The United States election was one of the crucial defining occasions within the crypto area in 2024. Particularly, the reelection of Donald Trump revived Bitcoin and all the crypto market after an uninspiring second and third quarter.

One of many guarantees made by President-elect Trump within the run-up to the polls was the establishment of a strategic Bitcoin reserve. Unsurprisingly, a lot of the current crypto conversations has been across the BTC reserve and its potential impression on the US financial system and the crypto panorama.

Why Ought to The US Set up Strategic Bitcoin Reserves?

CryptoQuant CEO and founder Ki Younger Ju is the most recent to weigh in on the difficulty of strategic Bitcoin reserves in the US. In a publish on the X platform, the crypto knowledgeable said that utilizing the world’s largest cryptocurrency to offset the US debt is a possible strategy.

The CryptoQuant CEO talked about:

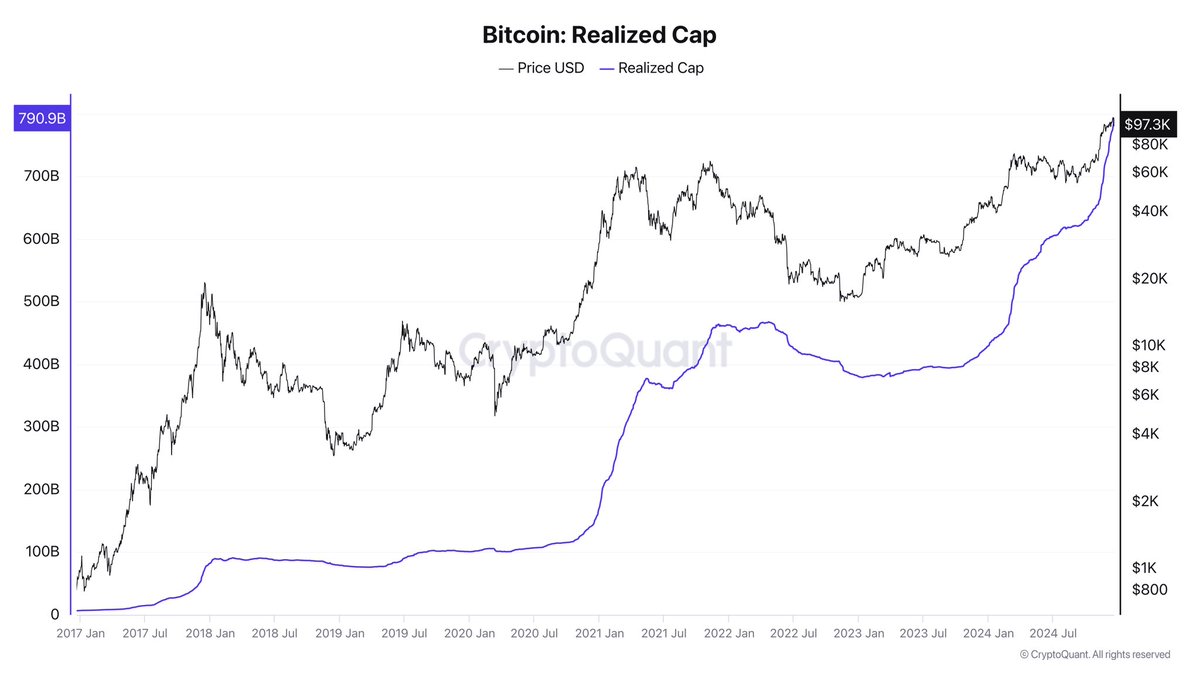

Over the previous 15 years, $790 billion in realized capital inflows have propelled Bitcoin’s market cap to $2 trillion. This 12 months alone, $352 billion in inflows have added $1 trillion to its market cap.

Younger Ju then disclosed that the US may trim their home debt (70% of the overall) by 36% if the federal government acquires 1 million BTC by 2050 and designates the premier cryptocurrency as a strategic asset. “Whereas the remaining 30% of debt held by overseas entities might resist this strategy, the plan doesn’t depend on settling all debt with Bitcoin, making the technique sensible,” the CryptoQuant founder added.

A chart displaying BTC's realized cap | Supply: Ki_young_ju/X

Younger Ju believes that utilizing a “pumpable asset” like BTC to compensate for dollar-denominated debt may face the problem of collectors’ acceptance. Nevertheless, the US instituting a strategic Bitcoin reserve may function a “symbolic first step” towards bringing global, nationwide legitimacy to the flagship cryptocurrency — as seen with property like gold.

Within the publish on X, the CryptoQuant CEO recognized outdated whales dumping their BTC to spite the US authorities as a threat that would include establishing a strategic Bitcoin reserve. “Nevertheless, if governments proceed accumulating Bitcoin till 2050 and its value retains rising, I doubt they’d really dump it,” Younger Ju concluded.

BTC Value At A Look

As of this writing, the price of BTC is hovering across the $97,000 mark, reflecting a 0.4% decline up to now 24 hours. Based on knowledge from CoinGecko, the premier cryptocurrency is down by 3.6% within the final seven days.

The worth of BTC on the day by day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView