Key Notes

- Double prime sample emerges at $4,000 resistance stage, creating long-term bearish sign for Ethereum’s worth trajectory.

- Symmetrical triangle formation confines ETH between $2,200-$2,870 vary with compressed volatility indicating imminent breakout.

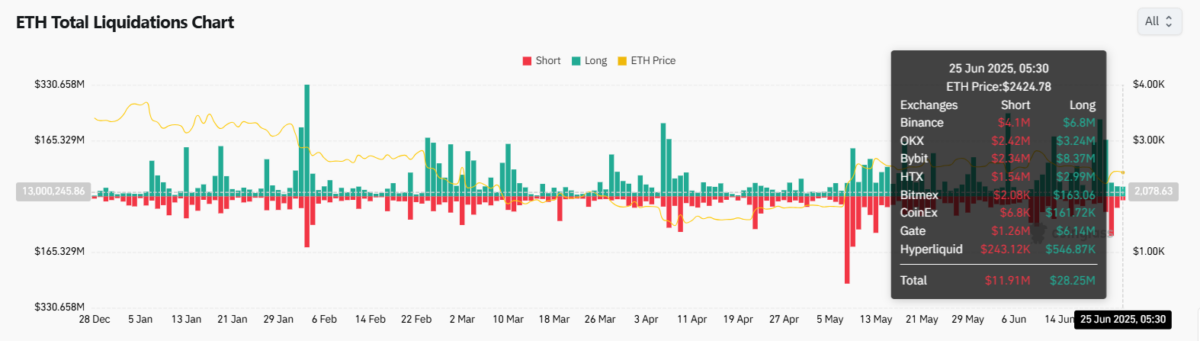

- Lengthy liquidations totaled $28.25 million versus $11.91 million in shorts, suggesting overleveraged bullish positions.

Ethereum

ETH

$2 426

24h volatility:

0.5%

Market cap:

$293.31 B

Vol. 24h:

$13.94 B

is flashing a long-term warning as its month-to-month chart reveals a double prime formation close to $4,000, a key resistance space rejected twice since 2021.

ETH worth dynamics | Supply: TradingView

The asset remains to be buying and selling above the multi-year trendline that started from the 2020 lows. Dynamic assist is seen across the 50-month EMA at $2,229, the place the latest bounce occurred. Ethereum worth is now buying and selling close to $2,424, however merchants are watching the neckline at $2,130–$2,200 for any indicators of breakdown.

Symmetrical Triangle Retains ETH Locked Under Key Resistance

ETH worth forecast | Supply: TradingView

On the each day chart, ETH stays caught inside a symmetrical triangle. Price recently rebounded from $2,220 however is capped by descending resistance at $2,520. RSI is close to 46 and MACD stays adverse, exhibiting no momentum shift but. Bollinger Bands are compressing, hinting at low volatility earlier than a possible breakout.

A decisive transfer above $2,525 might flip the pattern bullish. Till then, Ethereum worth stays in a broader vary between $2,200 and $2,870. Quantity has been muted all through, pointing to accumulation relatively than distribution.

Regardless of near-term volatility, some market individuals stay extremely optimistic. A latest projection shared by Crypto GEMs suggests Ethereum might attain $50,000 inside 5 years, based mostly on long-term channel pattern evaluation.

$ETH #Ethereum might hit $50,000 within the subsequent 5 years

???? pic.twitter.com/mKn5GuJqYa

— Crypto GEMs ???????? (@cryptogems555) June 21, 2025

Lengthy Liquidations Outpace Shorts

In accordance with liquidation knowledge, Ethereum noticed $28.25 million in lengthy liquidations over the previous day, greater than double short-side liquidations at $11.91 million.

ETH liquidation chart | Supply: Coinglass

Bybit led long-side liquidations at $8.37 million, whereas Binance topped the quick facet with $4.1 million.

These figures counsel that long-side leverage had overheated across the $2,500 mark, triggering liquidations as worth failed to increase upward.

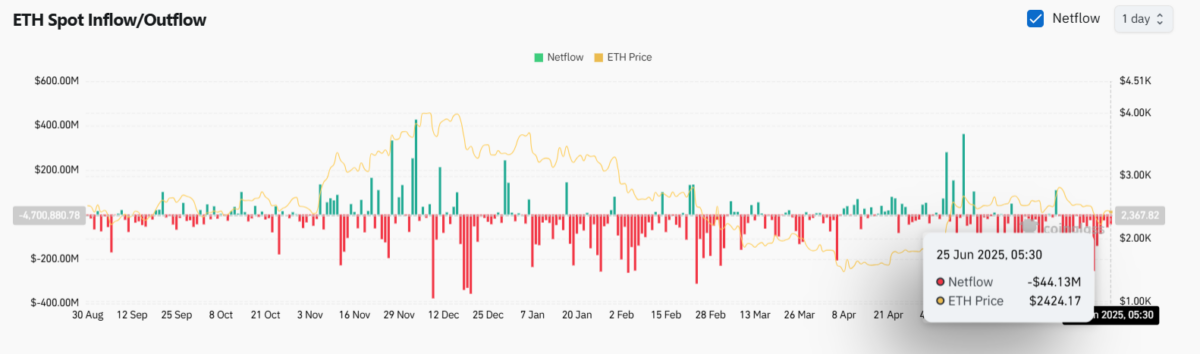

Spot Outflows Add to Brief-Time period Bearish Tone

Netflows present $44.13 million in ETH outflows from exchanges, sometimes a bullish signal. However paired with the liquidation stress and stagnant worth motion, this possible displays risk-off repositioning relatively than accumulation.

ETH internet inflows/outflows | Supply: Coinglass

Till Ethereum reclaims $2,870 or holds firmly above $2,300, the bias stays impartial to bearish within the quick time period. The month-to-month chart stays a vital inflection level, with bulls needing to defend $2,200 to take care of construction.

Ethereum just lately rebounded from $2,131 following a significant whale accumulation exceeding $8.9 million, which helped carry worth again towards the $2,400 stage.

Finest Pockets Positive factors Investor Consideration As Ethereum Consolidates

Whereas Ethereum stays range-bound, merchants searching for diversification are turning to Finest Pockets, a self-custodial app providing multichain assist, actual yield, and AI-based asset monitoring.

With over 100,000 downloads and assist for Ethereum, Solana, and BNB Chain, Finest Pockets is rising as a go-to platform for safe Web3 interplay. Be taught extra and obtain now at Best Wallet.

Disclaimer: Coinspeaker is dedicated to offering unbiased and clear reporting. This text goals to ship correct and well timed data however shouldn’t be taken as monetary or funding recommendation. Since market circumstances can change quickly, we encourage you to confirm data by yourself and seek the advice of with knowledgeable earlier than making any choices based mostly on this content material.

Parshwa Turakkhiya is a talented monetary author with a powerful background in overlaying crypto, foreign exchange, inventory markets, and world finance. With a give attention to translating advanced monetary matters into clear, actionable insights, he creates content material tailor-made to each skilled and retail buyers.