The Fed rate cuts have boosted the boldness of Bitcoin traders, with whales shopping for as much as 1.6 billion BTC because the macro determination. With such a bullish outlook, there may be the chance that the flagship crypto can soon reach $70,000.

Fed Charge Cuts Immediate Shopping for Spree Amongst Bitcoin Whales

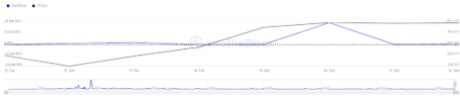

The Fed charge cuts have prompted a shopping for spree amongst Bitcoin whales. These traders purchased over 1.6 billion value of Bitcoin following the macro determination on September 18. Information from the market intelligence platform IntoTheBlock exhibits that these whales have purchased 25,510 BTC since September 19.

Associated Studying

This accumulation trend is unsurprising, because the 50 bps curiosity minimize has supplied a bullish outlook for threat belongings, together with Bitcoin. The flagship crypto is anticipated to expertise a major value surge since extra liquidity will move into its ecosystem as traders can entry extra money following the Federal Reserve’s quantitative easing (QE).

With Bitcoin projected to take pleasure in large strikes to the upside, an increase to $70,000 quickly sufficient is feasible. The flagship crypto already flipped the $60,000 price level as help following the Fed charge cuts and is holding comfortably above that stage. As anticipated, extra liquidity is already flowing into the BTC ecosystem, as is clear from the $1.6 billion buy by these whales.

Due to this fact, it shouldn’t be lengthy sufficient earlier than the crypto reaches the $70,000 value stage. Bitcoin reaching this stage is important because it might pave the way in which for BTC to hit a new all-time high (ATH). The $70,000 value stage has acted as robust resistance because the crypto dropped under this stage after rising to its present ATH of $73,000 earlier in March.

Nonetheless, Bitcoin might simply break above this resistance this time, contemplating it has extra bullish momentum because of the Fed charge cuts.

Historical past Might Repeat Itself

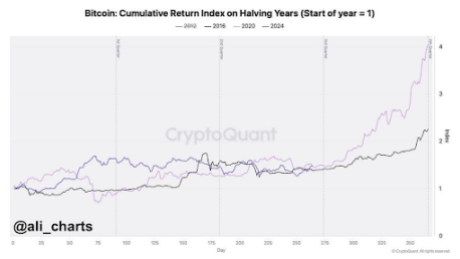

Along with the Fed charge cuts, Bitcoin’s historic development supplies a bullish outlook for the flagship crypto and suggests {that a} rise to $70,000 ought to occur quickly sufficient. Crypto analyst Ali Martinez not too long ago famous that Bitcoin loved a 61% and 171% value enhance in 2016 and 2020, respectively. These years have been each halving years.

Associated Studying

The analyst additional revealed that Bitcoin’s value motion this 12 months mirrors 2016 and 2020. As such, historical past might repeat itself, and the flagship crypto might take pleasure in beneficial properties just like these in earlier years.

Furthermore, Q4 of each year is traditionally when Bitcoin enjoys its most returns. Due to this fact, BTC ought to witness important value beneficial properties heading into the final quarter of this 12 months. In the meantime, the post-halving rally can also be across the nook, which might immediate this price surge to $70,000.

On the time of writing, Bitcoin is buying and selling at round $63,900, up over 1% within the final 24 hours, in response to data from CoinMarketCap.

Featured picture created with Dall.E, chart from Tradingview.com