Amidst the final monetary market crash in early August, Ethereum (ETH) lost about 30% of its value, falling to $2,226 per unit. Notably in the previous couple of weeks, the distinguished altcoin has proven a lot resilience climbing again into the $2,600 worth area. Albeit, this current worth retracement is accompanied by a lot uncertainty on how lengthy Ethereum can maintain such upward momentum. Commenting on this dialogue, CryptoQuant analyst ShayanBTC has postulated that Ethereum might possible resume its bearish course.

Ethereum Worth To Endure From Sellers’ Dominance

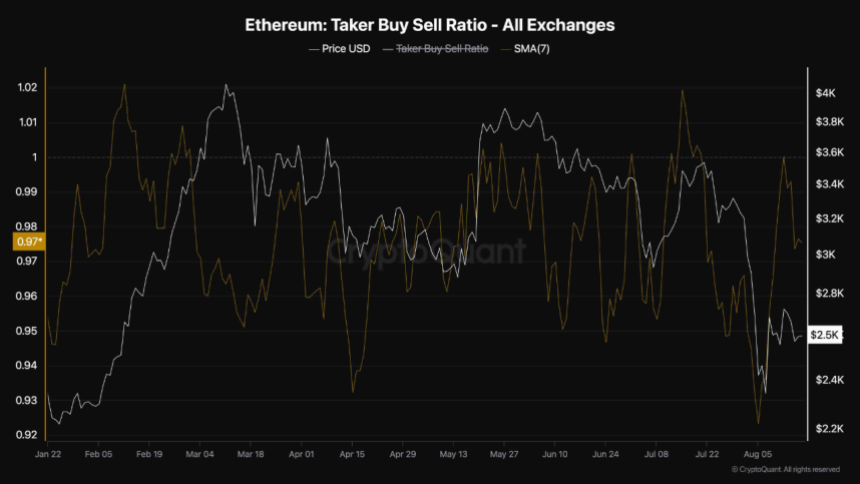

In a QuickTake post on Saturday, ShayanBTC shared that the Taker Purchase/Promote Ratio indicated that Ethereum could also be set for extra worth loss within the coming days. To elucidate, the Taker Purchase/Promote Ratio is an evaluation device that gauges the steadiness between aggressive shopping for and promoting exercise. It’s calculated based mostly on the quantity of taker purchase orders and taker promote orders.

As widespread with different indicators, a Taker Purchase/Promote ratio above one suggests there’s an upward market momentum with extra aggressive consumers than sellers and a ratio beneath one represents a downward market strain with the other state of affairs.

In accordance with ShayanBTC, after just lately failing to surpass the $3000 worth resistance, Ethereum’s Taker Purchase/Promote Ratio declined drastically as evidenced by the asset’s worth motion. As anticipated, the metric additionally skilled a rebound following ETH’s current worth features. Albeit, the Taker Purchase/Promote Ratio couldn’t rise above 1 staying within the zero area, which indicated an absence of adequate shopping for strain permits the sellers to retain market management.

Nonetheless, ShayanBTC studies that the TakerBuy/Promote Ratio has as soon as once more declined indicating that sellers are getting ready to dump their belongings, doubtlessly inflicting an Ethereum worth fall. The analyst requires warning, stating that the ETH market would require an enormous rise in demand to keep away from resuming the downward worth motion.

ETH Worth Overview

In accordance with data from CoinMarketCap, Ethereum at the moment trades at $2,610 reflecting a minor 0.61% acquire within the final day. Nonetheless, the asset’s efficiency on bigger time frames continues to be unimpressive with a decline of 23.93% within the final month.

With persistent features, essentially the most distinguished altcoin is about to come across an early resistance on the $2,700 worth area. If shopping for strain proves adequate, ETH may transfer previous this barrier rising as excessive as $3,000. However, an enormous promoting strain as indicated by the Taker Purchase/Promote ratio can pressure the asset’s worth as little as $2300.