- Ethereum demonstrated indicators of restoration, although it remained beneath earlier highs amid cautious market sentiment.

- Rising Ethereum trade outflows indicated investor confidence, probably pointing to a bullish development forward.

Ethereum [ETH], the second-largest cryptocurrency by market capitalization, has lately skilled a modest restoration in its worth, buying and selling at $2,661 on the time of writing.

This marked a 1.6% improve over the previous day.

Previous to this, Ethereum had been on a downward trajectory, reaching a low of $2,545 final week.

Regardless of the recent uptick, Ethereum’s worth remained considerably beneath its March excessive of $4,070 and was nonetheless down by roughly 45% from its all-time excessive of $4,878, recorded three years in the past.

The present market circumstances elevate questions on whether or not Ethereum is on the verge of a extra sustained restoration, or if the latest worth actions are merely a short lived correction.

Inasmuch, CryptoQuant analyst Burak Kesmeci recommended that Ethereum could also be within the late levels of its correction, citing on-chain metrics that point out a possible shift in market sentiment.

Market sentiment

In his latest analysis, Burak Kesmeci highlighted two key datasets, which indicated that Ethereum was nearing the tip of its correction section.

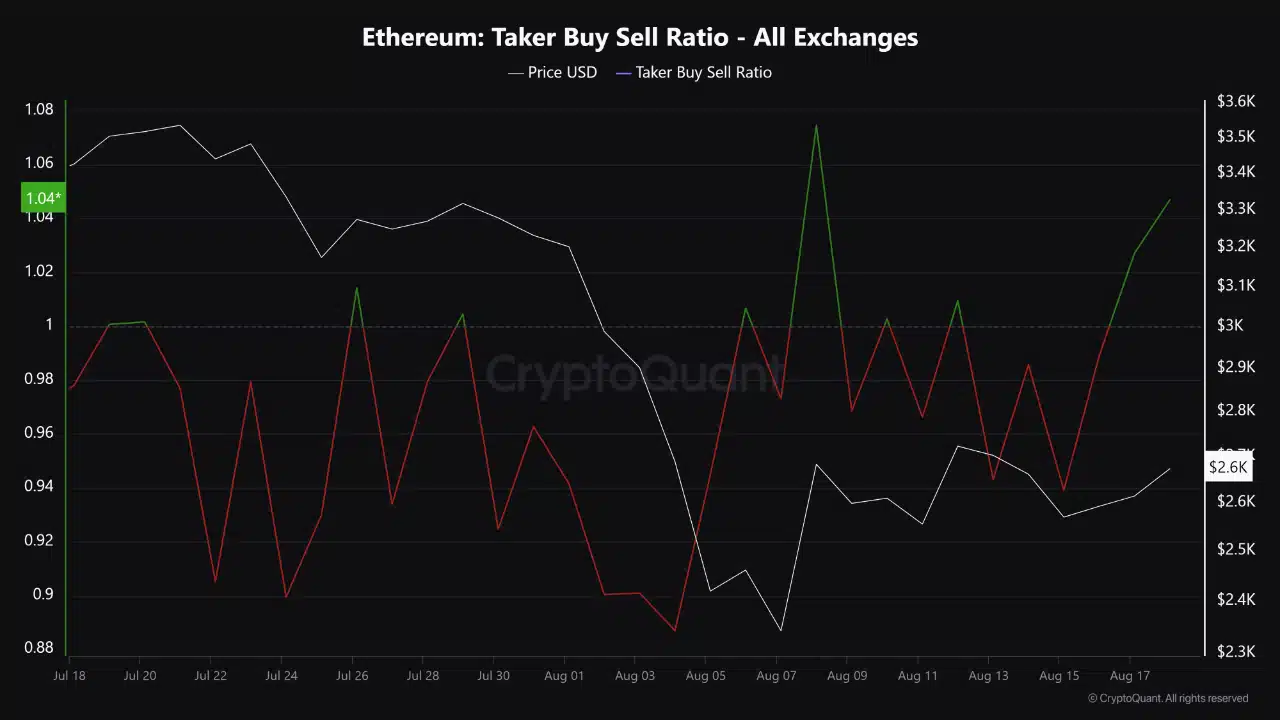

The primary is the Taker Purchase Promote Ratio, which measures the ratio of consumers to sellers throughout all exchanges.

In line with Kesmeci, this ratio has turned optimistic, indicating that consumers are starting to regain energy.

