ETH outshines BTC

An in-depth evaluation by AMBCrypto revealed that the share of ETH holders who saved their property for over a yr rose from 59% in January 2024 to 75% by December 2024, in keeping with IntoTheBlock knowledge.

This contrasted sharply with Bitcoin, the place the proportion of long-term holders declined from 70% to 62.3% over the identical interval.

The rising retention price for Ethereum instructed heightened confidence amongst traders, pushed by expectations of future community upgrades and broader utility.

In the meantime, Bitcoin’s decline in long-term holders could mirror profit-taking or diversification methods, indicating a possible shift in market sentiment as traders prioritize ETH heading into 2025.

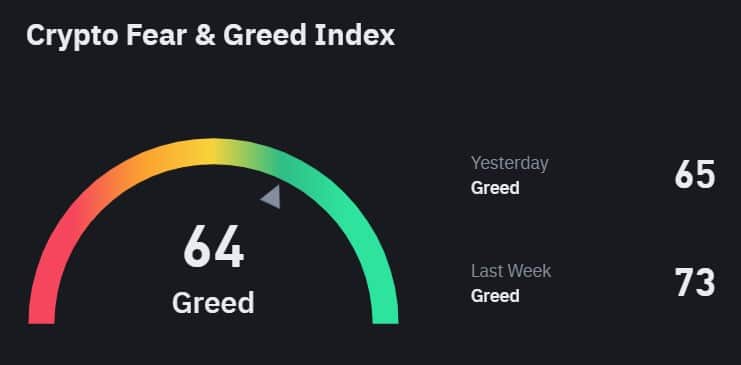

Worry and Greed Index drops to two-month low

Notably, dropping HODLers wasn’t the one downside the king coin was dealing with. It’s Crypto Worry and Greed Index fell to 64 on the thirty first of December, marking the bottom degree because the fifteenth of October.

This decline mirrored waning market optimism as Bitcoin tumbled over 12% previously two weeks to commerce close to $93,000.

After peaking at 94 in November—pushed by pleasure surrounding pro-crypto U.S. election outcomes, the index remained above 70 for a lot of December earlier than the latest pullback. The drop signaled a shift from excessive greed to a extra cautious sentiment amongst traders.

Whereas greed nonetheless dominated, the decline highlighted heightened considerations about short-term market volatility as merchants reacted to Bitcoin’s value actions and the broader market’s blended indicators.

Learn Ethereum [ETH] Price Prediction 2025-2026

BTC in an accumulation section?

Regardless of the dip, investor James Williams believes Bitcoin is coming into a vital accumulation section. In his newest X (previously Twitter) publish, Williams described the present situations as a possibility for long-term positioning.

Williams predicted a consolidation interval over the approaching weeks, probably setting the stage for a big breakout. Assured in Bitcoin’s long-term trajectory, Williams views the present value motion as a part of a pure market cycle and forecasts a value of $131,500 or larger by Q1 2025, calling such ranges “inevitable.”

He emphasised that having persistence during times of consolidation usually rewards traders, as such phases traditionally precede substantial upward strikes in Bitcoin’s value.