- Ethereum on a gentle decline since dropping under $3400.

- The gang is shedding curiosity in ETH throughout this gentle crypto stoop.

Ethereum [ETH] has proven indicators of weak spot, even after current features failed to interrupt above the $3,400 mark. This has raised issues that ETH would possibly enter a short-term correction section, as instructed by varied metrics.

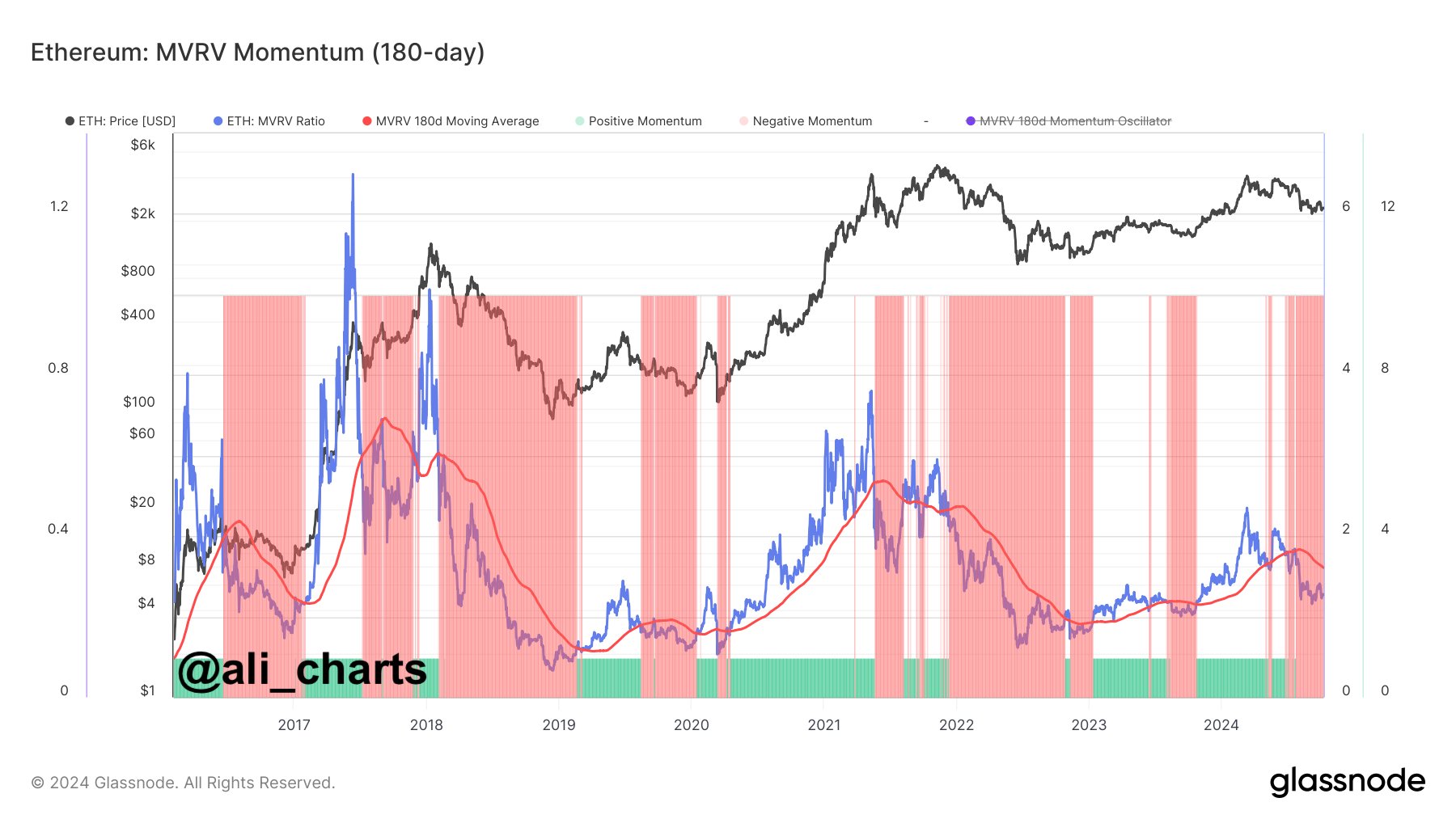

One key indicator, MVRV Momentum, highlights that Ethereum has been on a gentle decline because it dropped under $3,400 on twenty third June, 2024.

This might point out a possible downtrend for ETH, making it essential for merchants to be cautious whereas additionally figuring out doable long-term shopping for alternatives if ETH reverses its present course.

