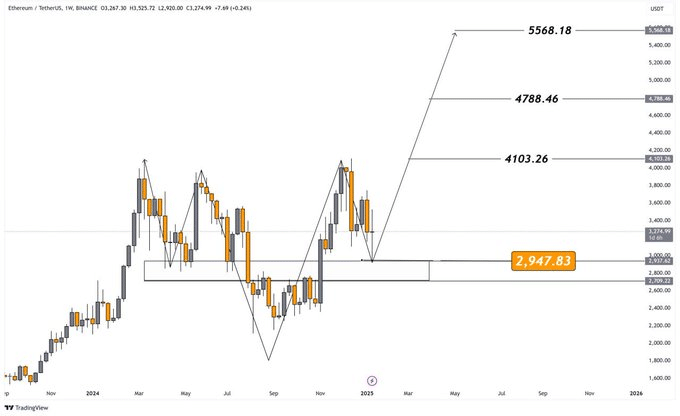

- Ethereum (ETH) gave the impression to be forming a bullish W-pattern on the weekly chart

- Altcoin’s Market Worth to Realized Worth (MVRV) ratio highlighted its truthful valuation

Ethereum (ETH), on the time of writing, was forming a bullish W-pattern on the weekly chart, signaling a possible development reversal and important upside. Actually, the altcoin gave the impression to be holding above the crucial $2,947 assist – A stage that’s now serving because the neckline of this formation.

This assist zone is pivotal in figuring out Ethereum’s trajectory, with value targets set at $4,103, $4,788, and $5,568, as highlighted on the chart. A breakout above the neckline resistance would verify the bullish development, opening the door for important good points.

This W-pattern may be interpreted to underline Ethereum’s resilience, highlighting a shift from bearish to bullish momentum. Actually, the altcoin’s value chart revealed that sustaining assist above $2,947 can be essential for this sample to play out.

A confirmed breakout above $3,200 might pave the way in which for fast upward motion in direction of the $4,100 resistance.

Gauging Ethereum’s momentum

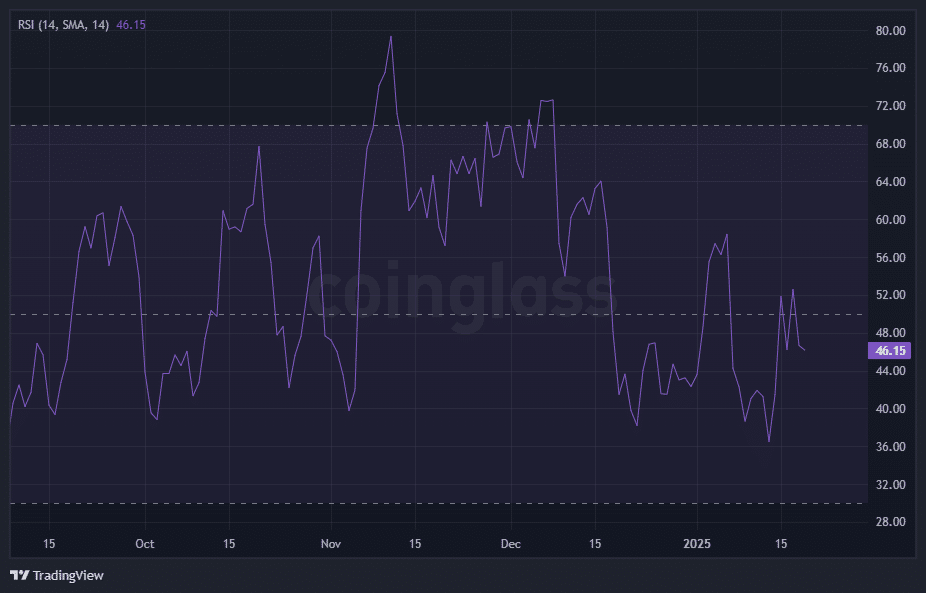

From the attitude of momentum, the Relative Power Index (RSI) had a studying of 46.15 at press time. This impartial stage hinted at a stability between consumers and sellers within the altcoin’s market.

Nonetheless, the RSI’s stabilization close to its midline hinted at waning bearish strain. A decisive transfer above 50 might sign renewed bullish momentum, aligning with a possible value breakout.

Conversely, a drop under 40 may be an indication of additional draw back, jeopardizing the $2,947 assist stage.

