- Ethereum liquidity suppliers diminished their lengthy positions.

- ETH traders remained bullish into 2025, regardless of excessive hypothesis.

For almost two weeks, Ethereum [ETH] has skilled excessive fluctuation. Over this era, ETH costs have dropped from $4109 to $3219. This worth volatility has left the altcoin buying and selling sideways.

These market situations have left analysts speaking about Ethereum’s efficiency into 2025. Inasmuch, Cryptoquant analyst Solar Moon has recommended a strong efficiency for ETH in Q1 2025 citing market stability.

Ethereum’s liquidity suppliers cut back lengthy positions

In response to CryptoQuant, Ethereum’s liquidity suppliers have diminished lengthy positions. When entities and merchants that offer capital into ETH cut back their lengthy positions, it signifies a shift in sentiment.

If liquidity suppliers cut back publicity, the market could wrestle to maintain bullish momentum with out recent shopping for stress.

The analyst additional famous that regardless of the shift in sentiment, Ethereum’s lengthy liquidations have declined. This absence of widespread liquidations implies that the market is turning into extra steady.

Thus, market corrections are much less more likely to set off cascading sell-offs.

Subsequently, going into 2025, ETH is following the identical sample as final 12 months. In 2023 December, ETH costs surged from $2045 to $2448 earlier than the correction then declined to $2259 because the 12 months ended.

Beginning January 2024, costs spiked from $2281 to $2717 then adopted a 2-week consolidation earlier than a robust upswing to $4090.

Subsequently, if the costs comply with the identical sample, and historical past is something to go by, ETH costs will see a robust upswing. Because the analyst famous, Ethereum’s worth will rise considerably in 2025 Q1.

What it means for ETH

Regardless of Ethereum’s liquidity suppliers lowering lengthy positions, ETH continues to be experiencing a major demand for lengthy positions amidst robust speculative exercise.

