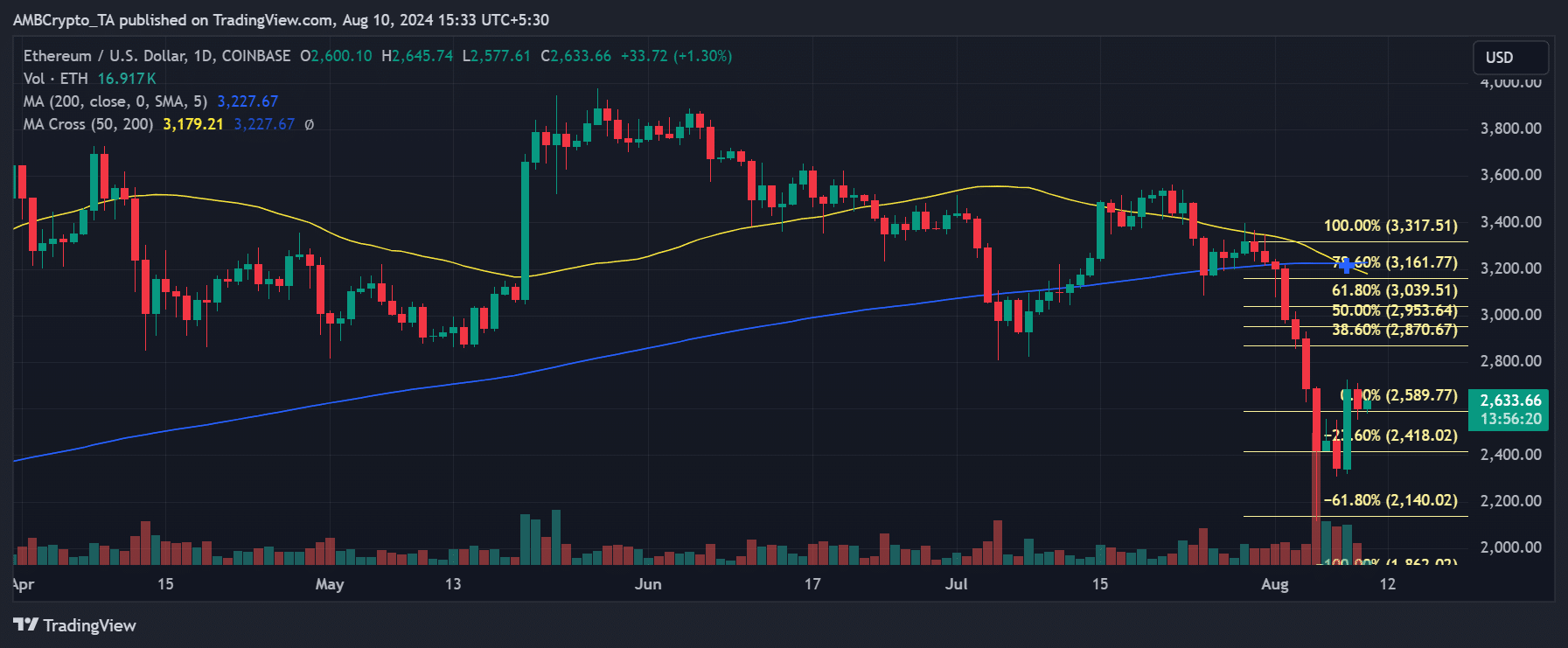

- ETH, at press time, was testing the 0% Fibonacci degree

- Its every day lively addresses have remained above 400,000 too

Ethereum [ETH] recorded main bouts of depreciation over the previous couple of weeks, pushing its worth effectively beneath $3,000 – A degree it had maintained for a while. Now, whereas there was a current rally, this uptick was not adequate to revive it above the aforementioned degree.

Contemplating the development of different indicators and market dynamics, ETH could have some volatility forward.

