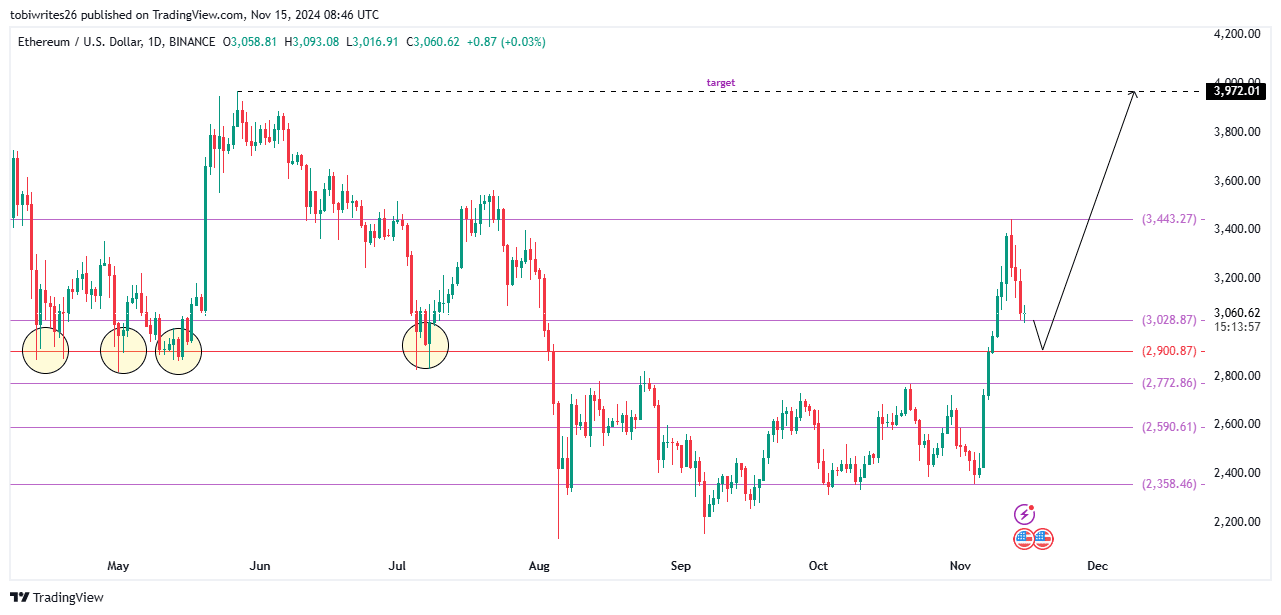

- Buying and selling at a help degree outlined by the Fibonacci retracement line at press time, ETH is more likely to breach this degree quickly.

- Constructive netflows and a rise in energetic addresses recommend sturdy investor exercise, regardless of the short-term bearish strain.

Prior to now month, Ethereum [ETH] has rallied by 18.56%, underscoring bullish momentum. Nevertheless, a 3.63% decline has begun, and this dip is predicted to deepen briefly earlier than ETH finds help.

Market sentiment and technical indicators nonetheless favor a possible rally as soon as this consolidation part concludes, retaining the long-term outlook bullish.

Slight decline may propel ETH to new highs

On the time of writing, ETH was trending downward, briefly touching a Fibonacci retracement line that presently acts as help.

The Fibonacci retracement instrument, extensively used to determine help and resistance ranges, marks this help at $3,028.87. Nevertheless, this degree is predicted to offer solely non permanent aid from additional worth declines.

If ETH breaks under this degree, the following goal is a minor drop to $2,900.87, representing a 50% retracement from its total rally. This degree is important, because it has acted as a catalyst for ETH’s restoration on 4 prior events, together with two main rallies.

Ought to this help maintain once more, ETH’s bullish momentum may reignite, with a possible push towards a goal of $3,971.02.

