- About $165 million in lengthy ETH positions have been liquidated as ICO participant deposited 1,700 ETH value $3.18M into Binance

- Regardless of ETH’s market cap, the community noticed a fall in transaction exercise, person development, and costs/revenues

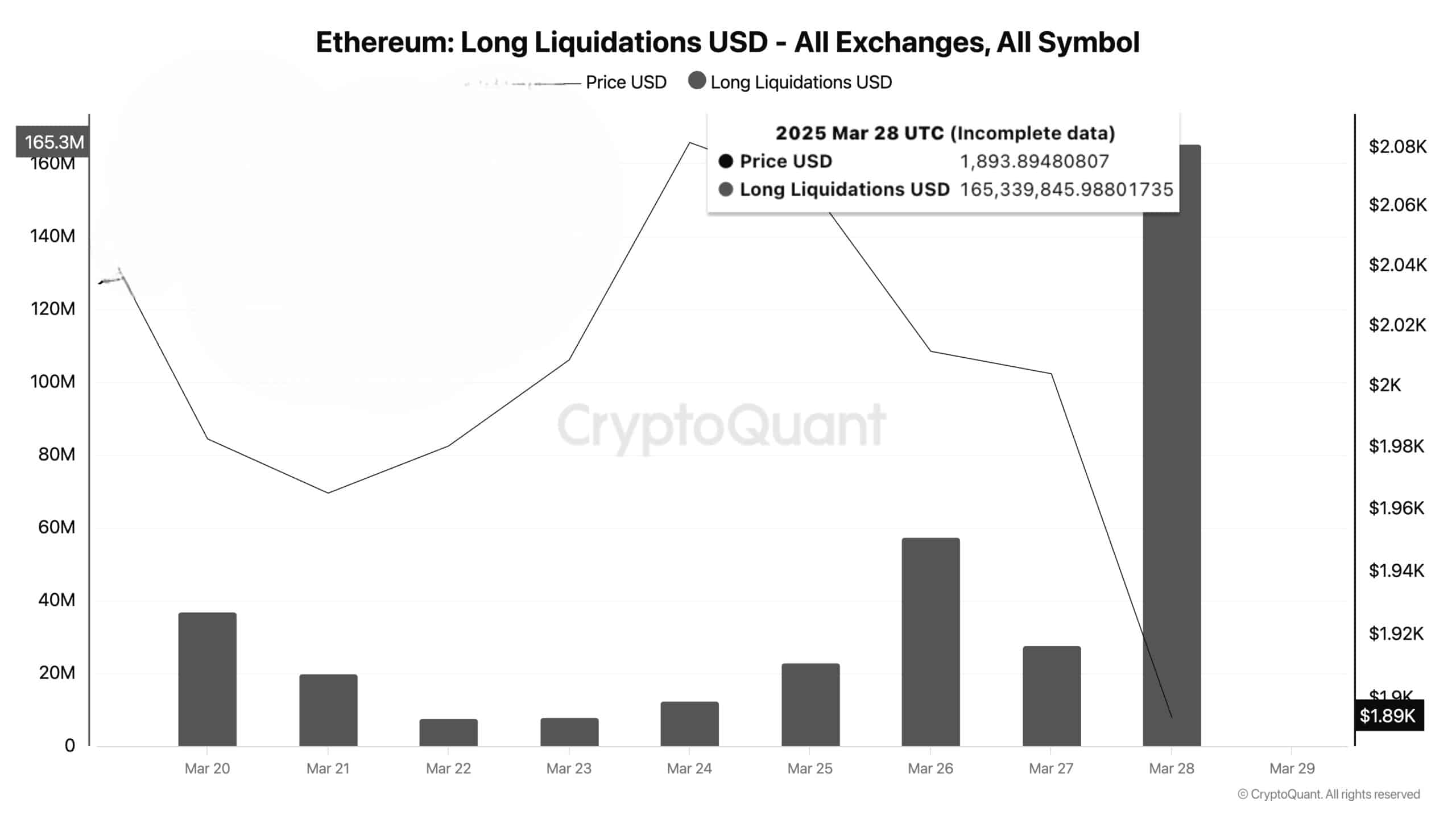

Ethereum [ETH] has seen important market correction these days. Because of the identical, merchants have confronted losses of $165 million from lengthy place liquidations.

Massive-scale liquidations occurred as leveraged merchants encountered surprising value declined which compelled many merchants to promote their belongings.

Prime quality market liquidity may proceed to push ETH’s value south, which may result in larger value fluctuations on the charts.

