- BlackRock holds extra ETH than the Ethereum Basis now

- BlackRock’s ETHA now on monitor to hit $1B mark in internet inflows

BlackRock has maintained its dominance within the Ethereum [ETH] ETF house, much like its exceptional efficiency in U.S spot Bitcoin [BTC] ETFs. Actually, the agency’s ETH holdings have reached figures of 318k, surpassing even the Ethereum Basis’s 308k cash.

BlackRock eyes $1B internet inflows – Will ETH’s value observe?

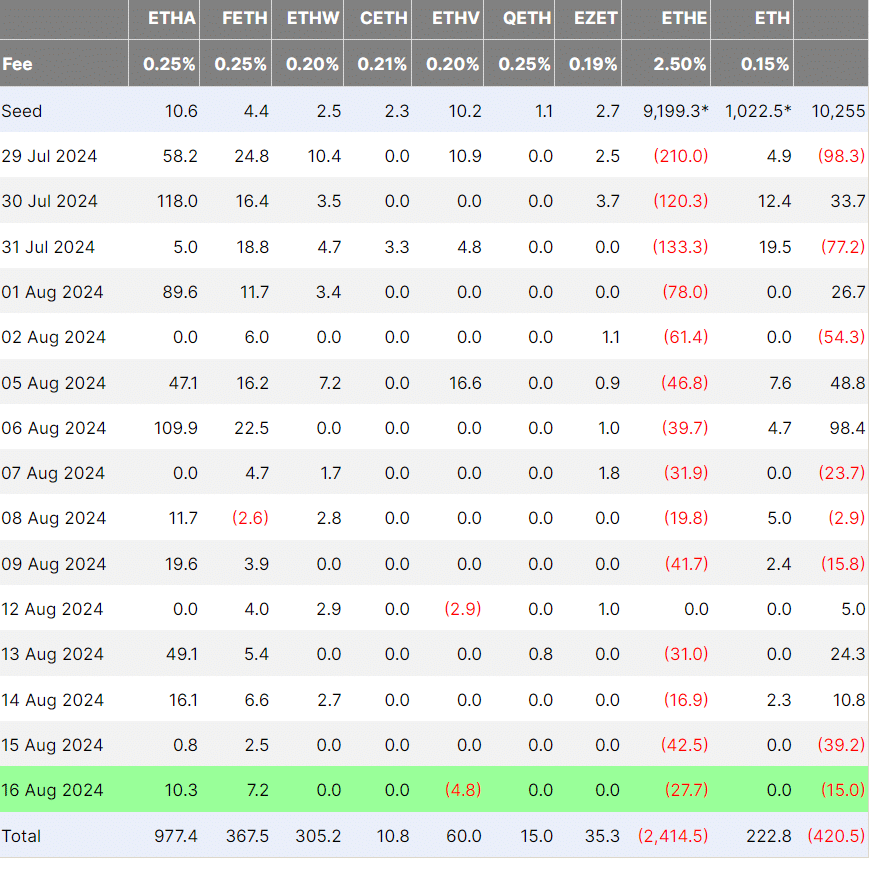

Apart from flipping Ethereum Basis in its ETH holdings, BlackRock might quickly cross the $1 billion internet inflows mark. As of 16 August, the agency’s ETHA product had a complete of $977 million in internet flows and was the one product above $500M.

This performance was achieved in lower than a month.

Apparently, the ETH ETFs noticed internet inflows in the direction of the start of the week. As noted by Coinbase analysts of their weekly report lately, this may be interpreted as a constructive catalyst for ETH’s value.

Nonetheless, the analysts additionally mentioned that the low community exercise illustrated by the slump in ETH gasoline charges to a five-year low might complicate value restoration.

That being mentioned, Ryan Lee, Chief Analyst at Bitget Analysis, informed AMBCrypto that the droop in ETH gasoline charges could possibly be an indication of ETH’s value backside within the mid-term.

“Traditionally, each time ETH gasoline charges have dropped to all-time low; it has usually signalled a value backside within the mid-term. ETH costs are inclined to strongly rebound after this cycle.”

Lee added that ETH’s gasoline charges droop is a constructive, particularly given the anticipated Fed price minimize in September.

“When this second coincides with an rate of interest minimize cycle, the market’s wealth impact is stuffed with prospects. Due to this fact, we’re sustaining a constructive outlook on this information.”

So far as the altcoin’s value motion is worried, it has been range-bound between $2500 and $2750 all through the week. Its indicators appeared to be flashing very combined alerts too.

Therefore, the altcoin’s subsequent value transfer would possibly simply rely on Bitcoin’s [BTC] subsequent value route on the charts.