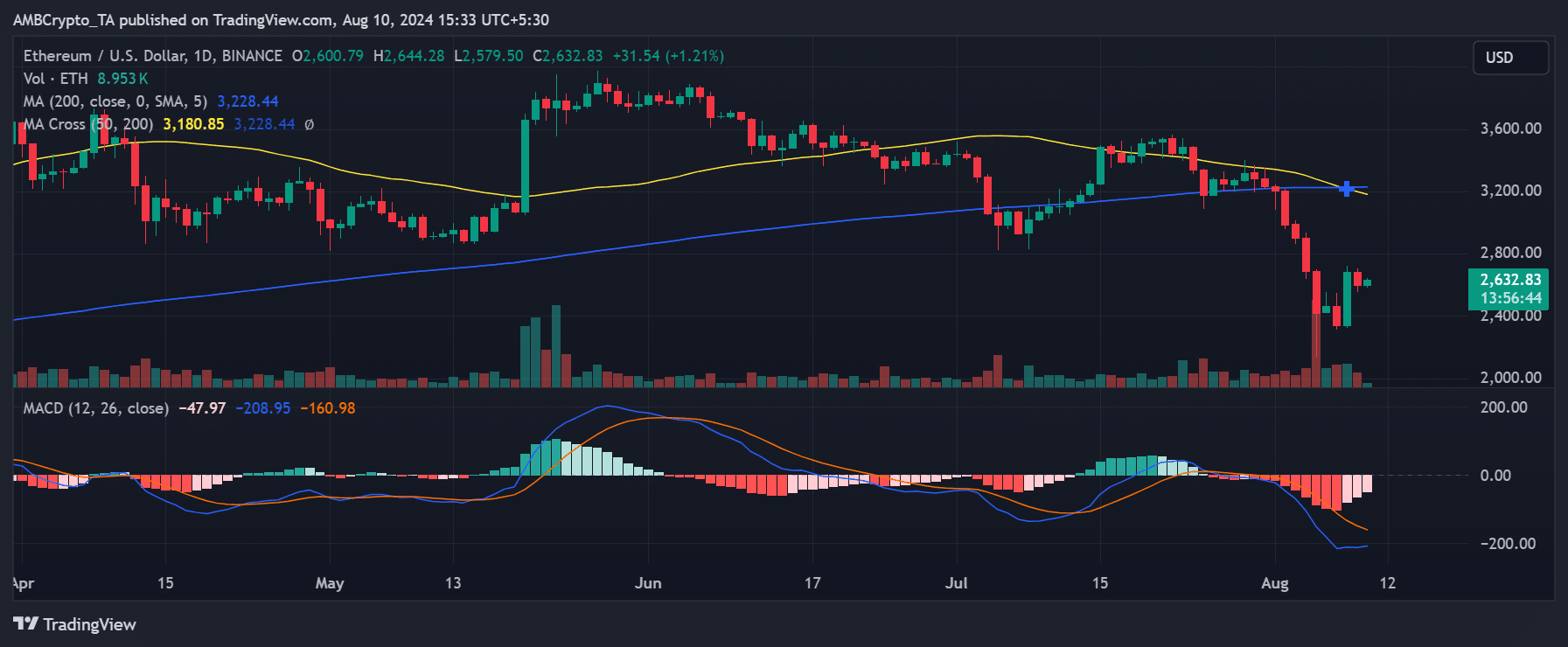

Ethereum sees a demise cross

The current worth development of Ethereum, regardless of a notable enhance of 14.56% on 8 August, has led to a regarding technical formation referred to as a demise cross.

This sample emerged extra strongly following a 3.10% decline on 9 August, which introduced the worth all the way down to roughly $2,601. A demise cross happens when a shorter-term transferring common (depicted right here by the yellow line) crosses beneath a longer-term transferring common (the blue line), signaling potential long-term bearish sentiment out there.

Moreover, the Shifting Common Convergence Divergence (MACD) evaluation indicated that ETH’s momentum was unfavorable. On the time of writing, the MACD line was positioned beneath the sign line.

Nonetheless, there gave the impression to be delicate indicators that this downward momentum could also be shedding power. The MACD histogram confirmed indicators of convergence, that means the unfavorable bars had been changing into much less pronounced. This might be indicative of weakening bearish momentum, which could precede a market reversal.

The bear and bull case for ETH

An evaluation of Ethereum utilizing the Fibonacci Retracement indicator pointed to a number of potential worth tendencies. On the time of writing, the worth had bounced off the lows close to $2,140 – the -61.8% Fibonacci retracement degree. It was then testing the 0% Fibonacci retracement degree at roughly $2,589.77.

If the worth stays above the 0% degree ($2,589.77), it may check the subsequent resistance ranges at $2,870.67 (38.6% retracement) and $2,953.64 (50% retracement). Additionally, a profitable breakout above the 50% degree could result in an additional restoration in direction of the 61.8% retracement degree at $3,039.51, and doubtlessly larger.

