- An evaluation of Bitcoin charts on the Chicago Mercantile Alternate (CME) recommended it would proceed to fall

- Bounceback nonetheless seemingly although as contemporary capital and technical indicators may present a foundation for restoration

During the last 24 hours, Bitcoin has continued to fall on the charts, with the crypto dropping again to $83,000 after beforehand buying and selling above it. Its newest decline got here on the again of the asset making an attempt to fill a CME hole on the chart.

Nonetheless, new market insights point out that additional declines could also be seemingly, especiallu since bearish sentiment remains to be sturdy. Quite the opposite, a rally could also be solely a matter of time.

Therefore, the query – How will all this play out?

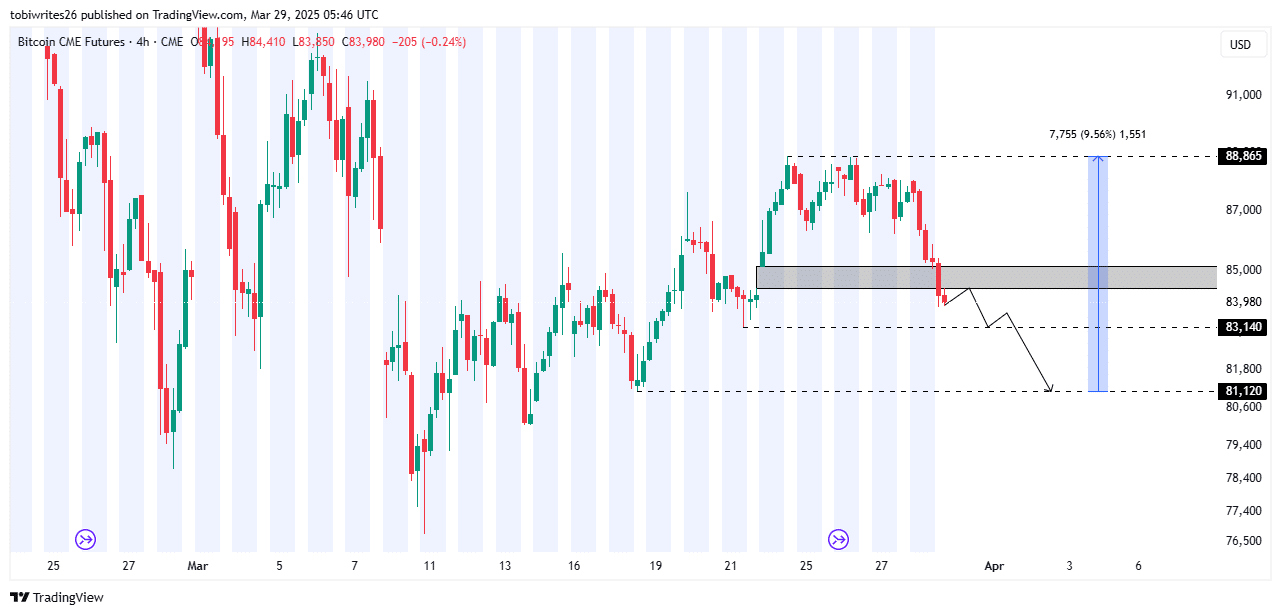

CME demand hole turns into provide

A drop right into a CME hole typically acts as a requirement zone, inflicting costs to rebound. Nonetheless, latest evaluation recommended that this demand degree has now become a provide zone.

A provide zone acts as a barrier, stopping an asset from buying and selling increased and forcing it to kind decrease lows. BTC’s CME demand hole now appearing as a provide zone may push the asset as little as $81,200 – The following notable degree the place demand could emerge.

Earlier than hitting this degree, the cryptocurrency may see a short lived rebound at $83,140 – A key degree of curiosity – earlier than persevering with south to the ultimate marked goal. From this decrease degree, a possible 9.57% rally to $88,000 may observe.

