- Ethereum is establishing itself as a singular asset, carving out its personal id.

- A number of components are contributing to this growth.

Two years in the past, the crypto market was rocked by the collapse of FTX, sparking widespread concern and triggering intense regulatory issues. Quick-forward to at the moment, and the panorama has remodeled.

The market is again with a vengeance, and Ethereum [ETH] is main the best way. ETH not too long ago broke out of a four-month hunch in below 5 buying and selling days, posting each day beneficial properties near 10%.

In early bullish cycles, capital usually shifts from Bitcoin into altcoins as traders chase new alternatives for revenue.

Nonetheless, with election uncertainty easing – an occasion that briefly pushed Bitcoin dominance over 60% – Ethereum is now rising as a definite asset class, not simply one other high-cap altcoin.

May this pave the best way for ETH to outperform Bitcoin [BTC], as traders start to view it with recent conviction?

Ethereum is on a journey of self-discovery

Trump’s pro-crypto manifesto has clearly resonated with traders, propelling Bitcoin near $80K.

Buying and selling at $79,500 at press time, Bitcoin has posted a achieve of over 15%, and it’s nonetheless lower than every week for the reason that election outcomes have been introduced.

Nonetheless, this fast progress in such a short while may spark warning amongst traders, significantly the “weak arms” – those that are fast to exit when Bitcoin enters the danger zone.

This might create a chief alternative for Ethereum, a possible shift that AMBCrypto suggests it might capitalize on, very similar to it did in the course of the mid-Might cycle.

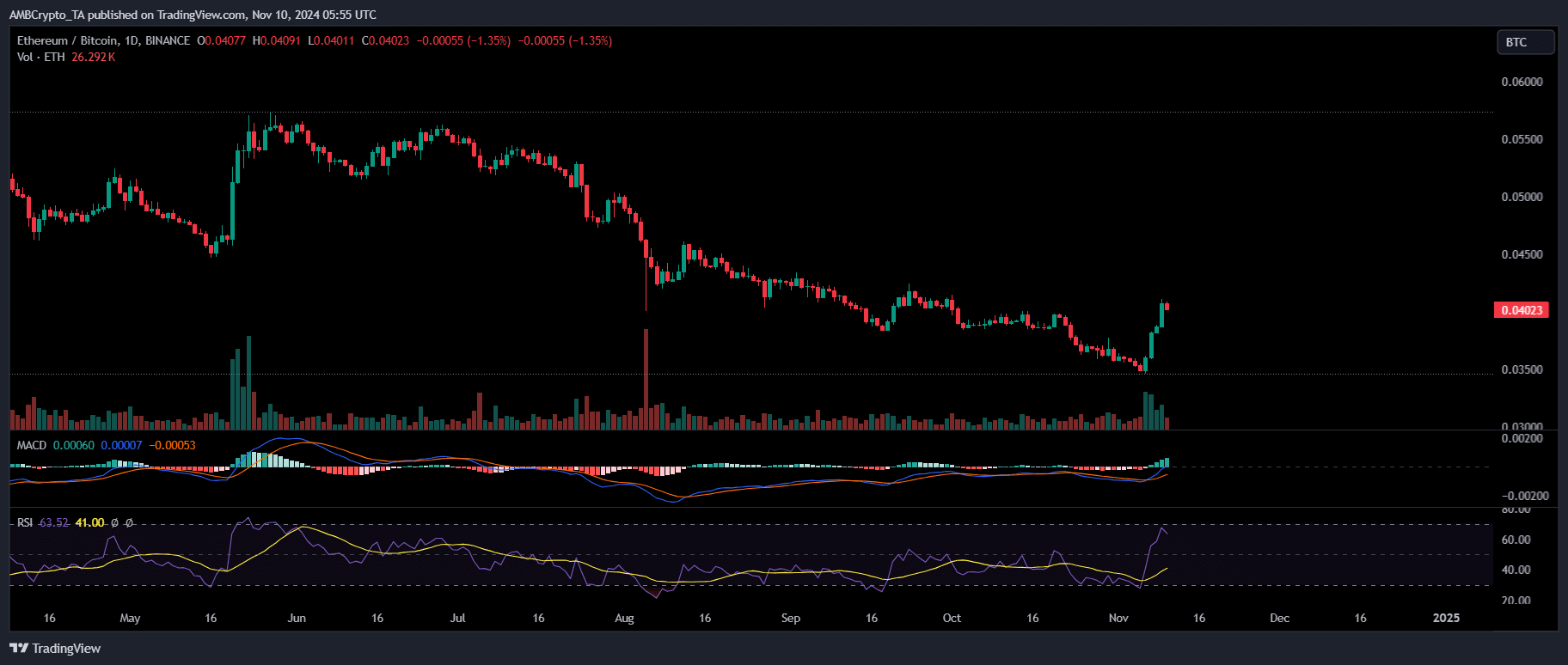

After six months of constant downtrend, Ethereum demonstrated vital dominance over Bitcoin. The final time this occurred, ETH posted an enormous each day candle, highlighting a 20% surge in a single day.

Equally, this time, a considerable move of capital from Bitcoin into Ethereum has performed a key function in serving to ETH break the $3K benchmark.

Nonetheless, there’s extra to this shift, which may sign Ethereum’s rising independence from Bitcoin, positioning the 2 as distinct asset sorts available in the market.

There’s enough proof to again this notion

To start with, Ethereum’s weekly achieve has doubled compared to Bitcoin, reaching a exceptional 30%. Driving this surge are double-digit capital inflows into ETH ETFs.

