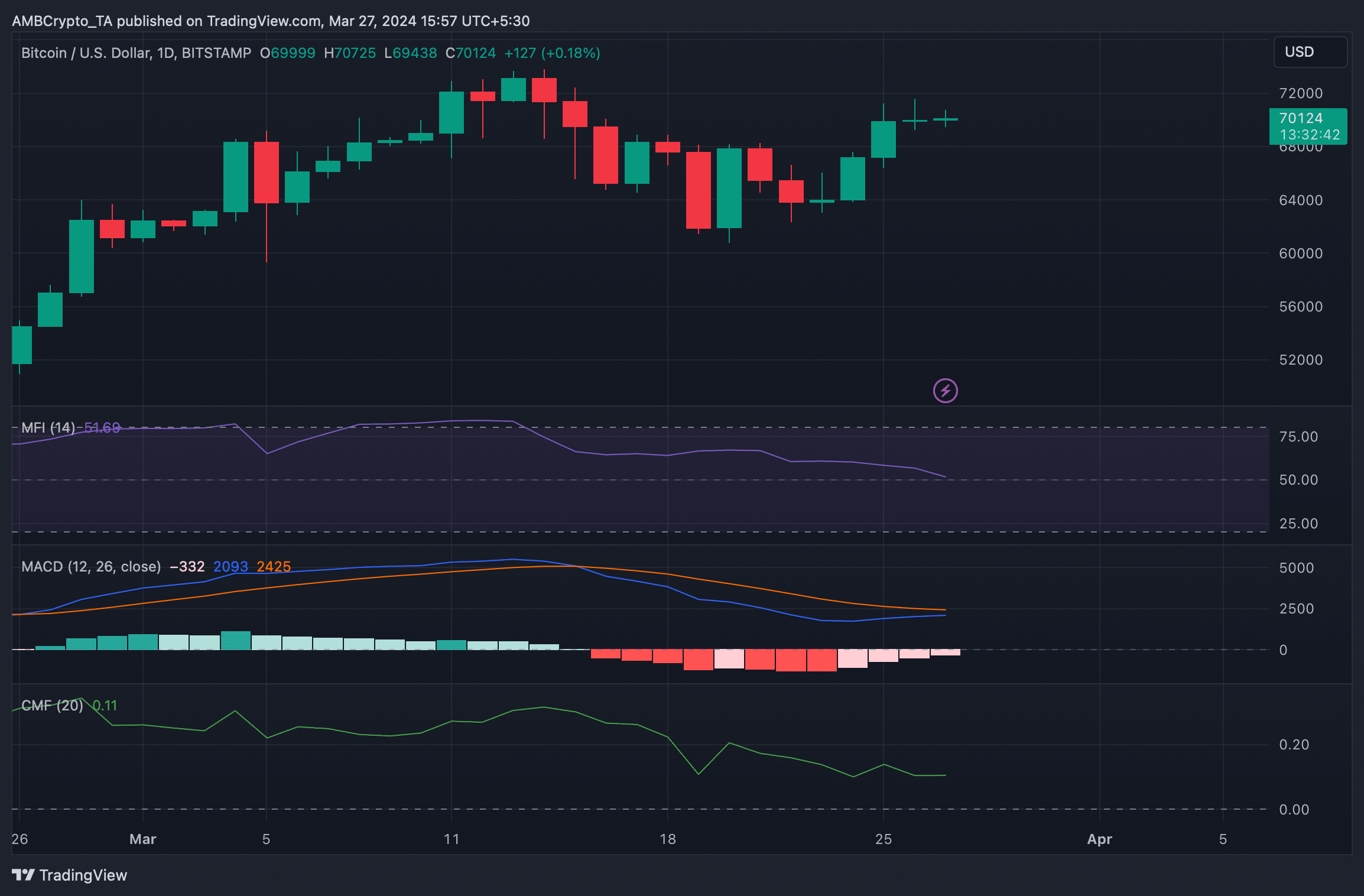

AMBCrypto then checked the coin’s every day chart to see whether or not this downtrend would last more. We discovered that Bitcoin’s Cash Movement Index (MFI) registered a downtick.

Learn Bitcoin’s [BTC] Price Prediction 2024-25

Its Chaikin Cash Movement (CMF) additionally moved sideways in the previous couple of days. These indicators steered that the possibilities of a continued worth decline had been excessive.

Nonetheless, it was fascinating to notice that the MACD supported consumers, because it displayed the potential for a bullish crossover.