- Ethereum’s newest bullish divergence hinted at finish of bearish development and begin of a bullish development

- CVD revealed many DEX merchants are taking earnings or closing their positions

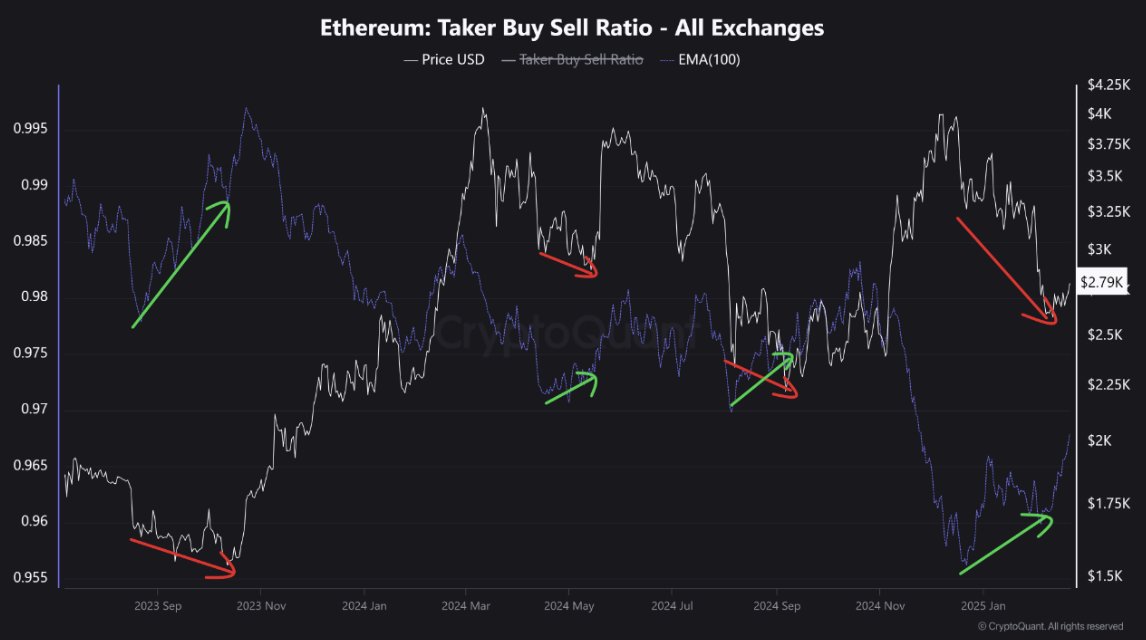

Ethereum’s (ETH) market, at press time, projected a serious bullish divergence, one recognized by the taker buy-sell ratio towards the value development. Such a divergence usually precedes a market restoration on the charts.

As an example, again in September 2023, regardless of the value declining to shut to $1,500, the taker buy-sell ratio started to climb – An indication of buildup in shopping for strain. This quickly resulted in ETH recovering in the direction of the $2,000-level.

Additionally, from November 2024 to January 2025, Ethereum’s value plummeted to round $2,700. Nonetheless, the taker buy-sell ratio once more flashed an uptrend, highlighting potential shopping for curiosity regardless of the autumn within the altcoin’s value.

Traditionally, such patterns sign the top of bearish phases and provoke new bullish traits.

Its newest interaction advised that regardless of the press time value of $2,800, an uptrend might be imminent. This might mirror previous patterns the place rising taker purchase exercise correlated with value recoveries.

Whales vs Sensible DEX merchants

Moreover, latest actions throughout the Ethereum ecosystem introduced a hanging distinction between large-scale patrons and lively merchants on decentralized exchanges. This was within the midst of rising costs, earlier than the sharp drop as a result of Bybit hack the place $1.4 billion ETH had been misplaced.

Notably, whale accounts have ramped up their holdings by accumulating a further 140,000 ETH – Signaling a bullish place or a long-term maintain. This mass acquisition appeared to be consistent with an uptrend in ETH’s value, hinting at robust confidence amongst giant holders.

Nonetheless, the Cumulative Quantity Delta (CVD) indicated a development the place good DEX merchants have been more and more taking earnings or closing their positions. This alluded to a doable sentiment shift or threat aversion at press time value ranges.

This promoting exercise might create short-term value volatility or strain as earnings are secured, contrasting with the whales’ accumulating conduct. The complicated interaction might result in divergent short-term versus long-term influence on Ethereum’s trajectory.

Ethereum’s log curves

Ethereum, on the time of writing, was buying and selling within the oversold zone. This traditionally means a possible reversal on the charts. ETH’s value appeared to be buying and selling beneath this crucial threshold throughout the log curve zones – Rising the chance of a value bounce.

Traditionally, such positioning has preluded main rebounds, like in mid-2017 and late 2020. Throughout this era, ETH navigated from the oversold area to larger zones, reflecting robust shopping for curiosity at perceived worth ranges.

Conversely, whereas oversold circumstances usually herald recoveries, exterior market shocks or broader bearish sentiment might override this potential, pushing ETH additional down earlier than any main restoration happens.

The prevailing oversold standing might catalyze a bullish reversal or set off an extended downtrend.