Assessing Ethereum’s valuation

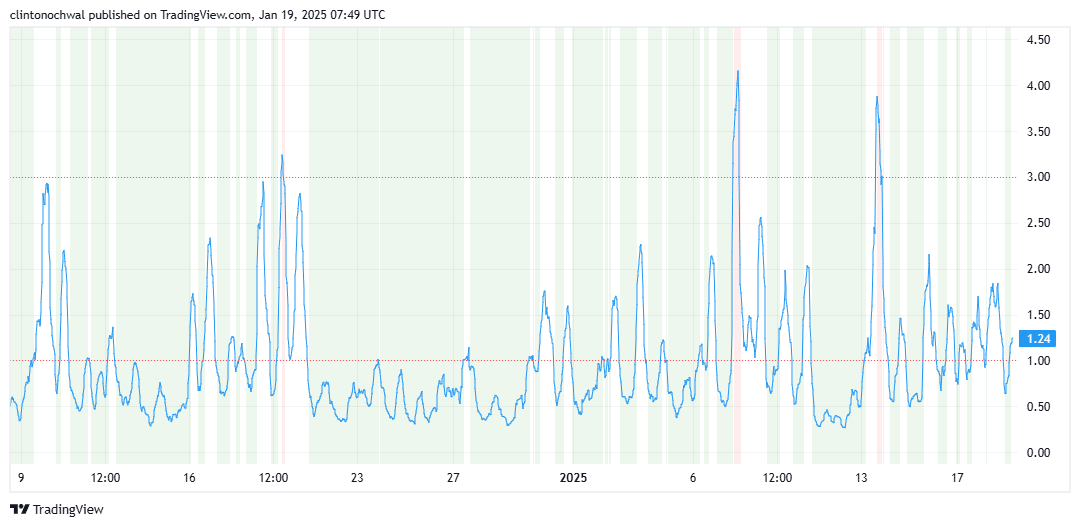

For extra insights, it’s price trying into Ethereum’s Market Worth to Realized Worth (MVRV) ratio too. On the time of writing, it’s studying mirrored truthful valuation. The ratio was hovering close to its impartial ranges – An indication that ETH was neither overvalued nor undervalued.

Traditionally, MVRV values above 1.2 have triggered some promoting strain, whereas values under 0.8 have attracted consumers. As ETH approaches increased targets, the ratio might enter the overvaluation territory, prompting warning amongst long-term buyers.

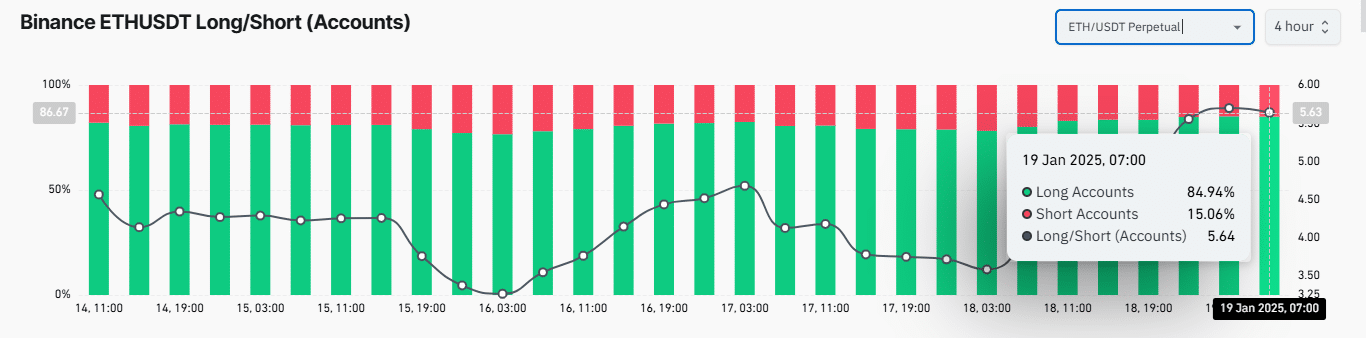

Lastly, the lengthy/quick ratio revealed that 84.94% of accounts had been lengthy – An indication of sturdy bullish sentiment for Ethereum.

This excessive imbalance alluded to potential upward value momentum as consumers have dominated the market to date. Nonetheless, overwhelming lengthy positions may introduce the danger of sharp value corrections. Particularly if the market sentiment shifts or lengthy liquidations happen throughout volatility.

Each Ethereum’s weekly chart and technical indicators hinted at a pivotal second for the cryptocurrency. The W-pattern, mixed with a impartial RSI and a balanced MVRV ratio, highlighted Ethereum’s potential for a bullish breakout if key ranges maintain.