- Greater than $2 Billion ETH shorts shall be liquidated if the Ethereum value pumps to $3,000.

- Ethereum is days away from printing the same BTC month-to-month Hammer candle that preceded a parabolic rally.

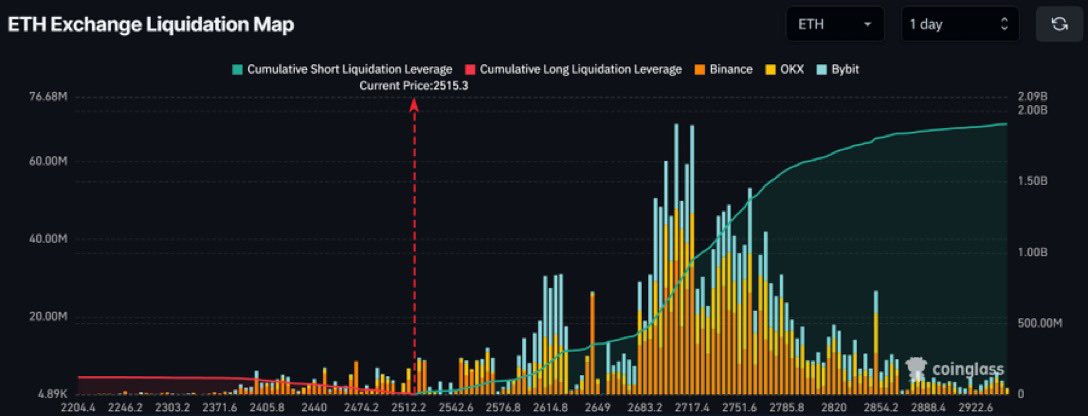

Ethereum’s [ETH] Change Liquidation Map indicated large accumulation of brief positions, with potential liquidations approaching $2 billion if ETH’s value reaches $3,000.

As of press time, ETH was buying and selling at $2,479.30. The rise in cumulative brief liquidation leverage steered excessive bearish hypothesis inside this value vary.

If ETH’s value surges to $3,000, liquidating these brief positions might create a brief squeeze. This might propel the worth even larger as brief sellers cowl their positions.

This might entice extra bullish sentiment and shopping for exercise, pushing ETH’s value in direction of new resistance ranges.

Alternatively, if Ethereum fails to succeed in this set off level, the bearish sentiment might proceed. This might result in value stabilization or additional decline if bearish market circumstances persist.

Lengthy place liquidations might exacerbate this if costs fall, as indicated by the smaller peaks in lengthy liquidation.

What potential month-to-month Hammer candle means?

A comparative evaluation between Bitcoin’s 2021 value motion and Ethereum’s present actions exhibits ETH is on the point of forming a month-to-month hammer candlestick. This sample mirrors Bitcoin’s sample earlier than its 2021 rally.

If Ethereum completes this sample, it suggests potential bullish momentum much like Bitcoin’s climb from round $10,000 to just about $66,000.

Presently, Ethereum’s value at $2,479.76 might comply with the same trajectory, doubtlessly focusing on the $4,800 degree, marked by earlier resistance factors in 2021 earlier than advancing in direction of $16,000.

Conversely, if the sample doesn’t fulfill and the candle turns damaging, Ethereum might see assist testing decrease bounds close to $2,150, aligning with previous assist ranges.

This sample suggests an imminent choice level for ETH. The formation of a hammer candle might catalyze a rally, reflective of historic patterns seen in BTC.

The subsequent few buying and selling periods shall be essential. They may verify whether or not ETH will emulate BTC’s explosive previous efficiency or diverge onto a bearish path.

Ethereum ICO whale cashing out

Regardless of the potential rally, one other Ethereum ICO whale from the 2015 ICO period has cashed out large. The whale deposited 3,046 ETH value $8.16M to Kraken. This follows a 6,046 ETH value $16.34M sell-off up to now day, in line with EyeOnChain.

With a jaw-dropping value foundation of $0.31 per ETH, this profit-taking spree leaves him with just one,024 ETH. As crypto markets grapple with widespread declines and capitulation, this transfer might amplify bearish sentiment.

Giant-scale liquidations from early adopters typically spook traders, doubtlessly driving ETH costs decrease amid fragile market confidence. Which means that Ethereum’s subsequent strikes grasp within the stability.