Conversely, if the worth fails to carry above the 0% Fibonacci degree and faces rejection, it would revisit decrease help ranges.

A drop beneath $2,418.02 (23.6% retracement) may set the stage for a retest of the current low close to $2,140. If bearish momentum intensifies, Ethereum may even fall beneath $2,140, leading to new decrease lows.

Ethereum’s demise crosses within the final three years

Right here, it’s price declaring that Ethereum has seen a death cross for the third time within the final three years. The primary occasion occurred on 27 January 2022, when Ethereum was buying and selling at roughly $2,500. Following this demise cross, the worth declined to about $1,500 over the subsequent few months earlier than recovering with a golden cross on 10 February 2023.

The second demise cross occurred on 2 September 2023, when Ethereum was valued at round $1,600. Nonetheless, this cross was short-lived, with Ethereum shortly rallying and forming a golden cross on 21 November 2023.

After this golden cross, Ethereum famous important uptrends, with the altcoin hitting the $4,000-level in early 2024.

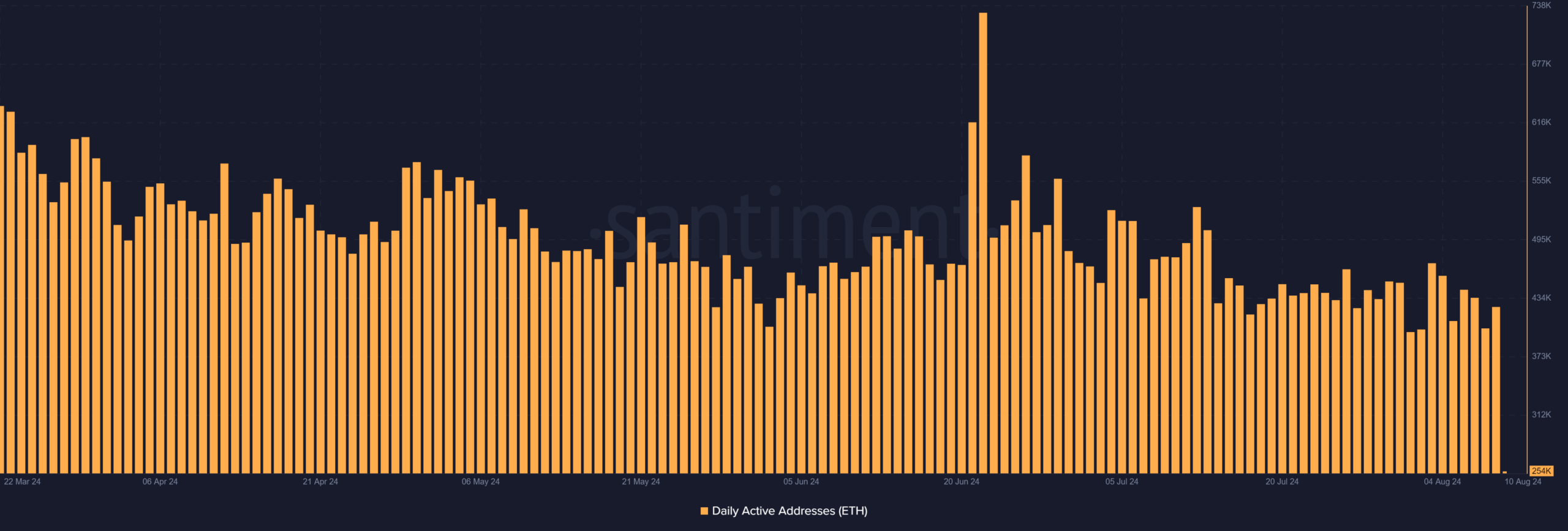

Ethereum lively addresses keep respectable

An evaluation of Ethereum’s every day lively addresses chart on Santiment revealed a slight decline over the previous few days.

Regardless of this drop, nonetheless, the variety of lively addresses has remained above the 400,000-threshold. On 3 August, lively addresses had been over 470,000, however by 9 August, this quantity had fallen to round 425,000. At press time, the variety of lively addresses stood at over 230,000.

– Learn Ethereum (ETH) Price Prediction 2024-25

If every day lively addresses proceed to say no, this might result in decreased community exercise and additional downward stress on the worth.

Conversely, if lively addresses stabilize or rise and the worth breaks above key resistance ranges, Ethereum may see a extra sustained restoration.