This shift within the buyer-seller dynamic might be an early signal of a possible rally, particularly if the development continues into the next week.

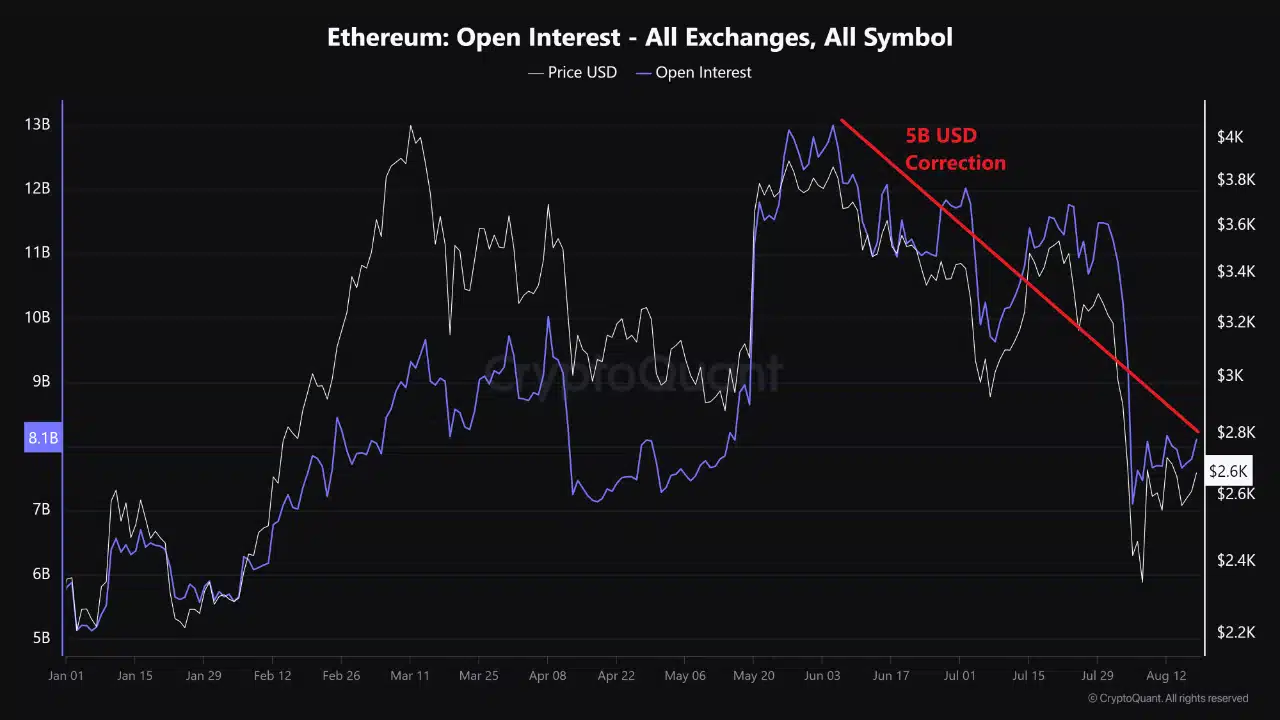

The second metric is Open Curiosity (OI), which represents the full variety of open lengthy and brief positions available in the market.

As Kesmeci identified, in June 2024, when Ethereum’s worth reached $3,800, OI hit a file excessive of over $13 billion, suggesting {that a} market correction was imminent.

This correction materialized on the fifth of August 2024, when a macroeconomic occasion prompted OI to plummet to $7 billion.

Kesmeci famous that for Ethereum’s worth to expertise a major upward motion, leveraged gamers would want to re-enter the market, doubtlessly driving a brand new wave of shopping for exercise.

Is Ethereum prepared for a rally?

