- ETH’s $2.7K breakout triggered a brief squeeze, however rising alternate reserves sign weakening momentum

- Ethereum’s decoupling from Bitcoin raises considerations about sustainability, with L2s and retail participation faltering

Ethereum’s [ETH] break above the $2,700 mark shocked the market, triggering over $50 million in brief liquidations on Binance alone.

However beneath the floor, there’s one thing a bit extra advanced: rising Change Reserves and notable whale outflows counsel that the bullish momentum could also be shedding steam.

On the identical time, Ethereum’s current worth decoupling from Bitcoin – as soon as seen as an indication of rising power – now raises recent considerations about sustainability and path for the broader Ethereum ecosystem.

Quick squeeze ignites as ETH breaks $2.7K

Ethereum’s surge previous the $2,700 resistance degree triggered a pointy liquidation occasion on Binance, wiping out over $50 million in brief positions, in response to CryptoQuant knowledge.

This zone, highlighted as a liquidity cluster on the Liquidation Delta chart, turned a magnet for stop-loss orders as ETH pierced by means of.

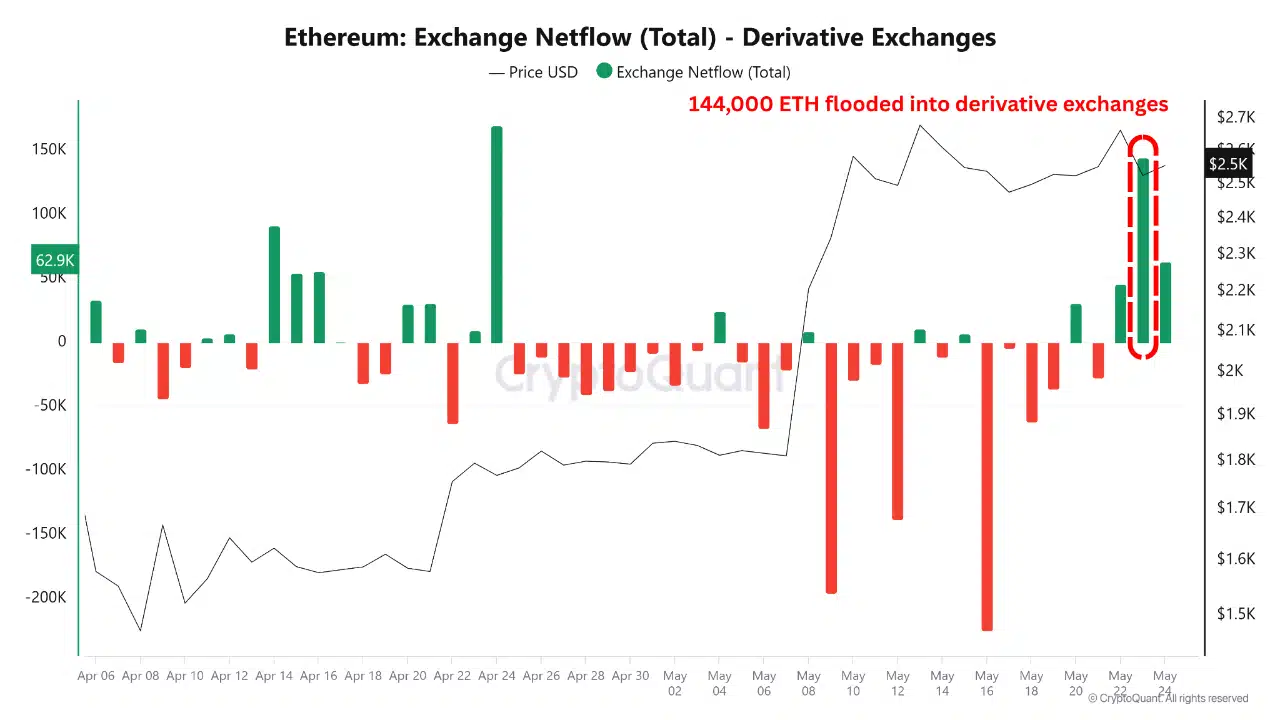

Nonetheless, that squeeze was instantly adopted by over 144,000 ETH flowing into Derivatives Change Reserves—a crimson flag. Such inflows usually precede renewed quick positioning, not pattern continuation.

Whereas the bulls briefly claimed victory, the speedy inflows and heatmap stress counsel warning could also be warranted amid the preliminary euphoria.

Ethereum-Bitcoin correlation collapses

For years, Ethereum and Bitcoin moved in near-lockstep, typically sharing a correlation above 0.7. However that relationship has almost evaporated.

In accordance with CryptoQuant, ETH’s 1-year Correlation with BTC plunged to only 0.05 as of the twenty second of Could – down from 0.63 at the beginning of the yr.

This sudden decoupling disrupts one of many crypto market’s most constant patterns, forcing a reassessment of conventional portfolio methods.

Extra critically, it coincides with ETH’s relative underperformance throughout Bitcoin’s rally.

Decoupling dampens momentum

Ethereum’s divergence from Bitcoin is eroding market confidence. With out the tailwind of synchronized BTC rallies, Ethereum’s ecosystem is struggling to maintain progress.

Retail participation seems to be thinning, and main L2s like Optimism, Arbitrum, and Polygon have failed to realize traction in 2025. Forecasting fashions that when hinged on Bitcoin’s directionality are shedding predictive energy.

Ethereum could also be evolving right into a extra autonomous asset pushed by inner fundamentals, however that independence dangers isolating it throughout bull cycles.

For now, the decoupling appears to be extra simply wind than evolution.