Key Notes

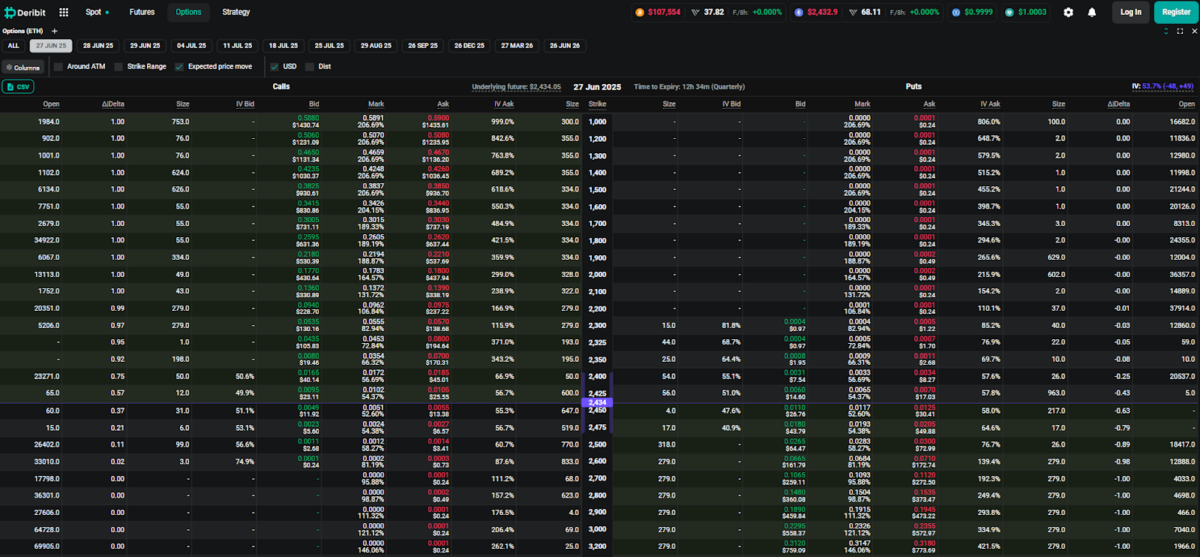

- Name choices dominate with 770 contracts at $2,500 and 647 at $2,450, indicating robust bullish sentiment amongst merchants.

- Ethereum has reclaimed the 50-day EMA at $2,425 and is testing resistance close to $2,520-$2,600 that would set off a transfer to $2,800.

- Put curiosity stays restricted with solely 665 contracts at $2,425, suggesting minimal defensive positioning forward of expiry.

Ethereum

ETH

$2 423

24h volatility:

0.5%

Market cap:

$292.68 B

Vol. 24h:

$13.68 B

is drawing robust dealer curiosity because the June 27 choices expiry nears, with open curiosity piling up at key bullish strikes.

Based on Deribit knowledge, name choices on the $2,500 and $2,450 ranges now lead with 770 and 647 contracts, respectively, marking them as probably the most lively bullish bets heading into expiry.

ETH possibility chain knowledge | Supply: Deribit

ETH value at the moment trades round $2,438, and the rising focus close to these ranges suggests merchants are positioning for a breakout. Implied volatility for at-the-money choices is hovering round 47%, whereas the $2,500 strike carries a barely elevated IV close to 56.7%. This displays expectations of short-term value motion and potential volatility spikes.

On the put facet, open curiosity is thinner by comparability. The very best focus seems at $2,425, the place 665 contracts are open, and $2,450 with 217 contracts, forming a smooth short-term assist zone. Total, positioning favors upside, with restricted defensive hedging on the draw back.

Speculative bets are additionally showing at deep out-of-the-money strikes above $3,000, with some contracts exhibiting implied volatility near 999%.

Ethereum Eyes $2,800 After EMA Reclaim

ETHUSD value dynamics | Supply: TradingView

Ethereum value just lately bounced from the $2,220–$2,250 assist space and reclaimed the 50-day EMA at $2,425. Worth is now compressing slightly below the $2,520–$2,600 resistance zone – an space that repeatedly rejected upside makes an attempt all through Could and early June.

An in depth above this resistance may set off a transfer towards $2,800 and presumably $3,100, aligning with historic provide zones and failed breakout levels. The every day RSI is at the moment flat close to 47, whereas parabolic SAR dots have flipped beneath value for the primary time in two weeks, suggesting a transition towards bullish momentum.

Volatility is increasing into expiry, with ETH value testing the median Bollinger Band round $2,518. If value breaks cleanly on quantity, the following leg may purpose for $2,793 or larger within the days following the expiry.

Going to $10,000 this cycle

U heard it right here first

???? pic.twitter.com/Y1goc5BpKQ

— Crypto GEMs ???????? (@cryptogems555) June 26, 2025

Snorter Heats Up As Ethereum Worth Eyes Breakout

As Ethereum value coils close to $2,600, meme-fueled hype is spilling into recent launches like Snorter, which is a Solana-based buying and selling bot challenge now in presale.

With over $1.3M raised and simply days left, $SNORT is gaining traction quick. Early patrons get entry at $0.0965, with staking perks and DeFi instruments inbuilt.

Disclaimer: Coinspeaker is dedicated to offering unbiased and clear reporting. This text goals to ship correct and well timed data however shouldn’t be taken as monetary or funding recommendation. Since market situations can change quickly, we encourage you to confirm data by yourself and seek the advice of with an expert earlier than making any selections based mostly on this content material.

Parshwa Turakkhiya is a talented monetary author with a powerful background in protecting crypto, foreign exchange, inventory markets, and world finance. With a deal with translating advanced monetary matters into clear, actionable insights, he creates content material tailor-made to each skilled and retail buyers.