Bitcoin’s newest bout of depreciation has been consistent with a hike in liquidity flows into the market – An indication that buyers are getting ready to purchase as demand for stablecoins rises.

Proper now, $1 billion value of USDT has entered the market through the TRON community. If Bitcoin attracts a big share of this stablecoin liquidity, the rally could possibly be sturdy.

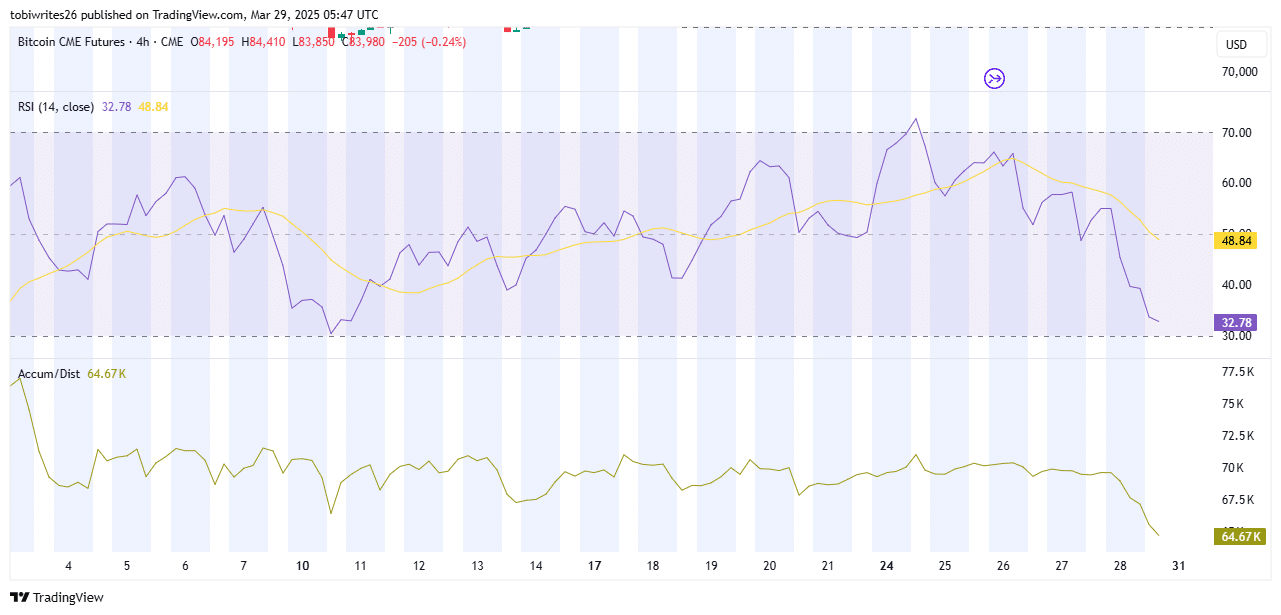

On the time of writing, the Relative Power Index (RSI) and Accumulation/Distribution indicators appeared to substantiate that BTC stays in a bearish section.

Right here, the RSI was notably notable because it appeared to be approaching the oversold zone. Whereas the market has been bearish, this recommended {that a} bounce could also be shut. If the RSI reaches oversold ranges round the important thing help at $81,200, a rally could be extremely seemingly.

Equally, the Accumulation/Distribution indicator, which tracks shopping for and promoting strain, was in a promote section at press time. This confirmed BTC’s potential for additional draw back on the charts.

Purchase dedication stays sturdy

Regardless of the newest fall on the charts, nonetheless, buy-side dedication stays sturdy.

Actually, during the last 24 hours, Bitcoin reserves on exchanges hit a brand new low – Dropping to 2.41 million.

Which means holders are transferring their property to non-public wallets, seemingly for long-term storage. Decrease trade provide reduces promoting strain and helps preserve the costs steady.

To place it merely, Bitcoin’s market stays bullish regardless of the newest value drop, setting the stage for a significant value rally.