- Ethereum’s Taker Promote Quantity spiked to $10.3B, reflecting robust market-wide promote stress from whales and retailers.

- ETH dropped to $2.3K earlier than recovering to $2.4K, as dip-buyers absorbed the bearish wave.

Since hitting an area excessive of $2.8k every week in the past, Ethereum [ETH] has traded inside a descending channel. Over the previous day, ETH touched a low of $2.3K, reflecting a pointy enhance in draw back stress.

This drop didn’t come out of nowhere.

The worth struggled to remain afloat as profit-booking intensified. Naturally, the extra ETH hovered in a slim band, the extra holders selected to dump, revealing waning conviction.

$321M in a minute?

In keeping with CryptoQuant analyst Maartun, Ethereum witnessed a big spike in promoting stress.

He noticed that Ethereum’s Taker Sell Volume throughout all exchanges surged considerably, recording over $321.3 million in a single minute.

That’s not a routine pullback. It marked intense sell-side aggression, with each whales and retailers contributing to the spike in quantity.

In truth, in whole, ETH recorded $10.3 billion in Taker Promote Quantity earlier than cooling to $839.6 million. This stage of exercise typically mirrors worry or aggressive profit-taking.

In fact, the panic wasn’t simply mirrored in commerce volumes. ETH additionally recorded 1.2 million cash in Alternate Inflows, principally from whales.

Who’s shopping for what they’re promoting?

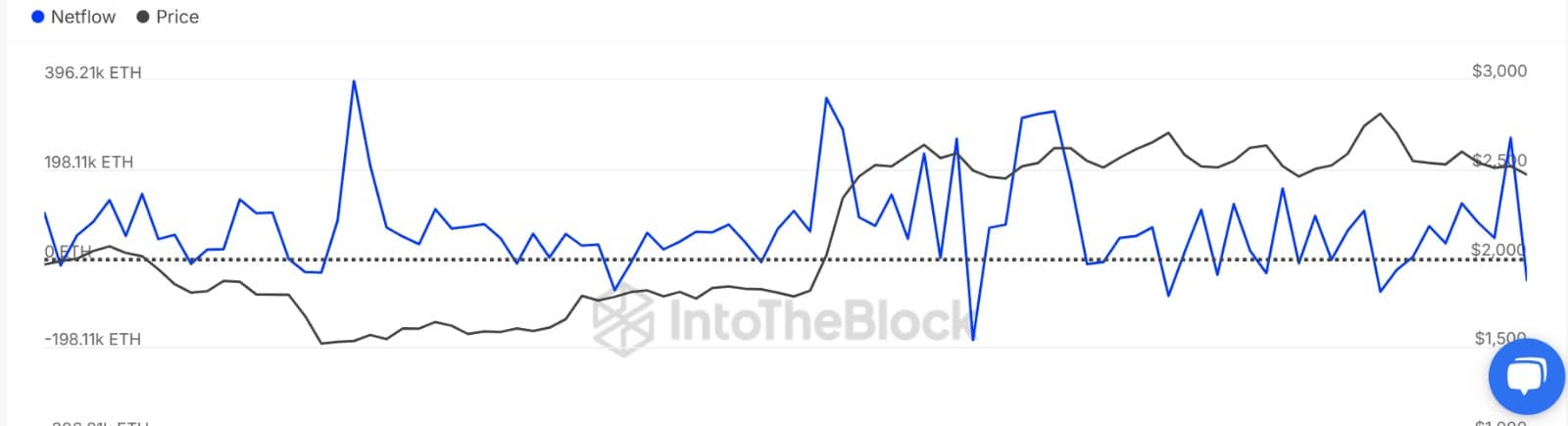

Once we checked out Massive Holders Netflow, the info indicated that whales offered 519k ETH whereas consumers scooped 471k ETH.

This leaves a detrimental netflow of -48.75k ETH, signaling a better promoting exercise from Ethereum giant holders.

Such detrimental Netflow, paired with rising inflows and elevated Promote Taker Quantity, spelled out robust bearish sentiment. Both holders had been locking in earnings or scrambling to chop losses.

Patrons step in, however is it sufficient?

As anticipated, this surge in promoting exercise impacted ETH’s value motion. It briefly slipped from $2.5K to $2.3K. However that wasn’t the tip of the story.

As of this writing, Ethereum recovered to $2,424. This delicate rebound hints that some consumers noticed a chance to purchase the dip, absorbing the stress and halting additional draw back, not less than for now.

Look ahead to THIS tipping level!

Apparently, Alternate Netflow turned detrimental, with outflows beating inflows by about 3.4K ETH.

Merely put, Ethereum consumers have entered the market and absorbed the not too long ago witnessed promoting stress. Sure, that’s usually a bullish signal.

That stated, the battle isn’t over. ETH has returned to a consolidation zone, the place bulls and bears seem locked in a short-term stalemate.

Subsequently, if the bulls can maintain their positions, it can increase ETH to reclaim $2575, which is a key stage to maintain bullish momentum alive. Conversely, if sellers retake the market as soon as once more, ETH might dip to $2350.