- Intraday merchants have positioned $330 million in brief positions.

- Regardless of the bearish outlook, a crypto whale has withdrawn $5.27 million value of ETH.

Ethereum [ETH] and different cryptocurrencies have considerably tumbled following U.S. President Donald Trump’s tariff announcement.

In keeping with current knowledge, most nations will now face a ten% tariff, whereas China, the EU, and Japan had been hit tougher with tariffs of 34%, 20%, and 24%, respectively.

This improvement has brought on a pointy decline within the total cryptocurrency market.

In the meantime, Ethereum has dropped over 4.50% and was buying and selling close to the $1,800 stage at press time, which seemed to be a make-or-break level for the upcoming value ranges.

Ethereum value motion and upcoming ranges

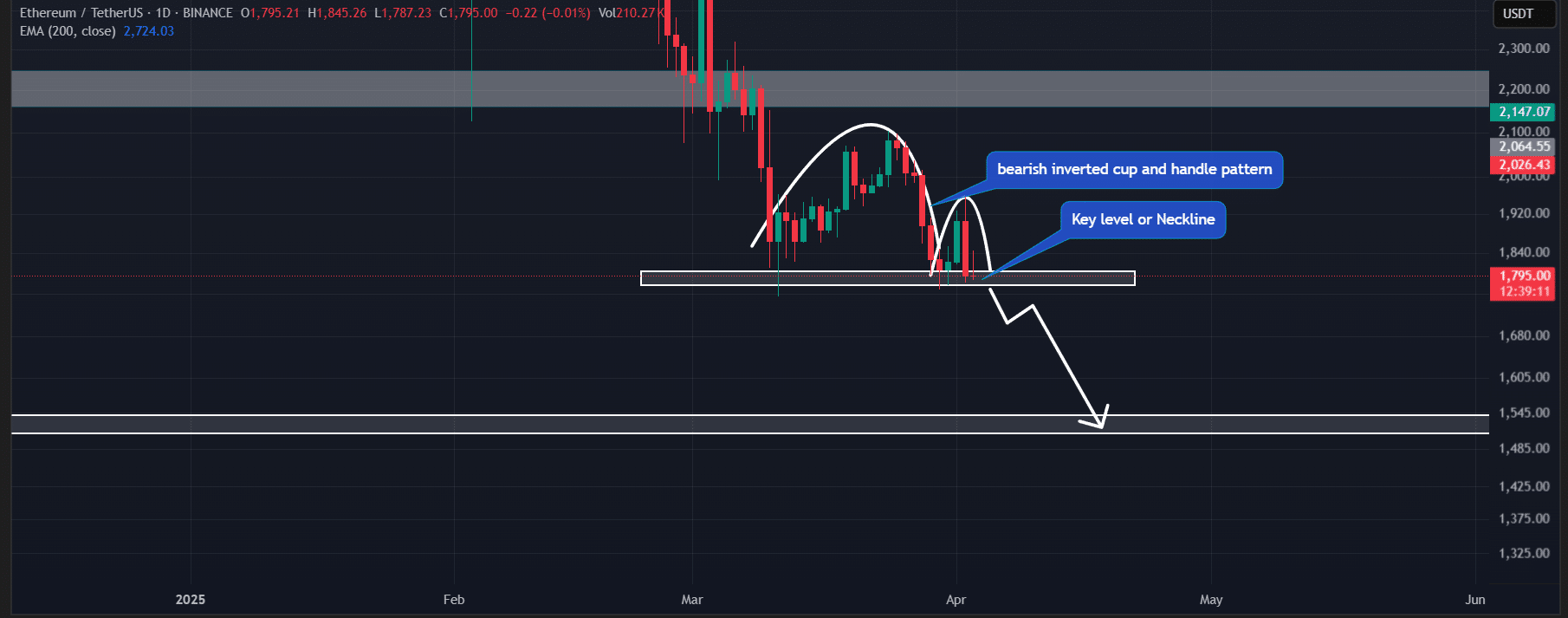

In keeping with AMBCrypto’s technical evaluation, ETH appeared bearish and was on the verge of a major value decline.

On the every day timeframe, the asset appeared to have shaped a bearish cup and deal with sample and was on the neckline.