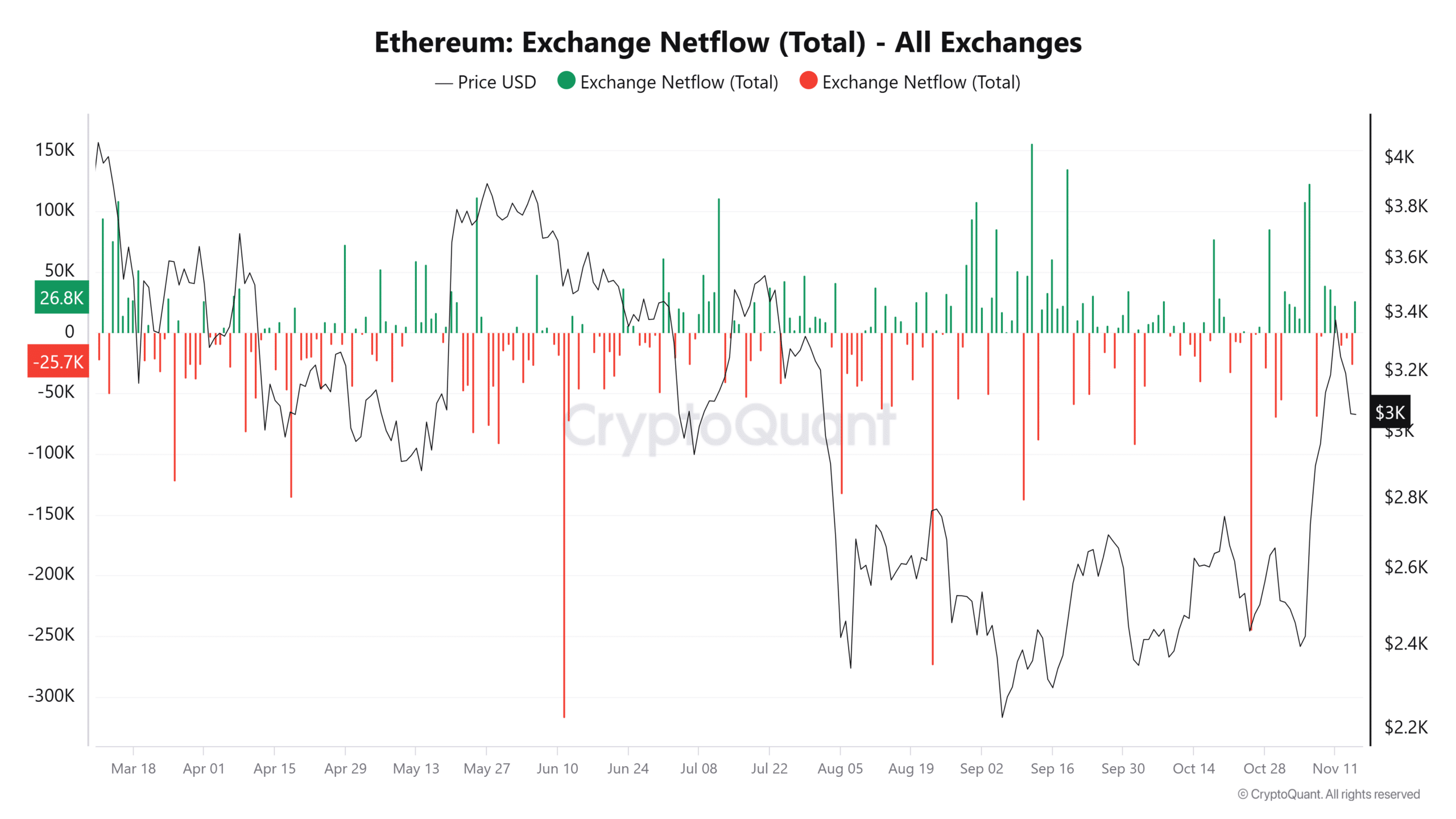

Key metrics level to promoting strain

ETH is in for a possible worth drop as a number of key metrics converge, indicating elevated promoting exercise. On the present help degree of $3,028.87, downward strain seems imminent.

A big driver is the optimistic alternate netflow, with over 32,600 ETH not too long ago moved to exchanges, seemingly for liquidation. This inflow sometimes indicators heightened promoting strain, limiting the asset’s means to rally additional.