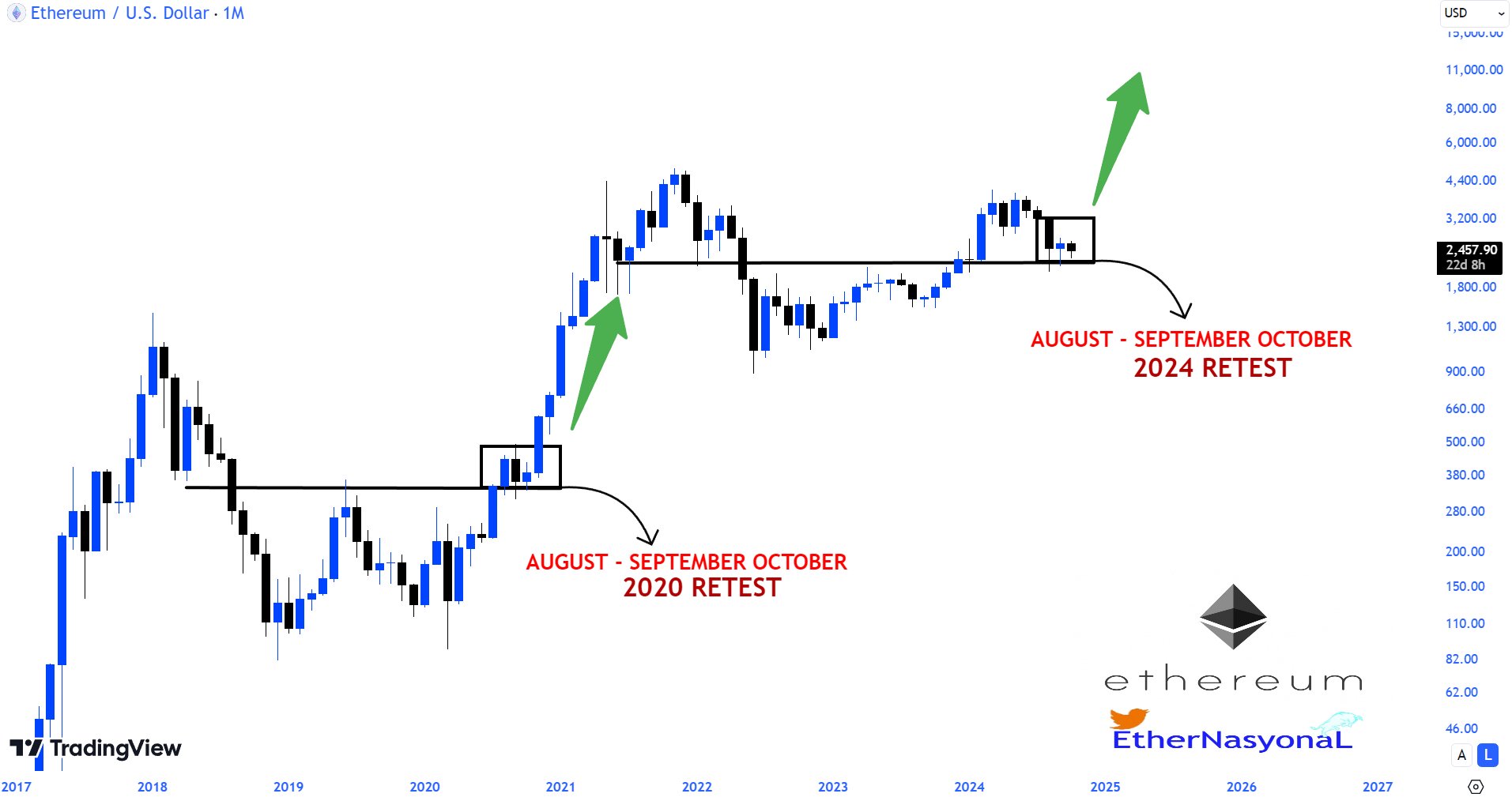

On the month-to-month timeframe, Ethereum is hinting at the potential of a 2025 mega bull run. Just like the 2021 bull market, ETH skilled a retest and accumulation section in August, September, and October of 2020.

This 12 months, ETH appears to be in an analogous stage of retest and accumulation throughout these similar months.

This sample means that whereas Ethereum could face extra declines in October, it may begin reversing by the top of the 12 months, setting the stage for future progress.

ETH valuation and social sentiment

Taking a look at Ethereum’s efficiency in opposition to Bitcoin (BTC), it seems the downtrend could proceed.

ETH’s valuation in opposition to BTC has dropped to 0.000295, breaking under the 0.0004 mark, which was beforehand seen as a key assist degree.

This reinforces the concept that Ethereum would possibly face additional declines within the quick time period, as BTC continues to outperform ETH throughout most timeframes.

One other issue including to Ethereum’s bearish outlook is its place in social sentiment rankings.

Ethereum ranked second, simply behind Chainlink, within the checklist of belongings with essentially the most damaging crowd sentiment throughout this era of market uncertainty.

Traditionally, belongings with sturdy bearish sentiment have usually seen the most effective possibilities for a worth rally. Whereas this decline in sentiment may result in additional worth drops, it additionally presents the potential for a turnaround.

If the bearish sentiment subsides, it may spark a rally that drives ETH to greater ranges, probably reaching new highs in 2025.

Learn Ethereum’s [ETH] Price Prediction 2024–2025

Whereas Ethereum is presently in a downtrend, the potential for a reversal exists, significantly with the 2025 bull market on the horizon.

Merchants ought to stay cautious within the quick time period however keep watch over key assist ranges, as they may present early indicators of a bullish reversal.