Based mostly on historic value momentum, if ETH breaches the neckline and closes a every day candle beneath the $1,770 mark, a large sell-off may comply with.

The value may drop by 15% till ETH reaches the subsequent assist stage at $1,500.

ETH was buying and selling beneath the 200-day Exponential Transferring Common (EMA) at press time, which signaled a bearish development that additional strengthened the bearish outlook of the asset.

Whales’ current exercise

Amid this value decline and bearish market sentiment, buyers and whales gave the impression to be making the most of the dip and persevering with to build up tokens.

Lately, blockchain-based transaction tracker Lookonchain revealed on X (previously Twitter) {that a} crypto whale withdrew a major 2,774 ETH, value $5.27 million, from the Binance cryptocurrency trade.

Moreover, the identical whale has withdrawn over 16,415 ETH, value practically $43.90 million, from Binance at a mean value of $2,676.

This means a “buy-the-dip” technique, as regardless of the continued value decline, the whale seemed to be averaging their ETH holdings at decrease ranges.

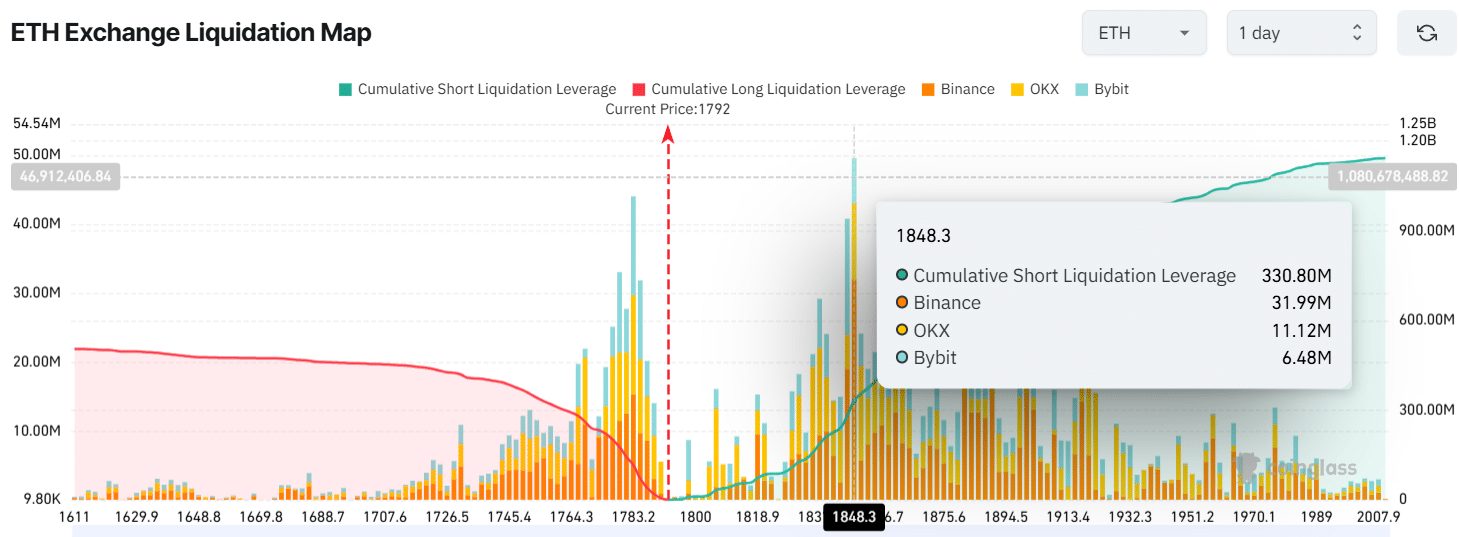

Merchants’ $330 million bearish wager

Taking a look at on-chain metrics, ETH appeared weak and poised for a value crash. Information from the on-chain analytics agency Coinglass confirmed that intraday merchants had been notably betting on the quick aspect.

At press time, merchants had been over-leveraged at $1,783 on the decrease aspect, the place they’ve constructed $115 million value of lengthy positions, whereas $1,848 is one other over-leveraged stage with $330 million value of quick positions.

These large over-leveraged positions replicate the true market sentiment, which seems bearish.