- Ethereum’s quantity has surged 85% in underneath two weeks, reaching $7.3 billion.

- Nevertheless, a consolidation section seems extra seemingly earlier than ETH bulls can goal $4K.

In 2024, Ethereum’s [ETH] on-chain buying and selling quantity largely adopted the broader crypto market’s sample, marked by a gentle downtrend, although occasional surges in exercise had been seen within the second and third quarters.

Nevertheless, November marked a big turning level. A mixture of things – together with massive inflows into Bitcoin [BTC] and Ethereum’s ETFs and the sudden Trump victory within the U.S. Presidential election – has sparked a shift.

In simply two weeks, Ethereum’s on-chain quantity surged by 85%, leaping from $3.84 billion on the first of November to $7.13 billion on the fifteenth of November, signaling a possible reversal in its earlier downtrend.

Retaining volatility in-check can be step one

Every week into the election rally, ETH had already surpassed $3,300, reaching a day by day excessive of 5%, besides on election outcomes day, when it noticed a big 12% surge.

Traditionally, such speedy good points in a short while have usually been a warning signal of a possible correction forward.

Within the following seven buying and selling days, ETH skilled a reversal, bringing its value again to round $3K, erasing a lot of the substantial good points made in the course of the rally.

Nevertheless, because the crypto trade usually dictates, each downturn presents a possibility for traders to focus on the native backside and purchase the dip. ETH bulls seized this chance, posting a close to 10% bounce the next day, pushing the token’s value to $3,357 (on the time of writing).

Whereas this appears bullish, Ethereum has displayed extra volatility with erratic value actions in comparison with different altcoins.

In distinction, prime belongings like Ripple [XRP] and Cardano [ADA] have proven a lot stronger resilience, positioning them because the standout “tokens of the month.”

Apparently, this shift has occurred whereas Bitcoin has been consolidating within the $90K vary for the previous 5 days.

Usually, such consolidation at psychological ranges for BTC has resulted in capital flowing into Ethereum, the most important altcoin.

Nevertheless, ETH’s underperformance relative to its rivals might sign the beginning of an underlying shift, probably threatening its means to interrupt the important thing $3,400 resistance degree, which has traditionally been important.

Surge in Ethereum quantity may not be sufficient

On the day by day value chart, Ethereum final examined the $3,400 vary about 4 months in the past, in mid-July. Since then, it has been in a hunch, buying and selling between the $2,200 and $2,600 vary.

Actually, the post-election cycle has positioned ETH for a breakout from its tug-of-war to breach $3K, bolstered by a large surge in Ethereum quantity, as famous earlier.

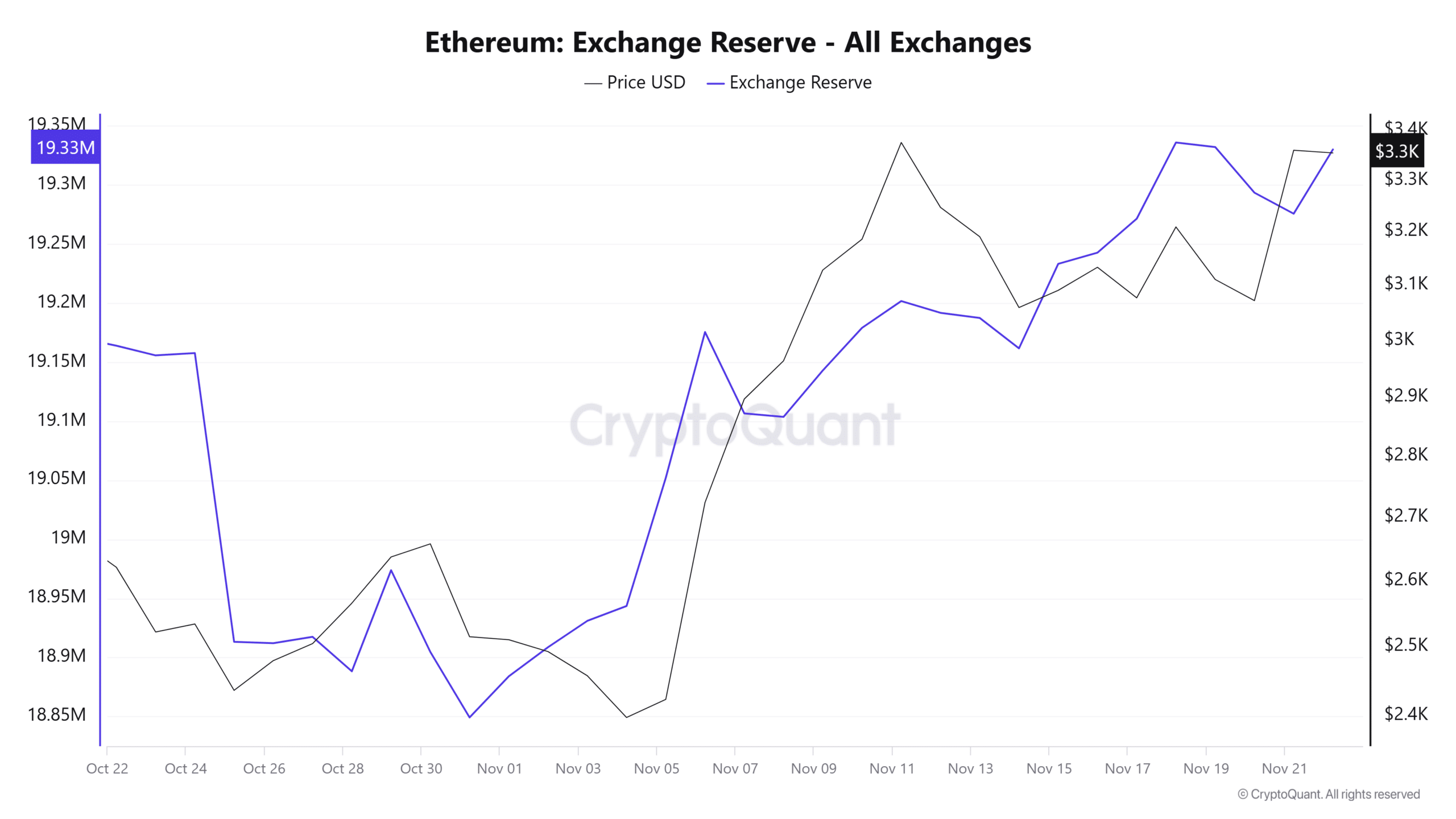

Nevertheless, regardless of this momentum, Ethereum’s alternate reserves are steadily rising, indicating rising promoting strain. This might result in a interval of consolidation within the coming days.

The reasoning is evident: consolidation occurs when shopping for and promoting exercise steadiness one another out, usually pushing a coin right into a impartial zone.

With on-chain quantity reaching $7.3 billion in just below two weeks, and promoting strain beginning to mount, Ethereum could also be getting into such a section.

Learn Ethereum’s [ETH] Price Prediction 2024–2025

Thus, a consolidation section earlier than a possible breakout looks like a great setup for Ethereum – except a number of key circumstances are met.

First, massive HODLers should enter the buildup phase to soak up the promoting strain. Second, Bitcoin wants to interrupt the $100K resistance degree to revive broader market confidence.

Whereas the surge in buying and selling quantity alerts elevated community exercise, if demand continues to rise, ETH may push in the direction of the $3,400 degree.

Nevertheless, a consolidation section earlier than a breakout to $4K appears extra seemingly, except these circumstances are fulfilled.