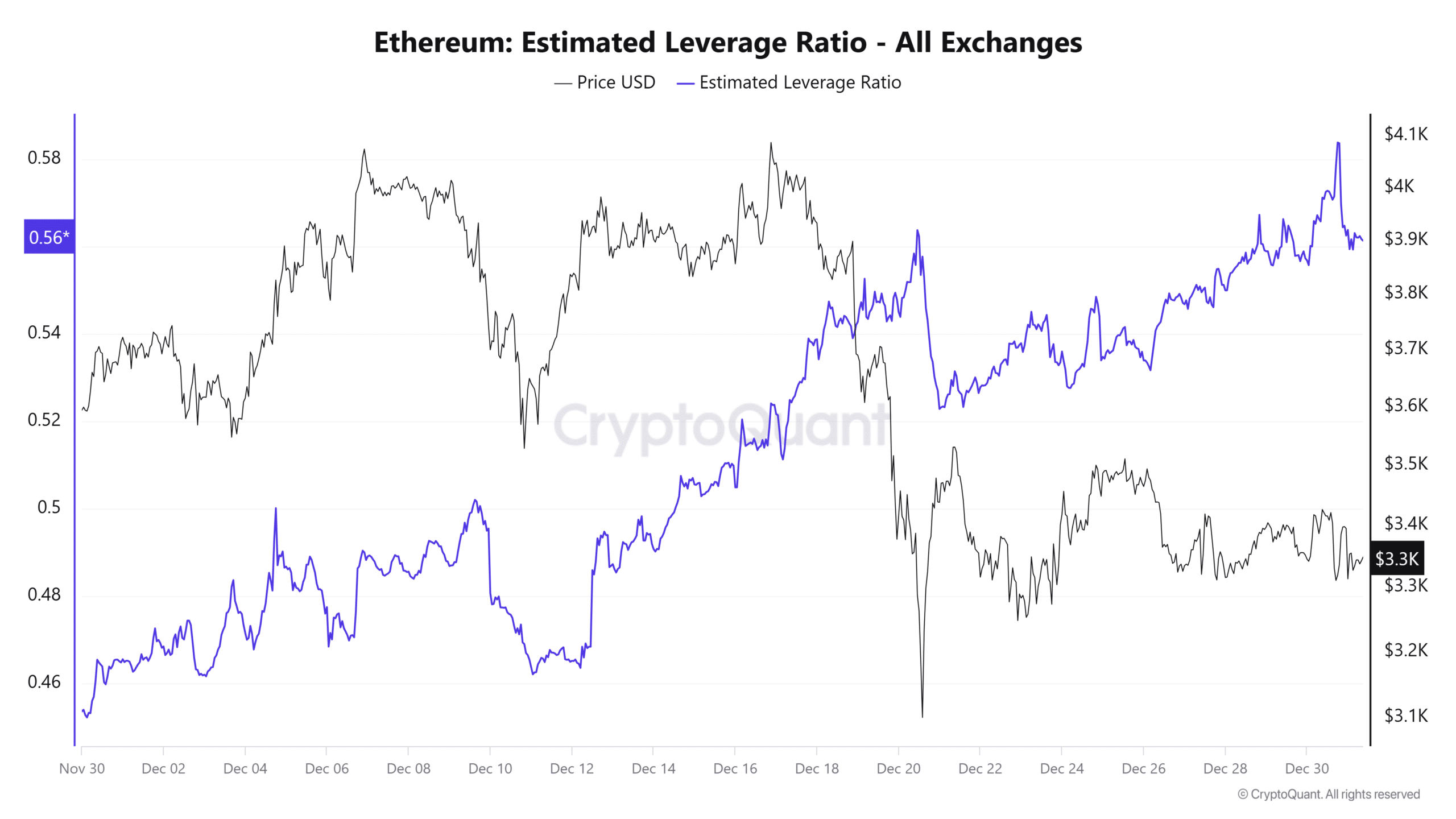

As such, in line with AMBCrypto’s evaluation, Ethereum is at present seeing a leverage-driven market.

For starters, that is evidenced by the truth that the estimated leverage ratio has skilled a sustained rise. Over the previous month, ELR has spiked from 0.4 to 0.56.

This upsurge displays heightened hypothesis as traders are extra prepared to take dangers with borrowed funds to maximise potential features and losses.

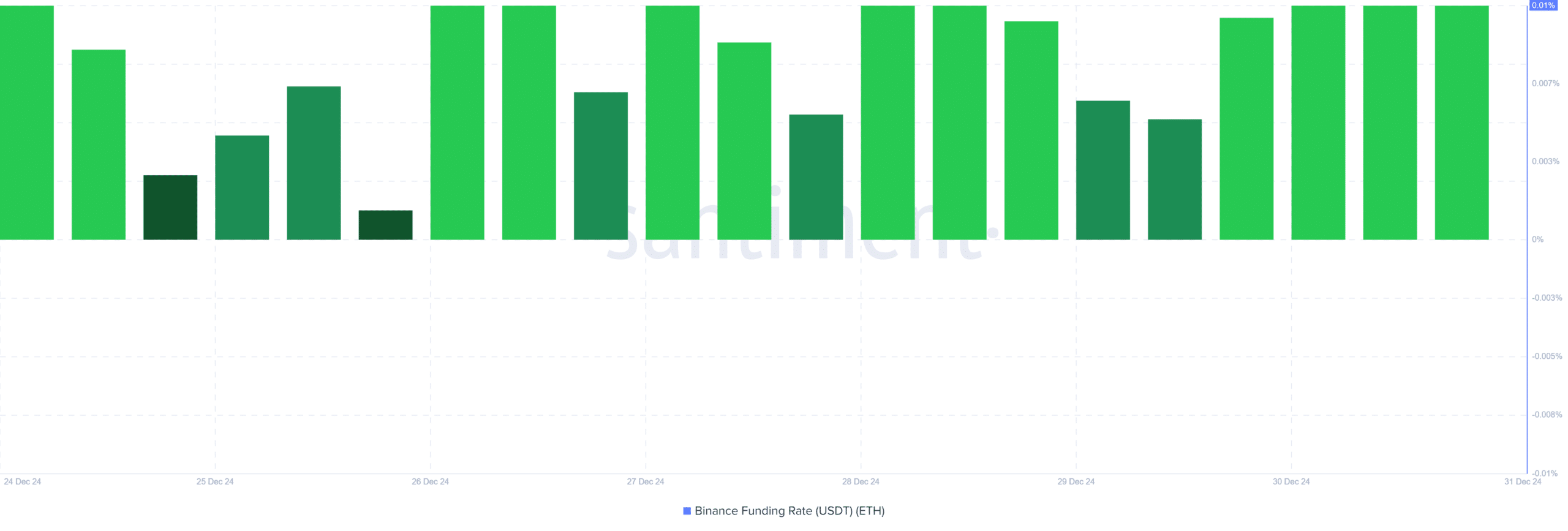

Moreover, the Binance Funding Price has remained constructive over the previous month.

This exhibits that although liquidity suppliers are frequently lowering their capital influx, merchants are nonetheless anticipating costs to rise and the demand for lengthy positions continues to be excessive.

ETH, going into 2025

Merely put, though liquidity suppliers are lowering their funds, the demand for longs continues to be excessive as noticed above. Subsequently, ETH continues to be seeing robust hypothesis actions.

Though speculative market exercise may end up in costs collapsing, it could additionally drive costs up within the quick time period.

Going to 2025, Ethereum’s market must strengthen its fundamentals and rely much less on a speculative-driven market, because it’s susceptible to corrections.

Learn Ethereum’s [ETH] Price Prediction 2025–2026

Subsequently, with demand for longs nonetheless excessive, it suggests the market continues to be bullish and ETH is getting into 2025 with constructive sentiment.

If bullish sentiment holds, ETH will get away of the $3500 consolidation vary and problem $4000 the place it has confronted a number of rejections. Nonetheless, if the hypothesis bubble burst, ETH might drop beneath $3000.