Ethereum has been struggling to regain momentum, buying and selling beneath the important $2,800 mark since final Thursday. Bulls are in hassle as the worth stays trapped beneath key provide ranges, leaving buyers involved about Ethereum’s short-term future. Many who anticipated a bullish 12 months for the second-largest cryptocurrency are actually questioning their outlook after final week’s huge promoting strain took ETH from $3,150 to $2,150 in lower than two days.

Associated Studying

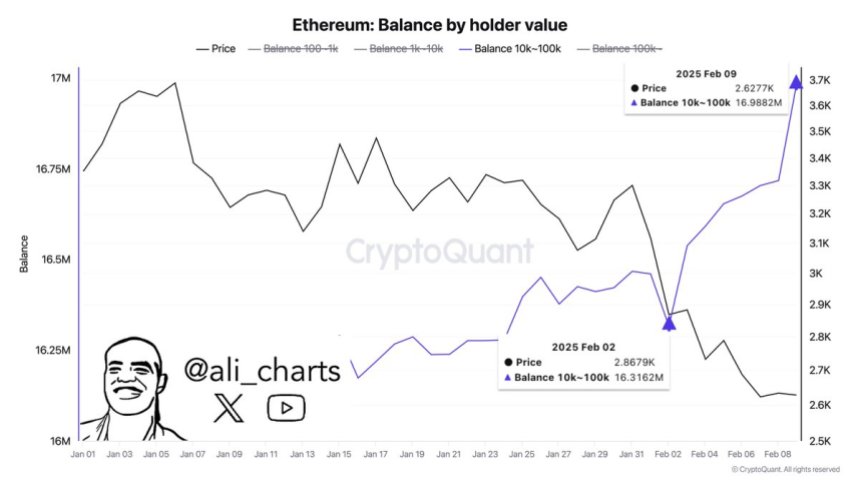

The current value motion has amplified worry and uncertainty amongst retail buyers, with many persevering with to promote amid the market turbulence. Nevertheless, on-chain metrics inform a unique story, signaling rising confidence from bigger gamers. Key knowledge shared by high crypto analyst Ali Martinez reveals that whales have accrued over 600,000 Ethereum up to now week, at the same time as retail buyers stay cautious. This divergence highlights a important development available in the market—retail buyers seem scared and reactive, whereas large gamers are quietly shopping for up ETH at discounted costs.

Because the market grapples with indecision and volatility, this accumulation by whales may set the stage for a major shift in momentum. If bulls handle to reclaim the $2,800 and $3,000 ranges, Ethereum might start a restoration rally. For now, all eyes are on whether or not the divergence will result in a turning level in ETH’s value motion.

Ethereum Buyers Are Divided: Retail Fears Vs. Whales Belief

Ethereum stays in a difficult place after final week’s dramatic sell-off, which noticed the worth drop from $3,150 to $2,150 in lower than 48 hours. Regardless of a powerful restoration again into the $2,700 vary, ETH has struggled to reclaim key provide ranges, leaving many buyers cautious. The value stays trapped beneath essential resistance at $2,800, with bulls needing to push above the $3,000 mark to shift the bearish development and regain market confidence.

Key metrics shared by crypto analyst Ali Martinez reveal a promising development amidst the uncertainty. Whales have accrued over 600,000 Ethereum up to now week, signaling sturdy shopping for exercise from large gamers.

This accumulation development is a stark distinction to the cautious habits of retail buyers, lots of whom proceed to promote amid worry and uncertainty. The divergence between whale accumulation and retail promoting suggests that enormous buyers stay optimistic about Ethereum’s long-term prospects, at the same time as short-term value motion stays shaky.

Associated Studying

This whale exercise provides hope to buyers who imagine Ethereum nonetheless has the potential to surge this 12 months. A breakout above $3,000, which aligns with the 200-day shifting common, may mark a major turning level for ETH, sparking a rally towards increased value ranges. Till then, ETH stays in a important part because it navigates between bearish strain and the potential for restoration.

ETH Value Motion: Key Ranges To Reclaim

Ethereum is presently buying and selling at $2,620, trying to reclaim the $2,700 mark because it battles towards key provide ranges. Bulls are beneath strain to interrupt by way of resistance at $2,800 and $3,000, as reclaiming these ranges would signify a reversal of the every day downtrend that has continued since late December. The $3,000 mark holds specific significance, because it aligns with the 200-day shifting common, a broadly watched indicator that indicators long-term energy when costs maintain above it.

A profitable push above the $3,000 degree may ignite a powerful rally, with Ethereum concentrating on increased value ranges rapidly. Such a transfer would restore confidence available in the market and sign a possible bullish development for ETH, which has struggled to regain its footing following final week’s dramatic sell-off.

Associated Studying

Nevertheless, if Ethereum fails to carry above the $2,600 mark, the outlook turns into bearish. A breakdown beneath this degree may open the door to additional declines, with ETH probably testing decrease demand zones within the coming days. The market stays at a important juncture, and Ethereum’s capacity to reclaim and maintain key ranges will decide its short-term path as buyers intently monitor the following strikes.

Featured picture from Dall-E, chart from TradingView