- Ethereum types a parallel upward channel as value breaks the 52 week shifting common.

- the RSI of ETH/USD is oversold as funding charges turn into typically optimistic.

The value of Ethereum [ETH] is beginning to present a transparent pattern as merchants put together for a possible bull market in late 2024 or early 2025.

On the 4-hour chart, ETH/USDT has fashioned a bear flag sample inside a rising channel, heading in the direction of the $2900 stage.

It appears seemingly that the worth of ETH will attain this provide zone, which coincides with the 200 EMA cloud on the 4-hour chart.

For a bullish pattern to solidify, ETH wants to interrupt above and keep above the 200 EMA. Whereas the general outlook is optimistic, warning is suggested if the worth stays under the $2900 mark for an prolonged interval.

Moreover, ETH value on the weekly chart is following a two-year upward pattern channel, repeatedly touching the decrease trendline and hinting at a possible rise to the $2900 stage.

At the moment, the worth is under the annual common, highlighting $2900 as a key resistance level.

The chart additionally reveals that ETH/USDT has lately damaged via the 52-week exponential shifting common however left an extended tail on the weekly candle, indicating sturdy shopping for strain.

This implies that regardless of the present value being decrease, there’s important curiosity and potential for a transfer in the direction of the $2900 mark.

Supply: Tech Charts, TradingView

Altcoins at ranges they bottomed

One other signal that ETH might rise is the present state of altcoins. They’re now at ranges much like these seen in 2020 and 2023, which marked the bottom factors for altcoins.

This implies Ethereum is likely to be approaching a backside. With market individuals feeling fearful and altcoins buying and selling at these historic lows, it’s a sign of potential alternative.

Skilled merchants typically advise being extra aggressive when the market is fearful. As retail buyers stay cautious, worthwhile merchants see this as an opportunity to speculate.

Supply: TradingView

RSI of ETH is oversold with optimistic funding charges

Wanting into the ETH/USDT value motion, RSI has dropped to the oversold zone and bounced sharply from the 30% stage.

This motion aligns with the ascending assist trendline for ETH/USD, suggesting that the worth is about to rebound from this level. This bounce may drive Ethereum’s value to new highs.