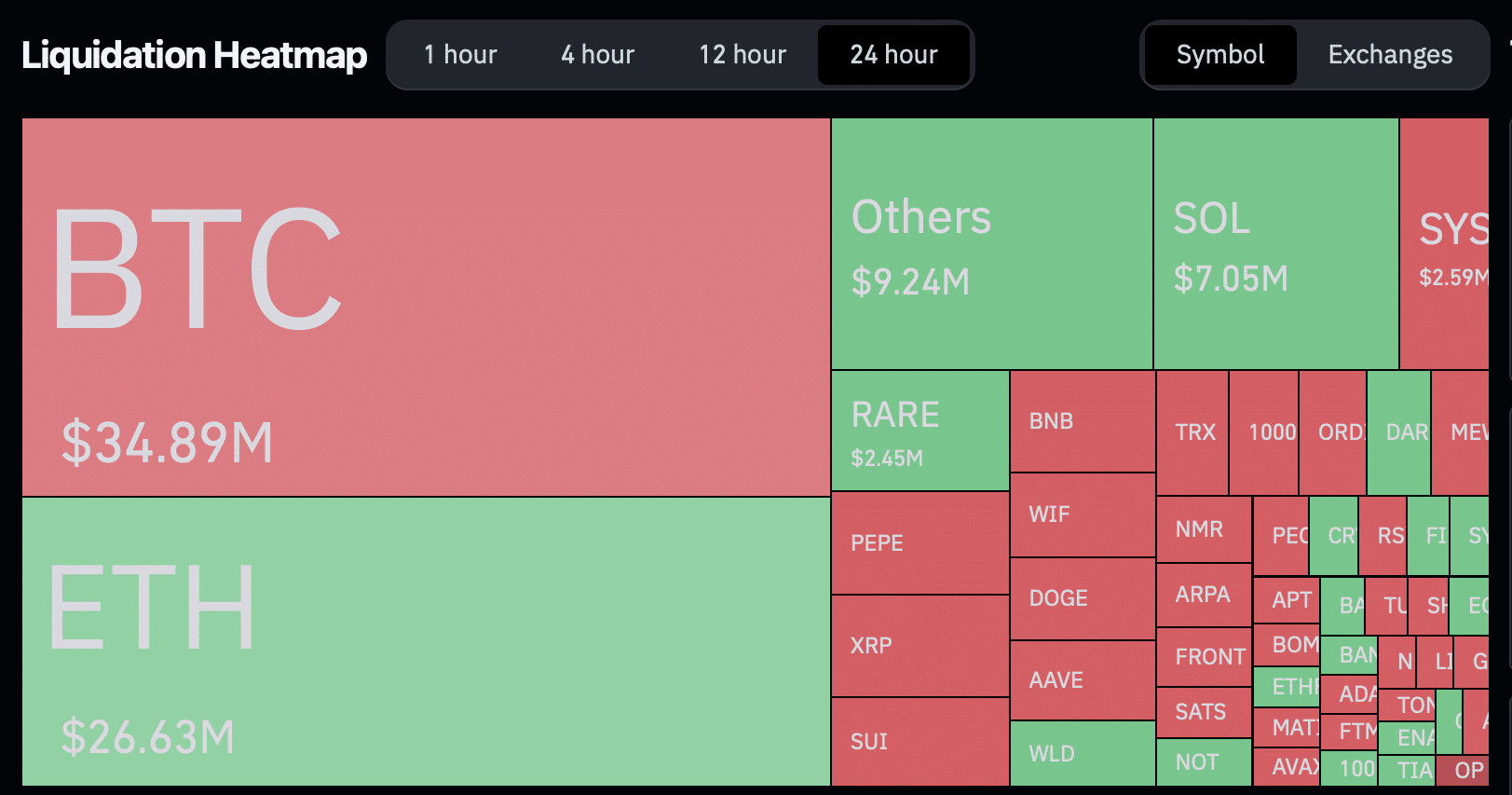

Whereas these metrics highlighted by Kesmeci supply a promising outlook, the broader market has borne the brunt of ETH’s 24-hour restoration.

Over this era, a complete of 43,521 merchants had been liquidated, with liquidations amounting to $111.52 million. Ethereum accounted for $26.63 million of those liquidations, with the bulk being lengthy positions.

This implies that whereas there’s optimism amongst some merchants, the market stays risky, and leveraged positions proceed to hold vital danger.