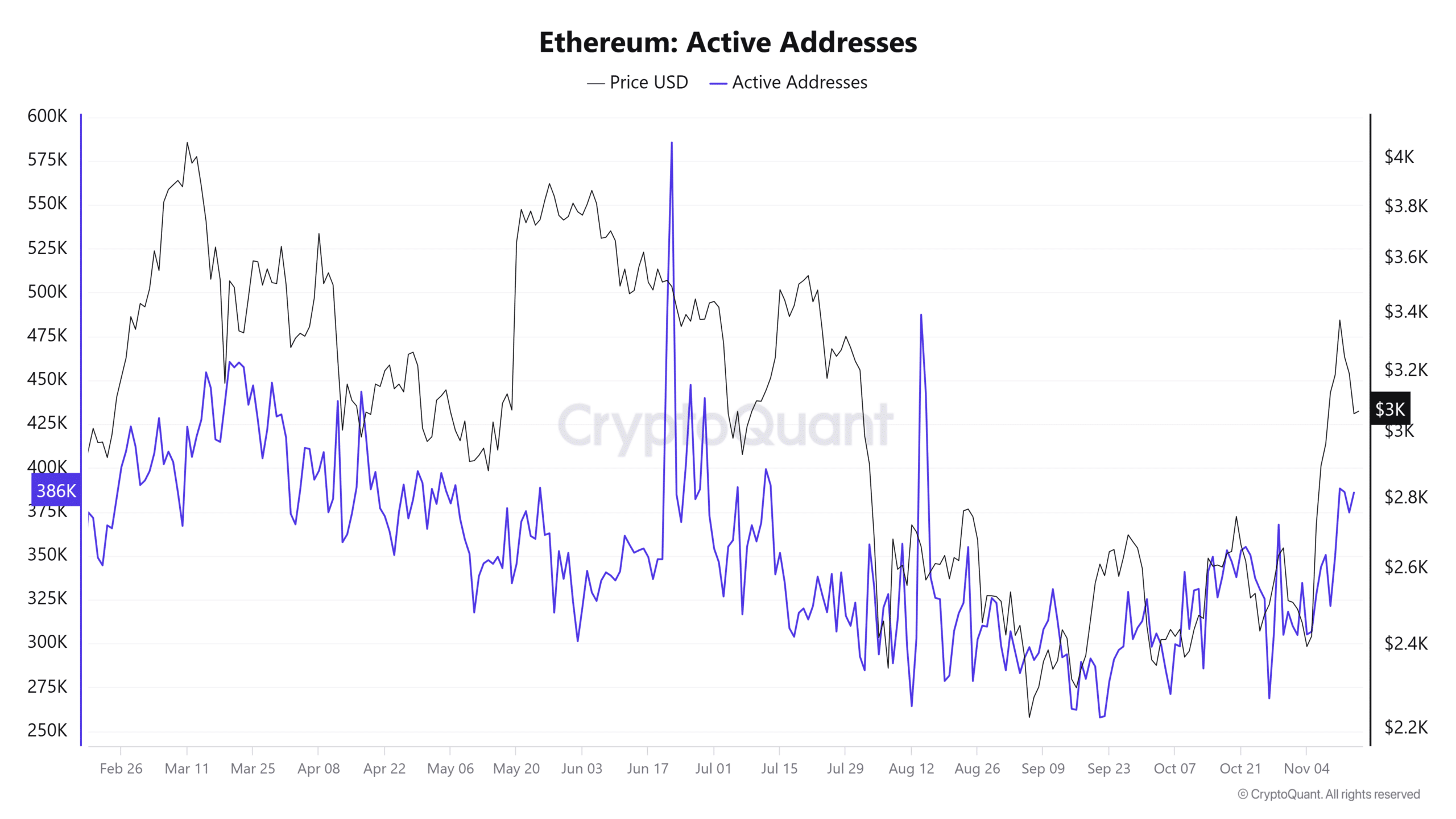

One other vital issue is the sharp rise in energetic addresses. Traditionally, when spikes in exercise aligns with worth declines, it recommend that almost all of those addresses are engaged in promoting moderately than shopping for.

These mixed metrics recommend that ETH is more likely to break under its present help, which might set off a short-term decline in worth.

