- Per Amberdata, ETH might rally increased if the U.S. spot ETH ETF staking is accredited.

- The choices market is positioned for a $6K upside ETH goal by December 2025.

Ethereum’s [ETH] current 70% run-up from April lows often is the starting of a bigger uptrend focusing on $3.5K-$6K, in line with crypto choices analytics agency Amberdata.

In its weekly market report, Amberdata’s Greg Magadini wrote,

“There’s argument for ETH ‘catching-up’ as spot ETFs with staking rewards could possibly be a catalyst for institutional participation and sentiment turns round. No purpose to be ‘calling tops’ proper now.”

ETH catalysts

The SEC has postponed its resolution on staking purposes for spot ETH ETFs from Grayscale and Hashdex, pushing the evaluation interval to between June and October.

However most analysts, together with Magadini, imagine this further staking yield (3% per 12 months) could possibly be a key catalyst for demand for spot ETH ETFs, ultimately rallying ETH.

In actual fact, the manager pointed to current robust bullish inflows focusing on $3.5K and $6K by year-end, suggesting merchants are positioning for such a state of affairs.

“ETH block trades final week noticed some very bullish move in EOY December choices. $3,500 / $6,000 name spreads traded for 30,000x contracts by way of 10 distinct trades. The overall premium spent right here was somewhat over $7 million.”

Name choices are bullish bets or safety for the upside, reflecting bullish sentiment for future worth motion. Places, quite the opposite, seek advice from the other and draw back safety, underscoring a bearish bias.

Merely put, merchants anticipated ETH to rally between $3.5K and $6K by December 2025.

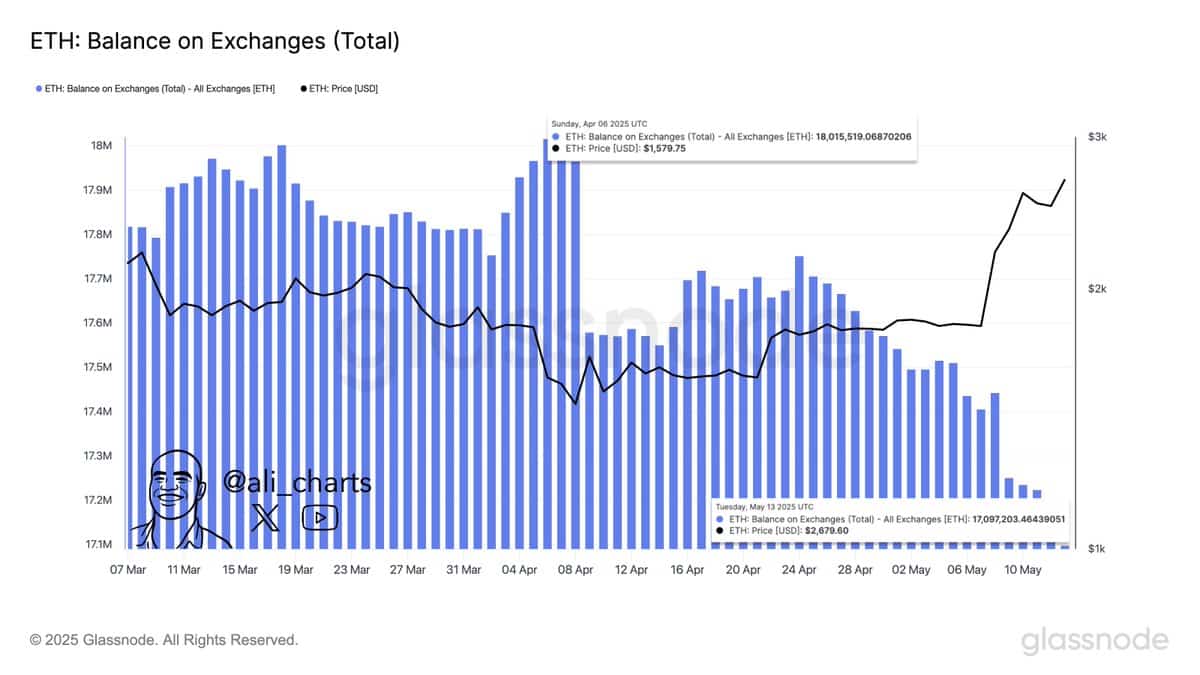

On-chain information additionally supported the continued uptrend thesis. Since April, over 1 million ETH (about $2.38 billion) have been moved from exchanges between April and mid-Could.

This mirrored broader accumulation amid the renewed altcoin surge.

That’s a big discount in promoting strain that might additional enhance the rally. Regardless of the mid-term bullish outlook, ETH’s short-term momentum weakened barely at press time.

In response to crypto dealer and analyst, Income Sharks, ETH’s On Steadiness Quantity (OBV) retreated, suggesting lowered quantity that might drag the rally.

In addition to, he added that the formation of a bearish head and shoulder sample might drag ETH decrease if validated.

On the each day worth chart, nevertheless, ETH flashed a golden cross, a formation that generally precedes huge rallies.