Supply: TradingView

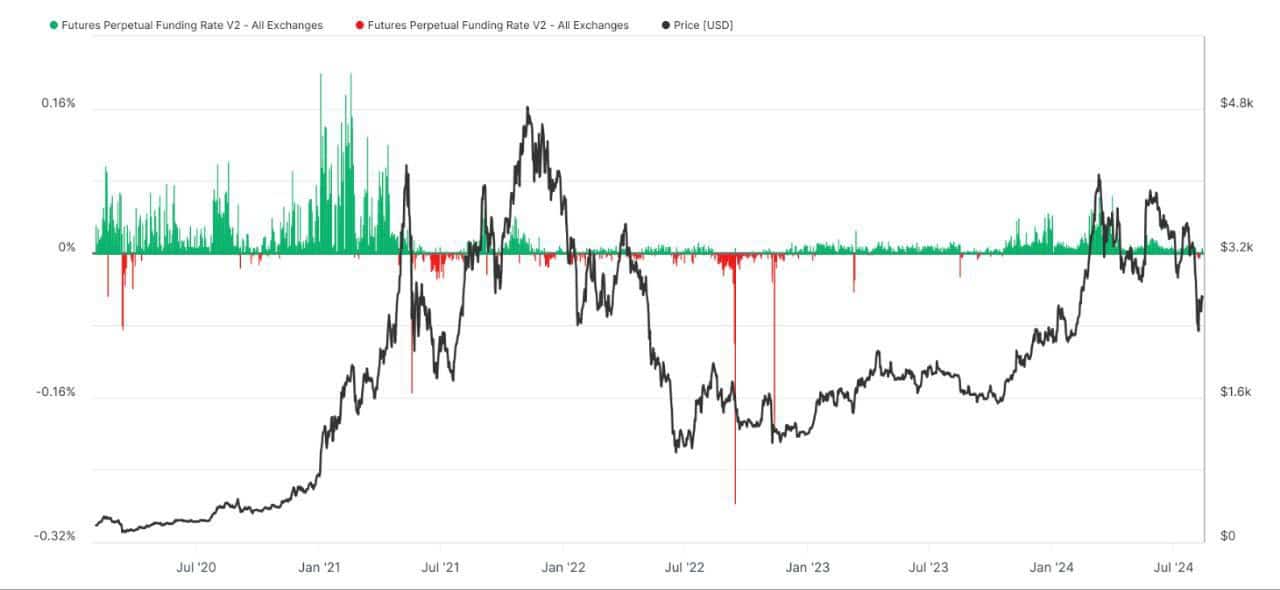

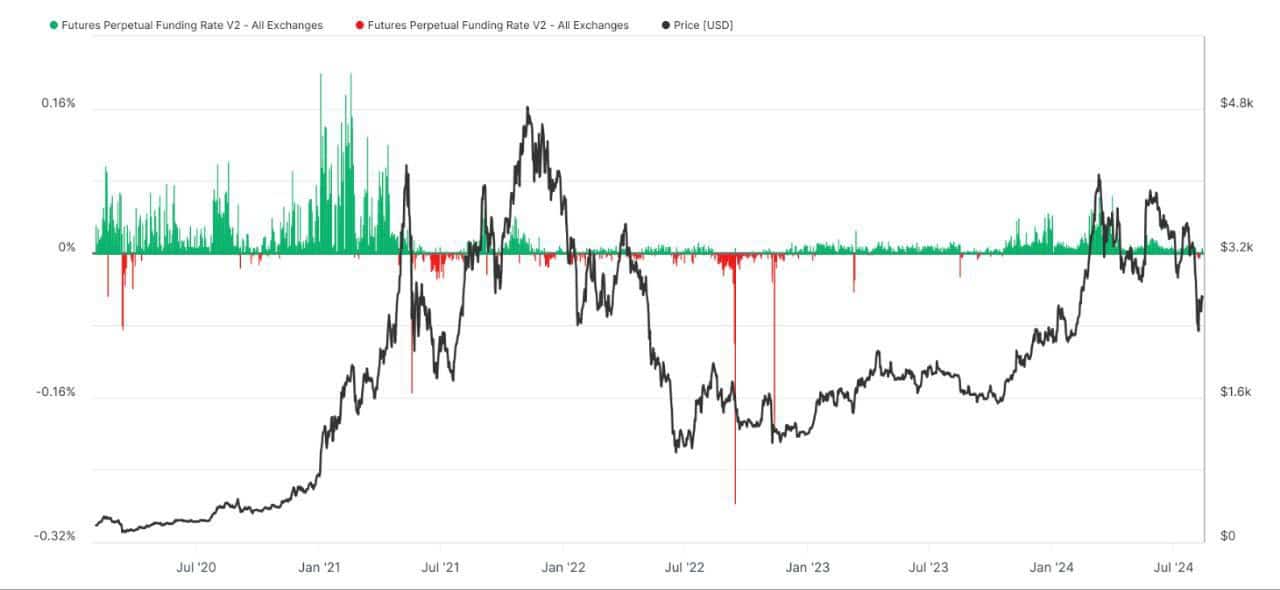

Lastly, adverse funding charges normally imply that merchants betting towards Ethereum (quick positions) are paying these betting on it (lengthy positions), indicating bearish sentiment.

Nevertheless, Glassnode knowledge reveals that in 2024, Ethereum’s funding charges have largely been optimistic, reflecting bullish expectations.

Supply: Coinglass

Learn Ethereum’s [ETH] Price Prediction 2024-2025

The latest drop in Ethereum’s value to $2,100, mixed with falling funding charges, suggests a shift in market sentiment.

Regardless of this latest decline, the general optimistic funding charges all through 2024 trace at a possible value rally within the close to future.