Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

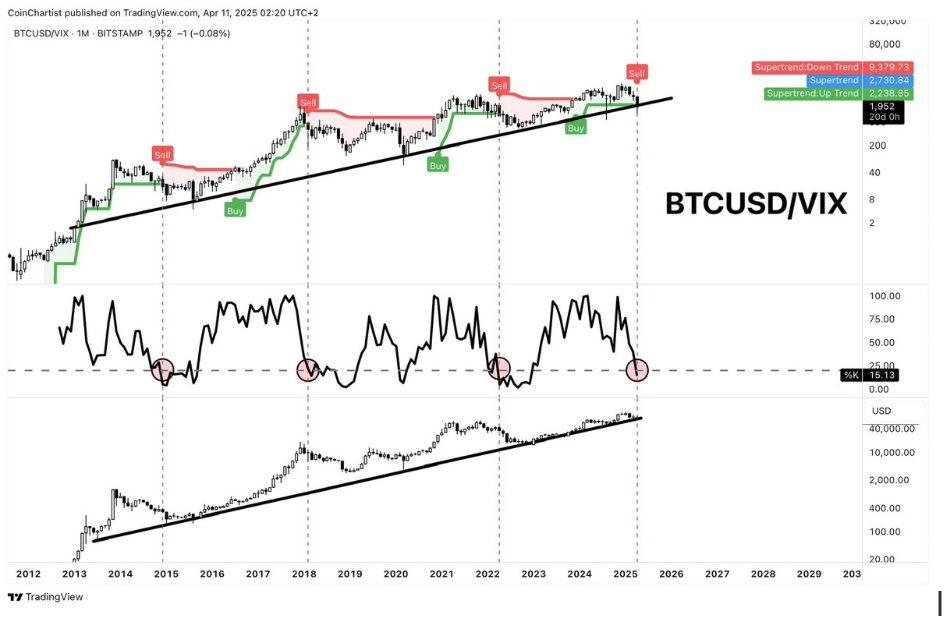

Technical knowledgeable Tony Severino has warned that the Bitcoin/VIX is just not as bullish as market contributors may consider. As an alternative, the knowledgeable revealed that the present indicators level to the flagship crypto being in a bear market.

Bitcoin/VIX Factors To A Bear Market: Analyst

In an X post, Severino warned that the Bitcoin/VIX isn’t bullish as some crypto influencers may paint it out to be. He remarked that the technical evaluation of it means that the present indicators are what market contributors are likely to see throughout Bitcoin bear markets. Nevertheless, the knowledgeable famous that the month isn’t over but, which means that these indicators may nonetheless flip bullish.

Severino beforehand highlighted a number of the reason why he’s now not bullish on Bitcoin and different crypto property. Again then, he alluded to BTC’s chart, which, primarily based on the Elliott Wave theory and different technical indicators, confirmed that the flagship crypto has doubtless topped on this market cycle.

Severino beforehand highlighted a number of the reason why he’s now not bullish on Bitcoin and different crypto property. Again then, he alluded to BTC’s chart, which, primarily based on the Elliott Wave theory and different technical indicators, confirmed that the flagship crypto has doubtless topped on this market cycle.

Amid Severino’s warning, crypto analysts like Saeed have supplied a extra bullish outlook for Bitcoin. Saeed said that this correction is solely a healthy retracement and that the flagship crypto’s broader pattern remains to be bullish. The analyst highlighted $85,000 as the extent Bitcoin wants to interrupt above to achieve new highs.

The macro facet additionally appears to be like to be bullish for Bitcoin for the time being. The newest CPI and PPI inflation information, which have been launched, got here in decrease than expectations, elevating hopes of a Federal Reserve fee reduce quickly. Based on a current report, Boston Fed President Susan Collins additionally assured that the US central financial institution is able to assist stabilize the market if needed.

With US President Donald Trump’s tariffs persisting, the US Fed might need to step in quickly, which is bullish for Bitcoin and different crypto property, as extra liquidity will circulate into them.

