Key Notes

- ETH’s common transaction measurement surged 430% from $2,555 to $15,845, indicating elevated whale exercise and retail participation.

- Technical evaluation exhibits potential for $5,000 breakthrough if worth closes above $4,758 Bollinger Band resistance degree.

- Company treasury purchases from BitMine, Basic International, and Sharplink Gaming fueled the current worth momentum surge.

Ethereum

ETH

$4 730

24h volatility:

0.9%

Market cap:

$569.59 B

Vol. 24h:

$57.05 B

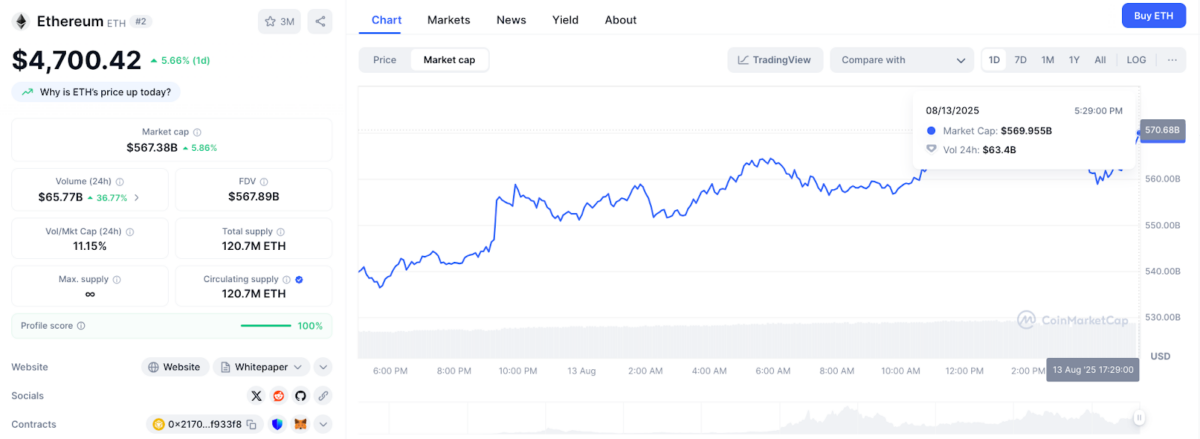

market cap reached a report $570 billion on Wednesday, Aug. 13, overtaking mega-cap shares together with Netflix and Mastercard. At press time, Netflix sits at $518.4 billion and Mastercard at $521.9 billion in market worth.

Ethereum (ETH) Value Motion, August 13, 2025 | Supply: CoinMarketCap

ETH traded round $4,700 after posting 5% intraday positive factors and a outstanding 55% rally over the previous 30 days, outperforming Bitcoin’s 2% acquire over the identical interval, according to CoinMarketCap data.

The rally has been fueled by fast Ethereum spot ETF inflows and a wave of company treasury purchases from companies akin to BitMine, Fundamental Global, and Sharplink Gaming over the previous month.