Ethereum decline anticipated to be non permanent

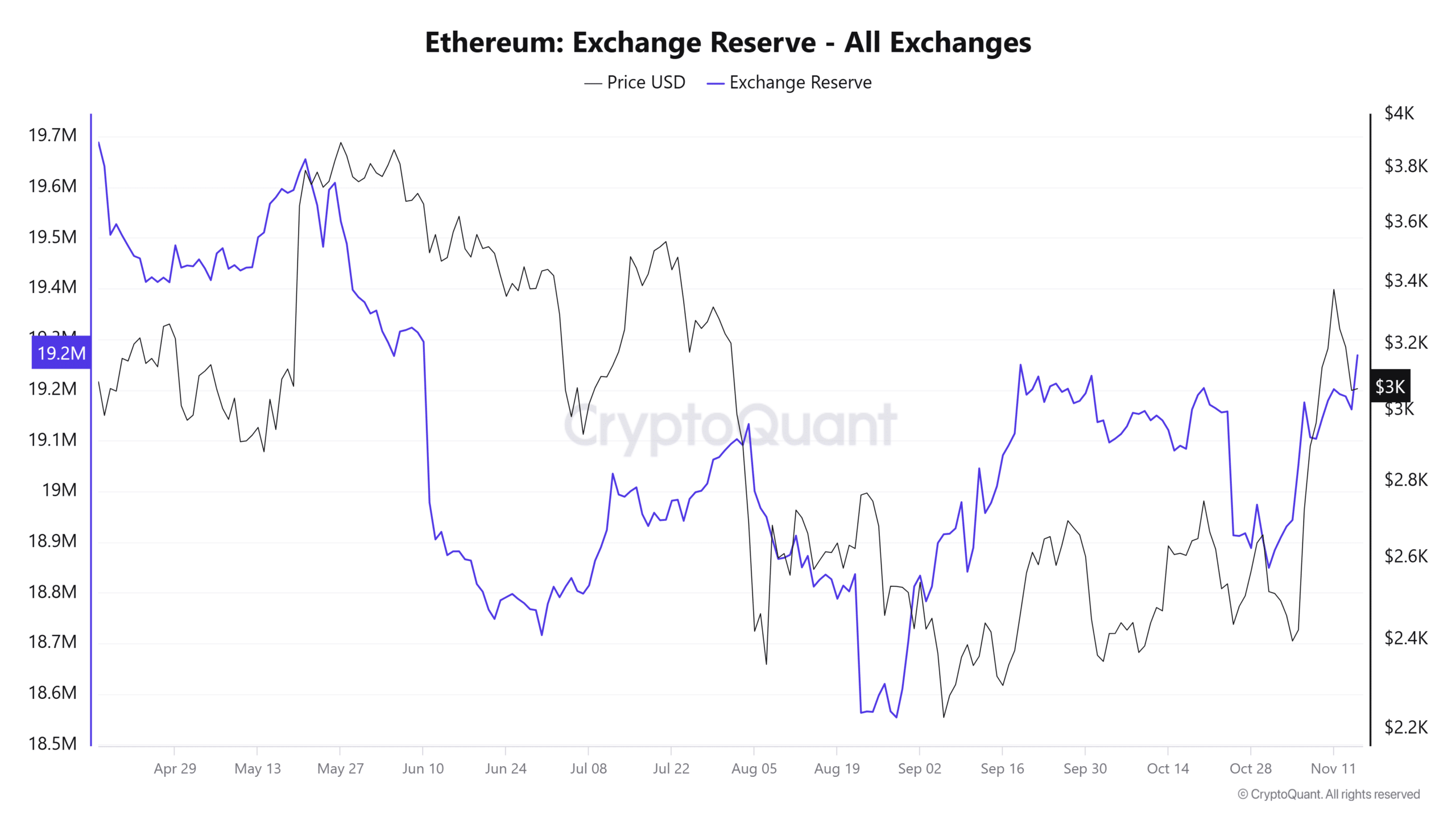

Latest knowledge from the Alternate Reserve signifies that ETH’s worth drop is pushed by a rise in circulating provide on exchanges, which generally contributes to promoting strain.

Learn Ethereum’s [ETH] Price Prediction 2024–2025

Nevertheless, whereas a decline seems inevitable, it’s more likely to be short-lived. The every day and weekly will increase within the Alternate Reserve have been minimal, at 0.03% and 0.32%, respectively.

If this pattern persists, the $2,900.87 help degree is predicted to behave as a key level of attraction, serving as each a goal for the present decline and a possible launchpad for the following rally.