- Novice crypto merchants are overwhelmed by worry, however seasoned market analysts advise in any other case.

- A mix of various ETH metrics point out sturdy bullish sentiment resulting from elevated pockets actions.

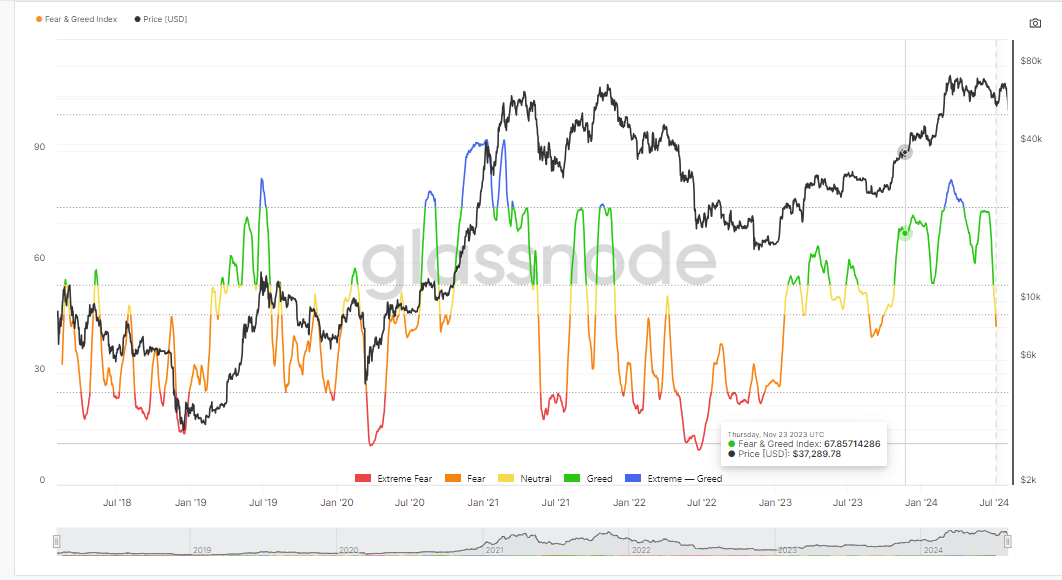

Worry is dominating the crypto markets proper now, and seasoned analysts typically advise to “be grasping when others are fearful.”

This technique has confirmed efficient over time, because it faucets into emotional intelligence to navigate market cycles.

Market analyst Quinten cited on X (previously Twitter) that the present worry out there is a sign to purchase extra crypto.

Historic patterns present that such worry typically precedes main value rallies, as seen when most cryptos beforehand surged to new ATHs, in accordance with Glassnode information.

What’s Ethereum as much as?

Regardless of considerations a couple of world recession and potential world conflicts, Ethereum [ETH] confirmed promising indicators of progress, as pockets exercise on the Ethereum blockchain has surged not too long ago.

Mixed key metrics together with lively pockets addresses within the final 30 days, circulation, community progress, and transaction quantity, are all on the rise because the graph from Santiment signifies.

This upward development means that now is just not the time to panic, however slightly a possibility to spend money on ETH property.

ETH: Covid crash vs. now

In the course of the Covid-19 crash, Ethereum hit a low that scared many new buyers, inflicting them to promote through the market’s drop.

Nonetheless, shortly after, Ethereum’s value surged because the market recovered. The latest crash prior to now 24 hours resembles the Covid-19 downturn, suggesting that we’d see an analogous rally quickly.

The present market worry might sign an upcoming upward development for Ethereum, mirroring the restoration sample seen beforehand.

Ascending triangle retested

The latest market sell-off is seen as a big take a look at of Ethereum’s earlier value patterns.

Is your portfolio inexperienced? Try the ETH Profit Calculator

Technically, Ethereum’s value motion is revisiting the outdated breakout degree and will doubtlessly rise to a brand new all-time excessive by the third quarter of 2024.

The technique is to purchase Ethereum aggressively every time the worth falls under $2300 and maintain, anticipating future good points because the market recovers.