It’s barely weeks into the second half of 2025, and it’s honest to say that the Bitcoin and world monetary markets have virtually seen all of it this 12 months. From global trade wars to precise disputes between nations (involving severe navy motion), the markets have been topic to completely different types of exterior strain all year long.

Consequently, the world has seen a sheer quantity of correlation and direct relationship between the normal monetary markets and the crypto market. Whereas the US equities market and Bitcoin haven’t notably moved in tandem in latest months, there is no such thing as a denying the existence of a relationship between the asset courses.

What Does The Falling Conventional Volatility Imply For BTC?

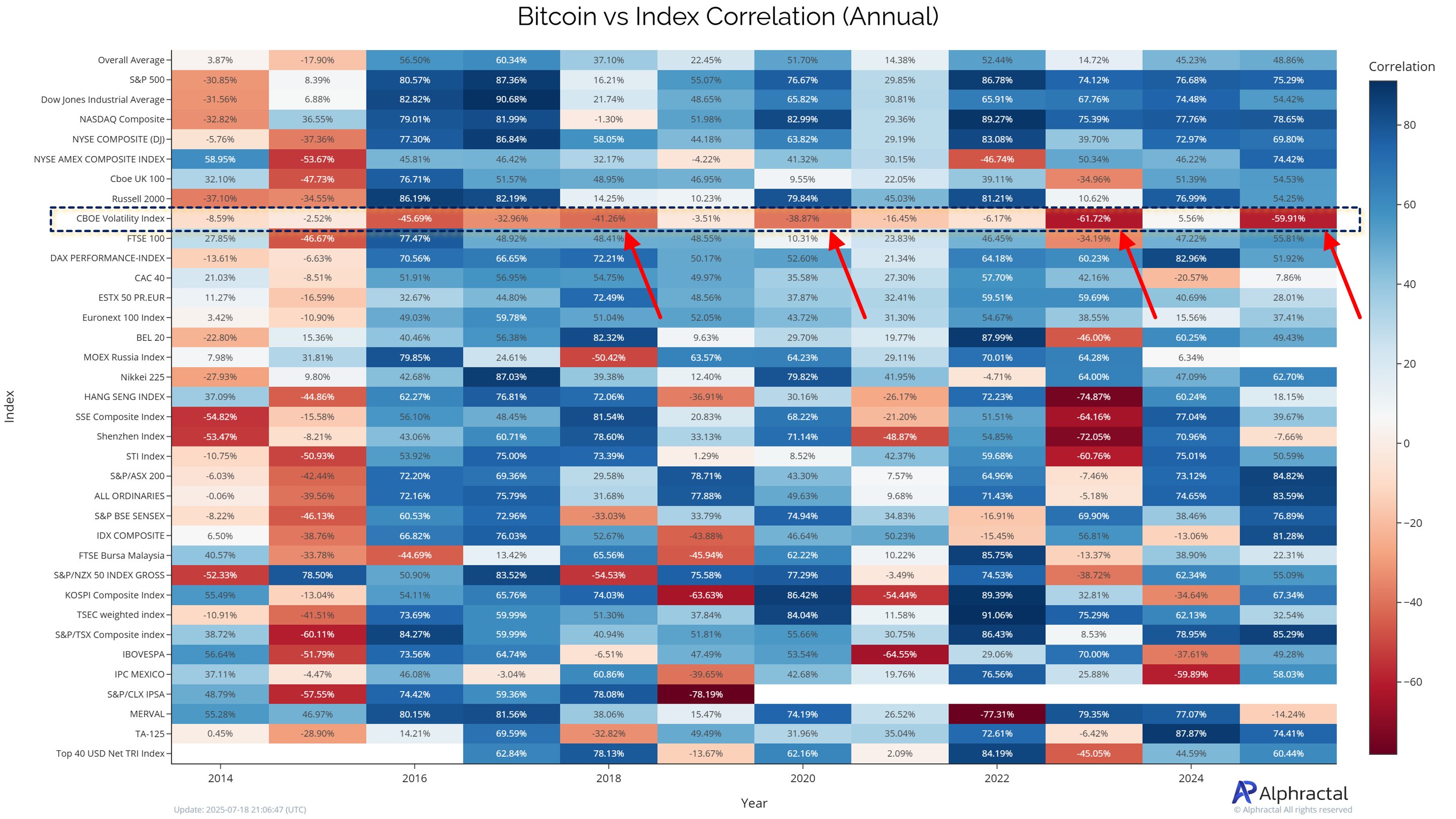

In a brand new put up on social media platform X, Alphractal CEO and founder Joao Wedson delved into the connection between Bitcoin and the US equities market (by way of the S&P 500 index). In keeping with the crypto skilled, the premier cryptocurrency is exhibiting low correlation with the CBOE Volatility Index (VIX), which tracks the market’s expectations for the volatility of the S&P 500 Index.

For context, volatility refers to how rapidly costs change inside a brief interval and is commonly seen as a method to gauge market sentiment. Wedson talked about that the VIX Index, also referred to as the concern index, is extensively used as a threat thermometer amongst members within the conventional monetary markets.

In keeping with Wedson, the value of Bitcoin historically tends to maneuver extra independently and considerably within the following 12 months each time it’s negatively correlated with the S&P 500 Index, particularly in periods of low VIX. This elevated volatility has typically translated into vital worth rallies up to now, based on the analyst.

Wedson stated:

In different phrases: don’t waste hours analyzing BTC vs. S&P 500 when BTC’s correlation with the VIX is low or unfavourable — that’s normally when BTC has the next probability of getting into an explosive part.

Supply: @joao_wedson on X

The on-chain analyst stated that on the flip aspect, when the VIX is excessive, it’s value wanting on the relationship between Bitcoin and US equities markets, as concern within the latter can affect the habits of the previous. Nevertheless, Wedson famous that the VIX is presently declining, and as such, the S&P 500 Index won’t provide a lot assist in analyzing Bitcoin’s subsequent transfer.

Wedson concluded that the extra BTC dissociates from conventional volatility (VIX), the stronger it’s as an unbiased asset. In the end, this could possibly be a positive sign for the Bitcoin worth and current contemporary alternatives for buyers seeking to get into the market.

Bitcoin Worth At A Look

As of this writing, BTC is valued at round $117,888, reflecting no vital worth motion up to now 24 hours.

The worth of BTC on the every day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our workforce of prime know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.