Bullish Technical Evaluation For BTC

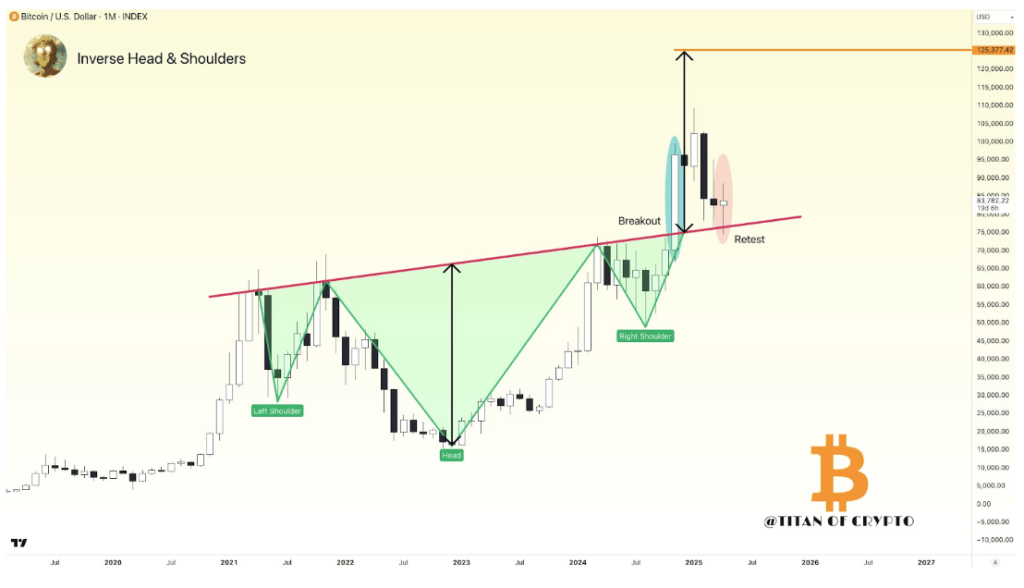

In a current X put up, crypto analyst Titan of Crypto revealed that Bitcoin is forming an inverse Head-and-Shoulders sample, though it nonetheless appears to be like like a clear retest for now. He remarked that if this sample performs out, the flagship crypto may attain $125,000 this yr, marking a brand new all-time excessive (ATH).

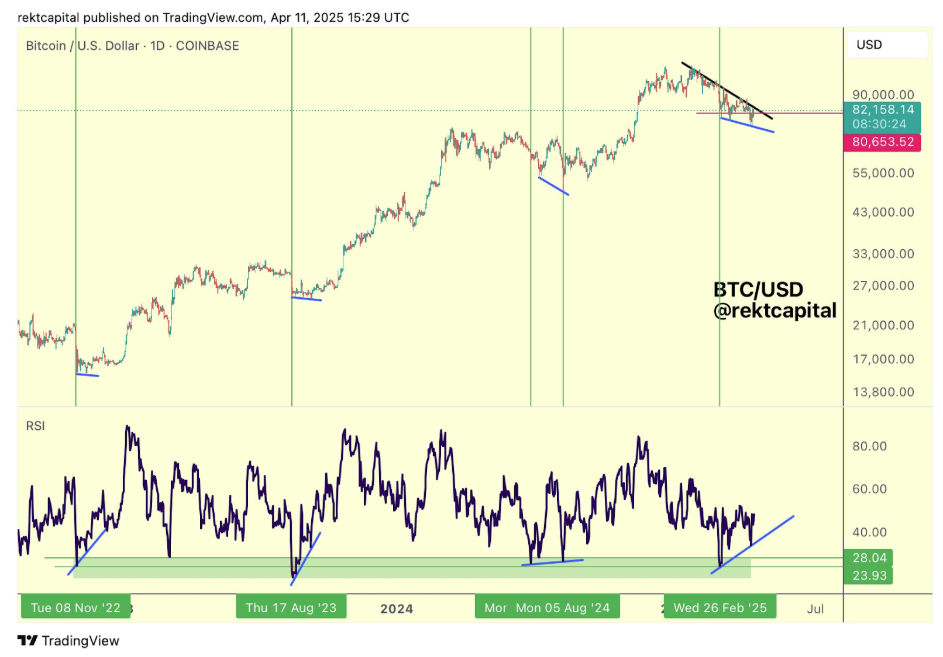

In the meantime, crypto analyst Rekt Capital revealed that Bitcoin is growing one other Greater Low on the Relative Power Index (RSI) whereas forming Decrease Lows on the worth. He famous that all through the cycle, BTC has fashioned bullish divergences like this on a number of events. It is a constructive for the flagship crypto, as every divergence has at all times preceded reversals to the upside, indicating that BTC may once more rally to the upside quickly.

Associated Studying

On the time of writing, Bitcoin worth is buying and selling at round $83,400, up over 3% within the final 24 hours, in accordance with data from CoinMarketCap.

Featured picture from Pexels, chart from TradingView