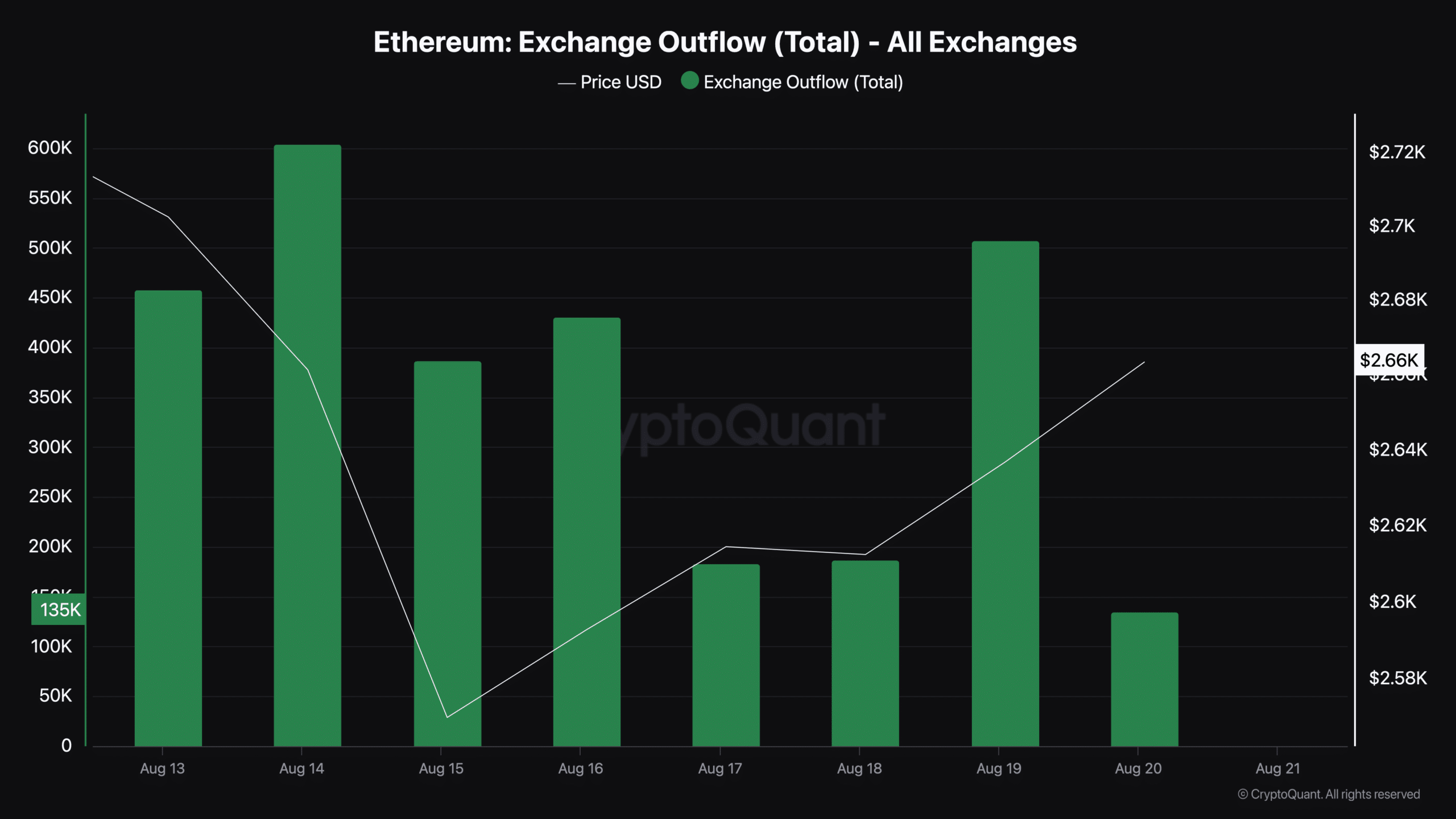

Past the on-chain metrics, one other vital issue to contemplate is the motion of Ethereum out of exchanges.

Data from CryptoQuant indicated a constant improve in Ethereum trade outflows over the previous week.

On the 14th of August, greater than 600,000 ETH left exchanges, adopted by roughly 507,000 ETH on August 19. As of at present, practically 200,000 ETH has already been withdrawn from exchanges.

This improve in trade outflows sometimes alerts that traders are shifting their Ethereum holdings into long-term storage, decreasing the availability obtainable for buying and selling on exchanges.

Such habits typically suggests a bullish outlook amongst traders, as they anticipate increased costs sooner or later.

Decreased trade provide, coupled with sustained demand, can create upward strain on Ethereum’s worth.

Learn Ethereum’s [ETH] Price Prediction 2024-2025

Nevertheless, it stays to be seen whether or not this development will result in a major rally or if the present market circumstances will proceed to problem Ethereum’s restoration.

Kesmeci concluded the submit by saying,

“Present knowledge reveals that consumers in Ether are regularly regaining energy. Nevertheless, time will inform whether or not this can be a momentary rebound or the beginning of a robust rally led by the bulls.”