These large lengthy place liquidations are an indication that bullish energy has been weak, making future leveraged entry unlikely within the coming classes. The detrimental market impressions may make ETH unable to succeed in essential help areas. This might gasoline further large promoting that will lengthen the downtrend.

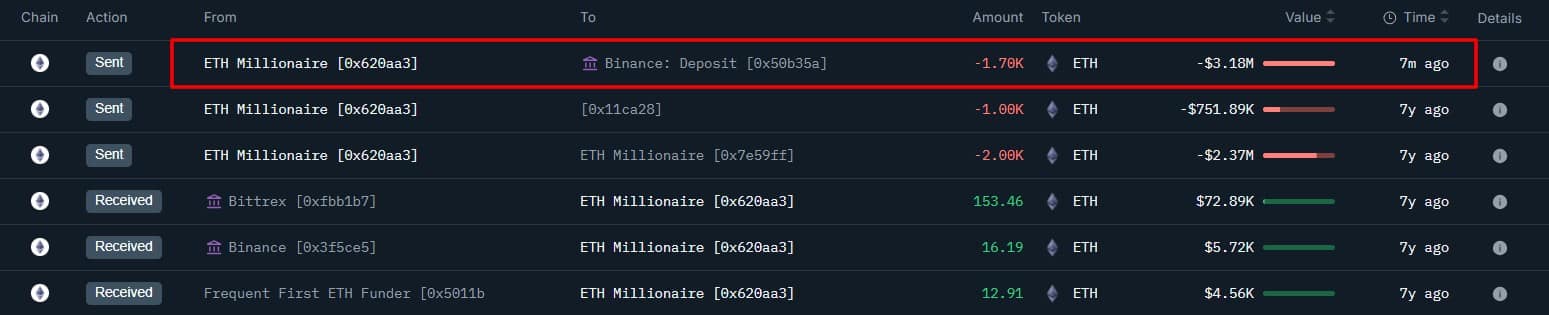

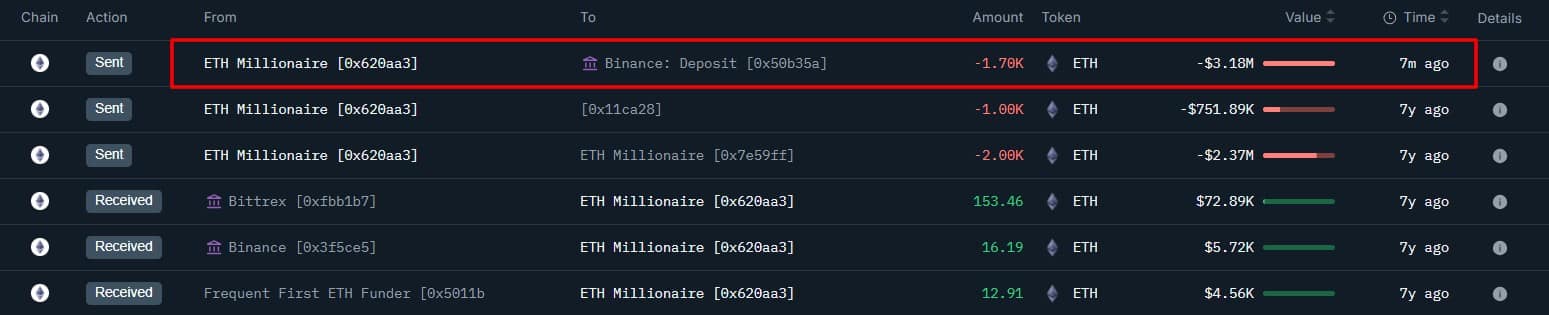

That’s not all although as moreover, an Ethereum ICO participant with no latest exercise in seven years despatched 1,700 ETH valued at $3.18 million to Binance.

The bizarre motion demonstrated that the holder could have deliberate to promote their cash – An indication of sell-side stress.

Supply: Onchain Lens

Whales generate market instability by relocating their current belongings since market speculators attempt to predict their aims. On this specific case, the deposited ETH may result in actual gross sales by traders so unfavorable market situations may emerge for Ethereum.

Nevertheless, ETH has just lately confirmed minimal adjustments if the whales carry out funding methods with their funds, as a substitute of conducting gross sales actions.

