Ethereum is presently buying and selling at $2,290 and is on a marginal improve of $0.17 up to now week. Though missing a lot motion and buying and selling round $2,300 for a lot of the week, on-chain knowledge concerning outflows has revealed the present sentiment amongst merchants. Based on knowledge from on-chain analytics firm IntoTheBlock, $500 million price of ETH was withdrawn from centralized exchanges this week, bringing the whole outflow up to now month to $1.2 billion.

Surge In Ethereum Outflow From Exchanges

Ethereum went on an unforeseen price growth subsequent to the approval of spot Bitcoin exchange-traded funds in the US. Consequently, numerous on-chain knowledge have revealed a robust bullish sentiment, with the second largest crypto witnessing outflows from exchanges since this era. Outflows have been notably exacerbated final week, per IntoTheBlock, contributing a bigger portion of $1.2 billion ETH withdrawn from exchanges up to now month.

$500M in $ETH was withdrawn from CEXs this week, including to a complete of over $1.2B in outflows within the final month pic.twitter.com/e8NFOGtrDV

— IntoTheBlock (@intotheblock) February 2, 2024

Ethereum presently buying and selling at $2,308 on the day by day chart: TradingView.com

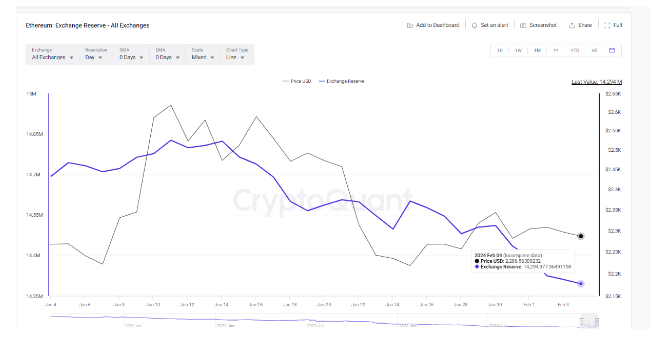

Based on CryptoQuant, 1.622 million ETH have been withdrawn from crypto exchanges final week. An identical metric from the analytics platform exhibits the ETH reserve on exchanges has been on a free fall for the previous yr. As of the 4th of January, the statistics indicated that the whole amount of Ethereum that was deposited with numerous cryptocurrency exchanges amounted to 14.69 million. This quantity, nevertheless, has decreased by 397,012 ETH over the previous month, bringing it right down to 14.296 million ETH on the time of this writing, its lowest stage ever.

What Does This Imply For ETH Value?

Dropping alternate reserves reduces the quantity of ETH out there for buying and selling, thereby growing shortage. The info from each Cryptoquant and IntoTheBlock signifies Ethereum is perhaps gearing up for a worth spike fueled by growing shortage.

On the time of writing, Ethereum is up by 3.21% in a month-to-month timeframe. Nonetheless, you will need to word that the crypto has been on a downtrend after reaching a 23-month excessive of $2,706 on January 12. A bigger a part of this draw back may be attributed to a $1 billion selloff by Celsius Community as a part of its plans to repay its collectors. On the identical time, the cryptocurrency is going through fixed competitors from different blockchains, with Solana recently surpassing it when it comes to day by day buying and selling quantity on Decentralized exchanges.

Primarily based on the current price action, it seems like Ethereum has established a help stage barely above $2,280 and is now trying a robust improve above this worth level. Based on a crypto analyst, the present configuration is an obvious duplicate of a worth motion in 2021 which led to ETH reaching its present all-time excessive of $4,878 within the months after.

$ETH is seemingly repeating the earlier chart configuration.🚀#Ethereum #ETH #Altseason pic.twitter.com/AA1PJiN24h

— Dealer Tardigrade (@TATrader_Alan) February 3, 2024

Featured picture from Adobe Inventory, chart from TradingView