Bitcoin (BTC) is again within the highlight, with a surge in investor exercise and contract holdings fueling greater than 20% worth leap this week. The main cryptocurrency smashed through the $52,000 barrier for the primary time since December 2021, sending shockwaves via the market and igniting bullish sentiment. Nonetheless, analysts warning that short-term holders may pose a problem to sustained worth will increase.

Bitcoin Open Curiosity Explodes, Mirroring Bull Market Frenzy

In keeping with information from Coinglass, Bitcoin contract holdings on main US dollar-denominated exchanges have reached a staggering $22.84 billion. This marks a major milestone, carefully mirroring the heights of November 9, 2021, when open curiosity peaked at $23 billion. Main platforms like CME, Binance, and Bybit maintain important shares, with CME taking the highest spot at almost $7 billion, adopted carefully by Binance at $6 billion and Bybit at $4 billion.

Supply: Coinglass

This surge in open curiosity suggests a resurgence in investor confidence, harking back to the earlier bull market. It signifies that extra merchants are getting into into futures and choices contracts tied to Bitcoin, probably anticipating additional worth will increase.

Value Surge Fueled By ETF Inflows And Hypothesis

Bitcoin’s current rally has been fueled by a number of components, together with a staggering $631 million inflow into spot Bitcoin exchange-traded funds (ETFs) on February thirteenth. This important influx suggests robust institutional demand and potential provide constraints, pushing the value upwards.

Bitcoin presently buying and selling at $51,830 on the day by day chart: TradingView.com

Moreover, there’s hypothesis that over-the-counter (OTC) desks could be depleting their Bitcoin reserves, prompting elevated shopping for on common exchanges and contributing to the bullish momentum. Nonetheless, analyses from Glassnode counsel a distinct story, revealing a decline in provide amongst short-term holders.

Quick-Time period Vs. Lengthy-Time period Holders: A Tug-Of-Conflict

Whereas the general sentiment is bullish, analysts warn that short-term holders would possibly pose a problem to sustained price increases. Latest information reveals a surge in transactions transferring Bitcoin to exchanges, typically a precursor to promoting. This contrasts with the steadfastness of long-term holders, who management a major 79% of the Bitcoin provide based on on-chain information.

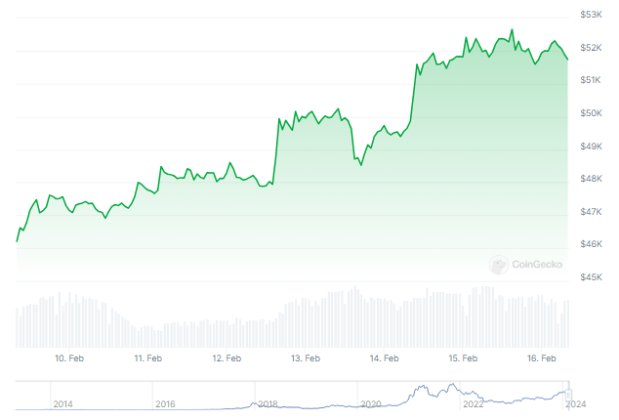

BTC worth motion within the final week. Supply: Coingecko

This creates a tug-of-war between short-term holders searching for to revenue from the rally and long-term holders who stay dedicated to the asset’s long-term potential. The end result of this battle will probably be essential in figuring out the sustainability of the present upward development.

A Bullish Outlook With Nuances

The current surge in Bitcoin exercise and worth paints a constructive image for the brief time period. Document open curiosity, important ETF inflows, and bullish sentiment counsel continued momentum.

Nonetheless, the presence of short-term holders and the inherent volatility of the cryptocurrency market spotlight the necessity for warning. Traders ought to fastidiously take into account their threat tolerance and conduct thorough analysis earlier than making any funding choices.

Featured picture from Adobe Inventory, chart from TradingView

BTC worth motion within the final week. Supply:

BTC worth motion within the final week. Supply: