- Establishments offered ETH value $105 million throughout the newest correction

- On-chain information recommended the decline may very well be a chance to purchase earlier than one other rally begins

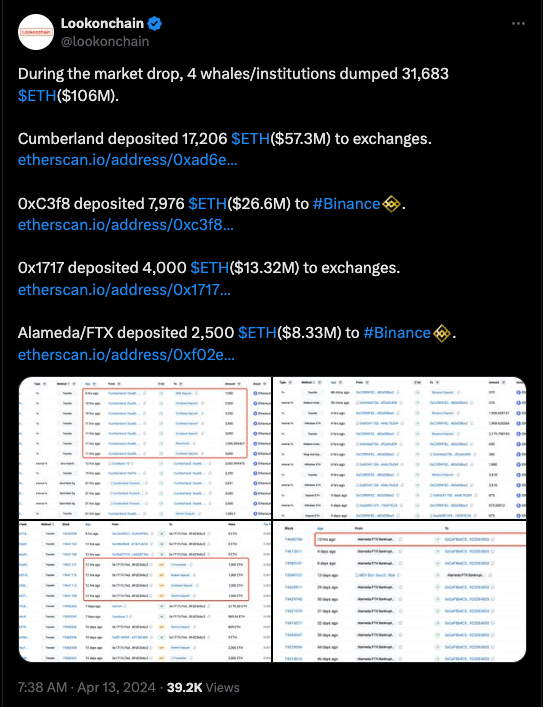

4 whales together with notable institutional traders took half in promoting off a few of their Ethereum [ETH] holdings because the altcoin’s value collapsed on the charts. Actually, ETH depreciated by over 7% in simply 24 hours.

In response to Lookonchain, Cumberland, a buying and selling agency, despatched a complete of 17,206 ETH to exchanges. On the time of the transactions, the cash had been value $57.3 million. FTX additionally deposited $8.33 million value of ETH to Binance. Lastly, the opposite two establishments offered a mixed $39.92 million in ETH.

Solely the short-sighted could also be affected

Whales promote their property for various causes. For some, it may very well be a traditional profit-taking occasion. For others, it may very well be an avenue to let go after a cryptocurrency has underperformed. Nonetheless, this altcoin doesn’t appear to fall into this class.

On the time of writing, AMBCrypto couldn’t affirm why the events offered. However one factor was sure— The sell-offs performed an enormous position as Ethereum’s value fell to $3,169. At press time, ETH was valued at $3,262, indicating that the cryptocurrency recovered barely. Nonetheless, it is very important verify if the cryptocurrency can maintain this gentle uptrend.

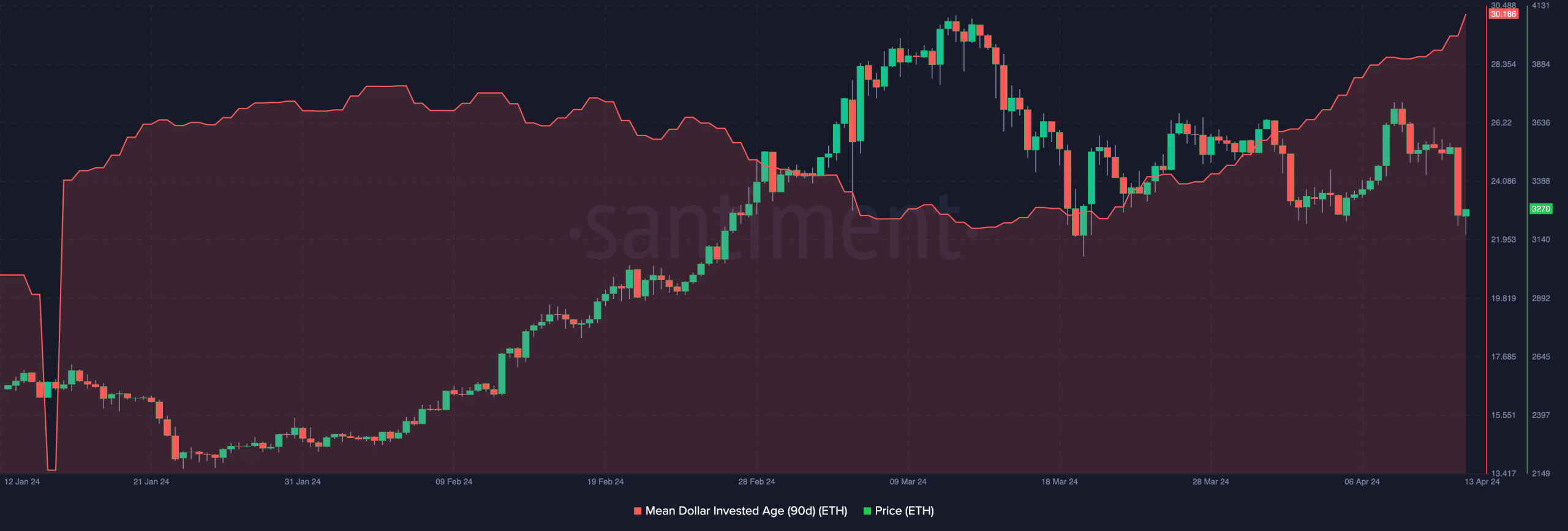

To do that, AMBCrypto checked out some metrics which may have an effect on the worth. First on the listing was the Imply Greenback Invested Age (MDIA).

The MDIA is the typical age of cash held in the identical pockets. If the metric will increase, then it means many cash are much less lively, and have remained in the identical place for an extended whereas. Alternatively, a falling MDIA implies that outdated cash are transferring. For Ethereum, on-chain information from Santiment revealed that the 90-day MDIA spiked.

Traditionally, an enormous decline within the metric was accompanied by an area high. Subsequently, the current improve recommended that ETH may very well be undervalued, and the newest correction may very well be an opportunity to purchase at decrease costs earlier than its potential rally begins.

Is the following path nice?

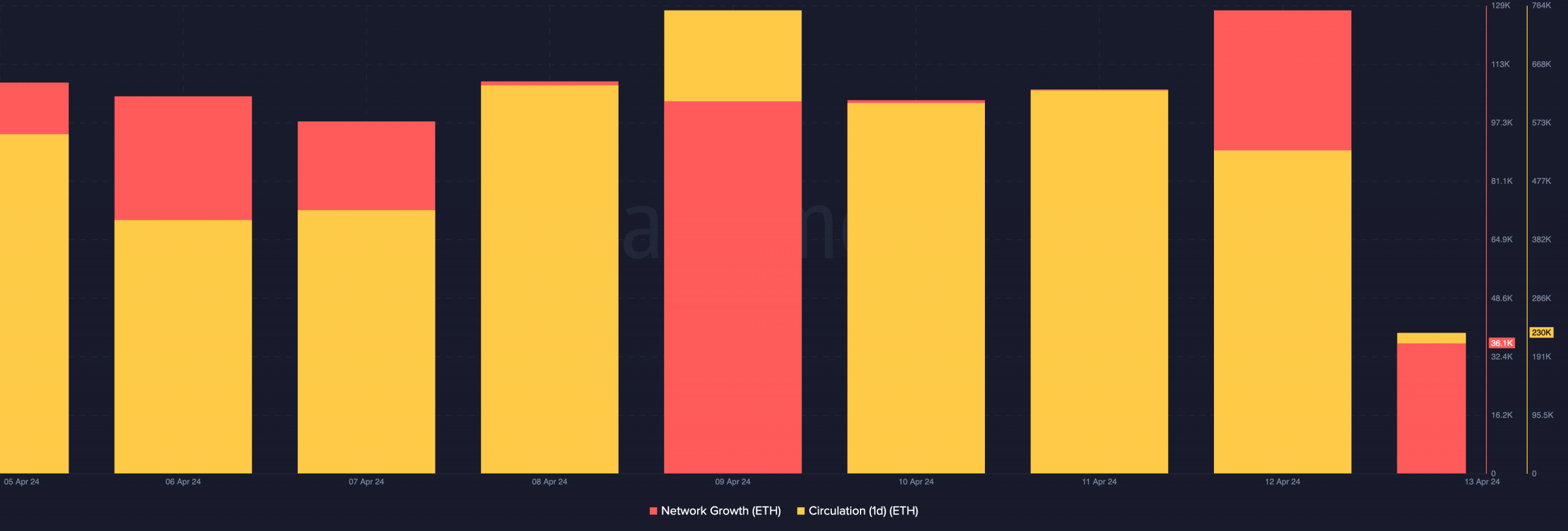

Community development was one other metric AMBCrypto analyzed. This metric gauges consumer adoption over time. If it will increase, then it means a mission is gaining traction. If it decreases, it implies that the mission is shedding traction.

On 12 April, Ethereum’s community development was 128,000, indicating that a number of new addresses interacted with the mission.

Nonetheless, it appeared that the value decline caused the quantity to fall to 36,100. If community development improves, demand for ETH would possibly assist the value motion leap.

Conversely, a decline within the metric may end in stagnancy for the worth. As well as, the one-day circulation dropped to 230,000, reinforcing the notion of decreased utilization.

Is your portfolio inexperienced? Test the ETH Profit Calculator

That being mentioned, the drop in circulation may very well be good for ETH because it may very well be an indication of much less promoting stress. Ought to the variety of cash used proceed to fall, then ETH’s value would possibly exit the terrible state it has been in during the last 24 hours.