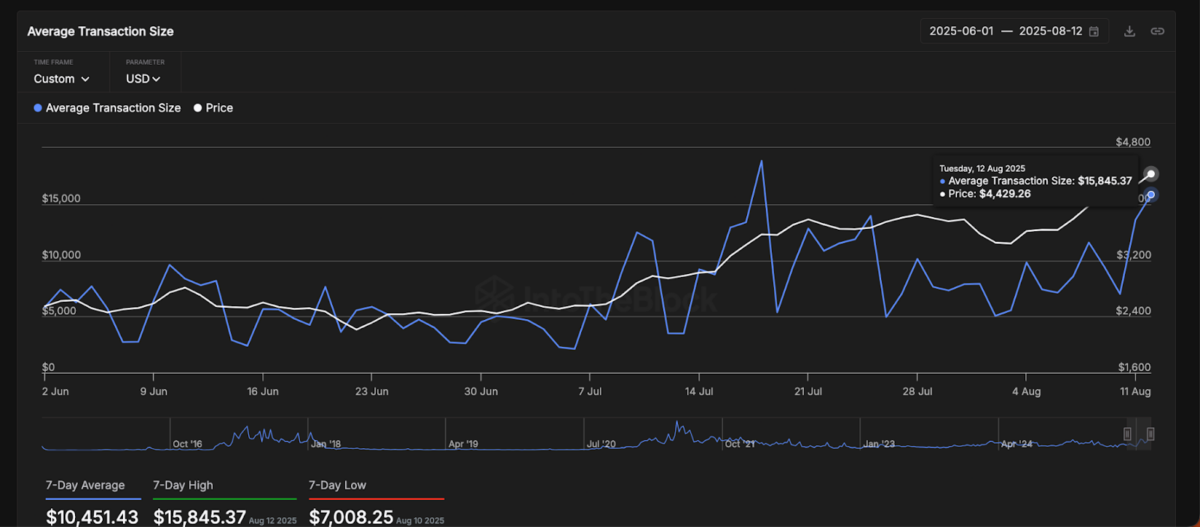

One of many strongest on-chain alerts has been the Common Transaction Measurement metric, the typical greenback worth moved per on-chain transaction. According to IntoTheBlock, Ethereum’s common transaction measurement dropped to simply $2,555 on July 6. The most recent knowledge on August 12 exhibits that it has now rocketed 430% to $15,845 per transaction.

Ethereum Common Transaction Measurement | IntoTheBlock

Such a surge is bullish for ETH because it alerts that retail merchants are upping their bets amid the fast whale purchases seen in current weeks.

With extra ETH corporate treasury fundraises announced this week, speculative merchants are prone to intensify bullish bets to front-run the upside influence of the upcoming inflows. On this situation, the sustained progress in common transaction measurement might speed up ETH’s path into new worth discovery above its $4,891 all-time excessive.

Ethereum Value Forecast: Bulls Eye $5,000 as Momentum and Quantity Speed up

From a technical perspective, ETH’s rejection at $4,734 got here because it hit the higher Bollinger Band resistance close to $4,758. A detailed above this degree would open the door towards the psychological $5,000 goal, which aligns with the subsequent psychological resistance.

RSI stands at 79.27, in overbought territory, indicating sturdy momentum but in addition elevating the danger of short-term profit-taking. The midline Bollinger Band at $3,889 serves as key help; a break beneath there would weaken the bullish construction.

Ethereum (ETH) Value Forecast | TradingView

If the Ethereum worth rally advances, a each day shut above $4,758 might ship ETH towards the $5,000 breakout goal.

On the draw back, failure to carry $4,578 (Bollinger median) might set off a drop towards $4,000 earlier than bulls regroup.

BTC Hyper Presale Positive aspects Traction as ETH Rally Lifts Layer 2 Hype

As Ethereum’s rally pushes towards its all-time excessive, merchants are additionally scouting the subsequent wave of high-growth alternatives like BTC Hyper, a promising Bitcoin Layer 2 mission.

BTC Hyper Presale

The BTC Hyper presale has already raised $9.175 million, promising instantaneous, low-cost Bitcoin transactions for funds, memecoins, and decentralized apps, alongside staking rewards of as much as 1,052%.

For merchants in search of diversification amid Ethereum’s ongoing worth rally, BTC Hyper gives publicity to Bitcoin scalability with high-yield potential. Go to the official BTC Hyper website to hitch the presale.

Disclaimer: Coinspeaker is dedicated to offering unbiased and clear reporting. This text goals to ship correct and well timed info however shouldn’t be taken as monetary or funding recommendation. Since market circumstances can change quickly, we encourage you to confirm info by yourself and seek the advice of with knowledgeable earlier than making any selections based mostly on this content material.

Ibrahim Ajibade is a seasoned analysis analyst with a background in supporting numerous Web3 startups and monetary organizations. He earned his undergraduate diploma in Economics and is at present learning for a Grasp’s in Blockchain and Distributed Ledger Applied sciences on the College of Malta.