Max ache value degree and community exercise

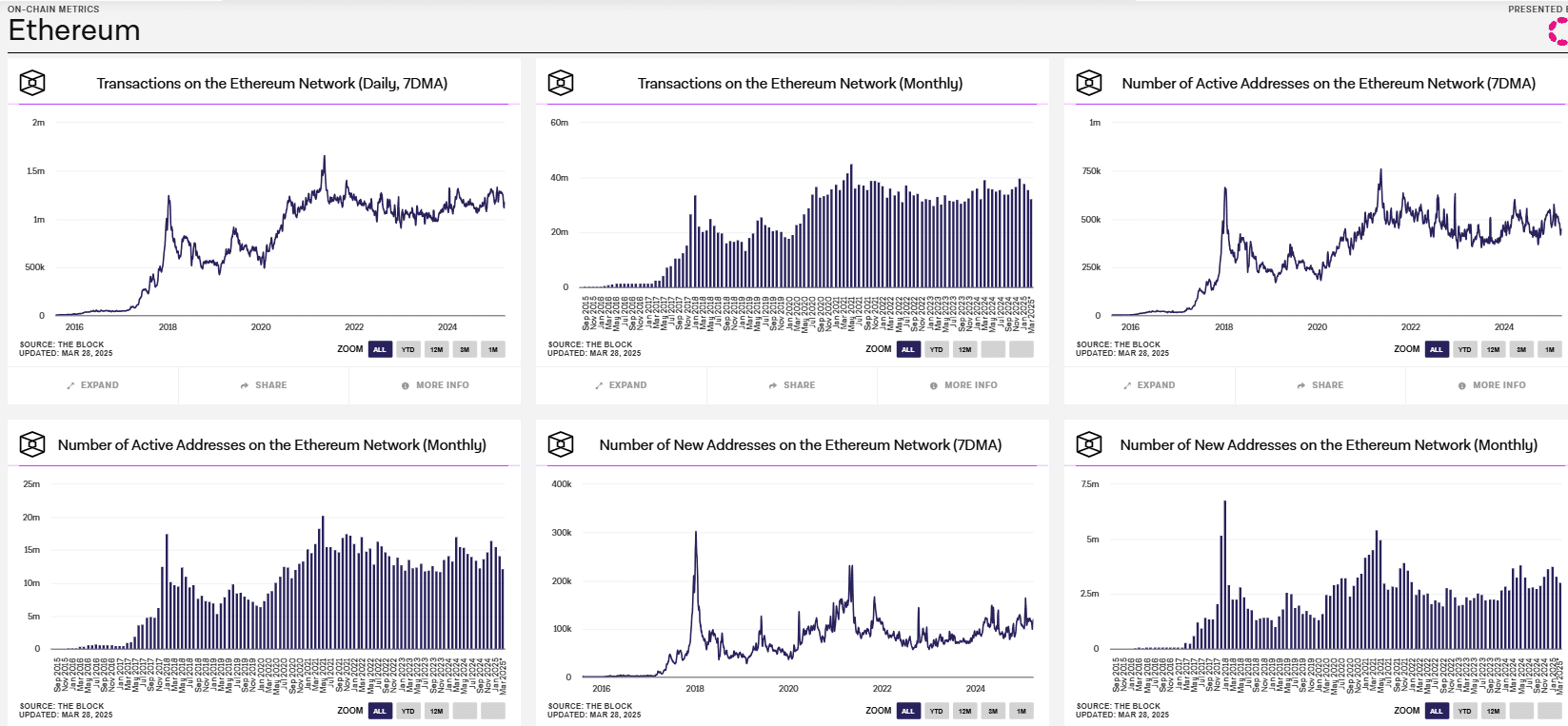

On the time of writing, bearish sentiment gave the impression to be emanating from the Ethereum blockchain. For instance – The variety of day by day transactions remained round 1M because the utilization steadily decreased throughout the board.

Whereas transaction frequency for a month surpassed 40M, nevertheless, it fell wanting reaching its peak numbers.

Energetic addresses stayed beneath 750k as person involvement gave the impression to be declining. And but, the month-to-month energetic addresses totaled greater than 10M – Indicative of sustained person engagement within the long-term.

New Ethereum community addresses (7DMA) revealed declining statistics since they fell to numbers beneath 100k. The two.5M month-to-month new addresses created much less most affect than beforehand recorded spikes of recent addresses.

For its half, Ethereum’s value broke down by the April max ache level of $2,200 – A degree that has traditionally served as help.

What this implies is that extra draw back will be anticipated.

Is ETH good as an funding or as a utility community?

Proper now, Ethereum may be functioning extra as a main utility system. Particularly because the information instructed person addition and transaction operations didn’t mirror rising developments.

The enchantment of Ethereum investments may fall relying on fixed adoption charges remaining stagnant. The autumn in community use, together with main holder sell-offs of whales and hike in liquidations of lengthy positions, are all indicators of detrimental sentiment. Lastly, ETH’s falling value continues to create doubts about its functionality to function an funding asset.

To place it merely, the market atmosphere for Ethereum is unclear proper now.