This can be a game-changer, because it marks the primary time ETH ETFs have seen an enormous inflow of capital since their launch 4 months in the past. Initially, regardless of the launch, the impression on ETH’s worth was minimal.

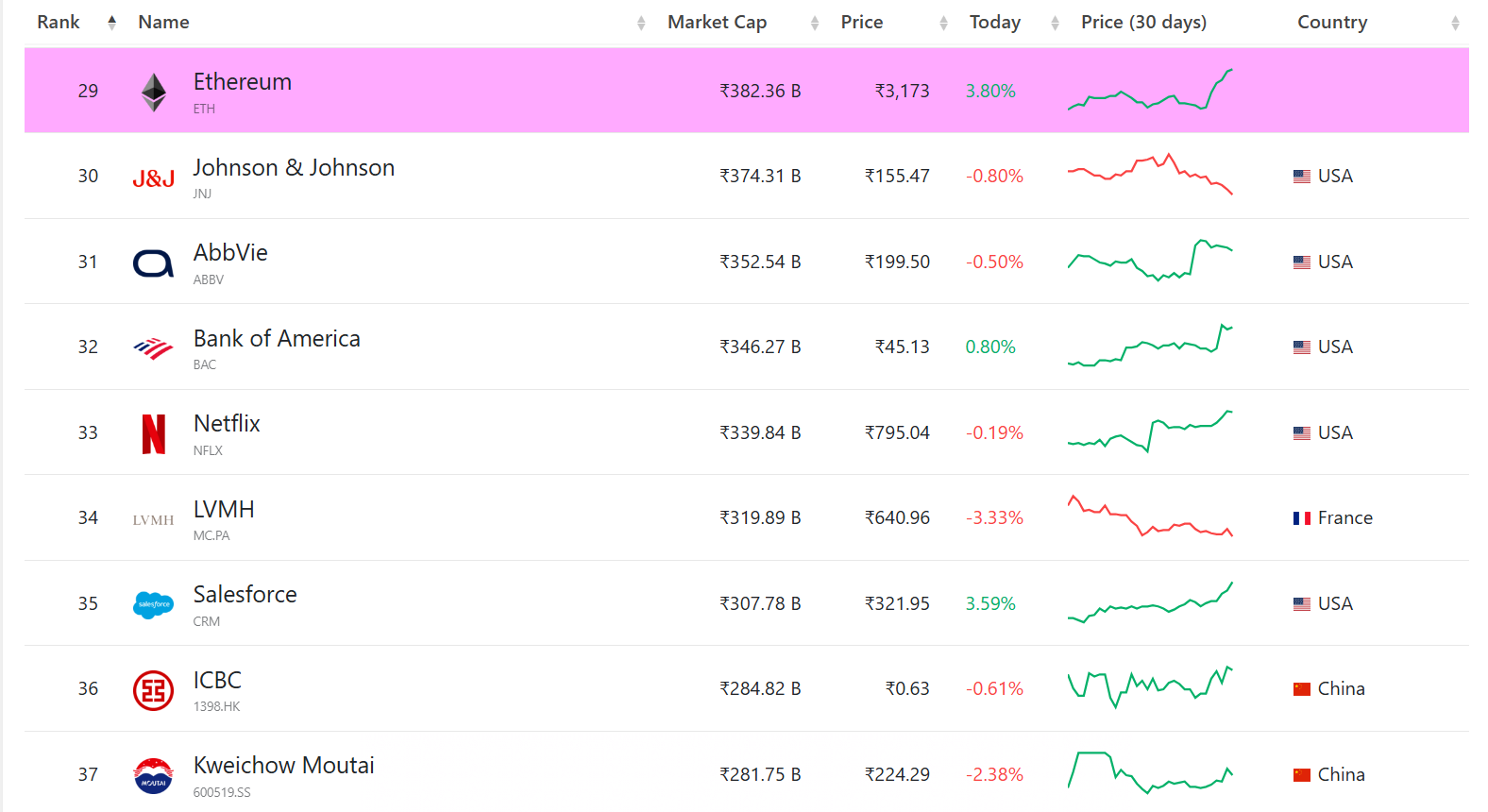

Nonetheless, this latest surge alerts a shift, propelling Ethereum again into the highest 30 most beneficial property on the earth, with a market cap of $382.36 billion.

These developments recommend a rising group of establishments backing Ethereum’s long-term potential. This institutional help is essential in mitigating any near-term pressure that might push ETH southwards.

Moreover, what was as soon as dubbed the “Ethereum killer,” Solana has lived as much as its title. Because the previous cycle, Solana has attracted notable liquidity from Bitcoin, buying and selling above $200.

This triggered a stir available in the market, main analysts to marvel if a market shift is underway, with Ethereum doubtlessly shedding floor to its rival.

Whereas Ethereum nonetheless lags behind Solana on varied fronts, its 7-day progress in a number of key metrics has been impressively robust.

With weekly income up 250%, in comparison with Solana’s 67%, and each day transactions growing by 10%, far outpacing Solana’s 3%, Ethereum is exhibiting resilience.

Is your portfolio inexperienced? Try the ETH’s Profit Calculator

Thus, this bull cycle has been a game-changer for Ethereum. Whereas it might face some sideways stress at key resistance ranges, this surge has positively boosted its long-term outlook.

Ethereum is now primed for a possible breakout, with an actual shot at surpassing the $3.5K mark within the close to future.