- Ethereum’s MVRV ratio nears the “crimson field” zone, signaling potential promoting strain.

- Historic patterns recommend a correction may comply with as ETH’s overvaluation dangers enhance.

Ethereum’s [ETH] MVRV ratio is inching nearer to the dreaded “crimson field” zone — a degree traditionally linked to market pullbacks.

Because the metric teeters on the brink, merchants are on excessive alert, weighing the danger of overvaluation in opposition to the potential of sustained momentum.

With previous patterns hinting at looming promoting strain, may Ethereum’s latest features be operating on borrowed time?

Ethereum’s MVRV nears vital ranges

Ethereum’s MVRV ratio is inching nearer to the vital “crimson field” zone — the metric is hovering at round 0.88 at press time.

This has drawn consideration from merchants cautious of a possible correction. Because the ratio edges nearer to this hazard zone, issues come up over whether or not Ethereum’s present worth degree precisely displays its intrinsic worth.

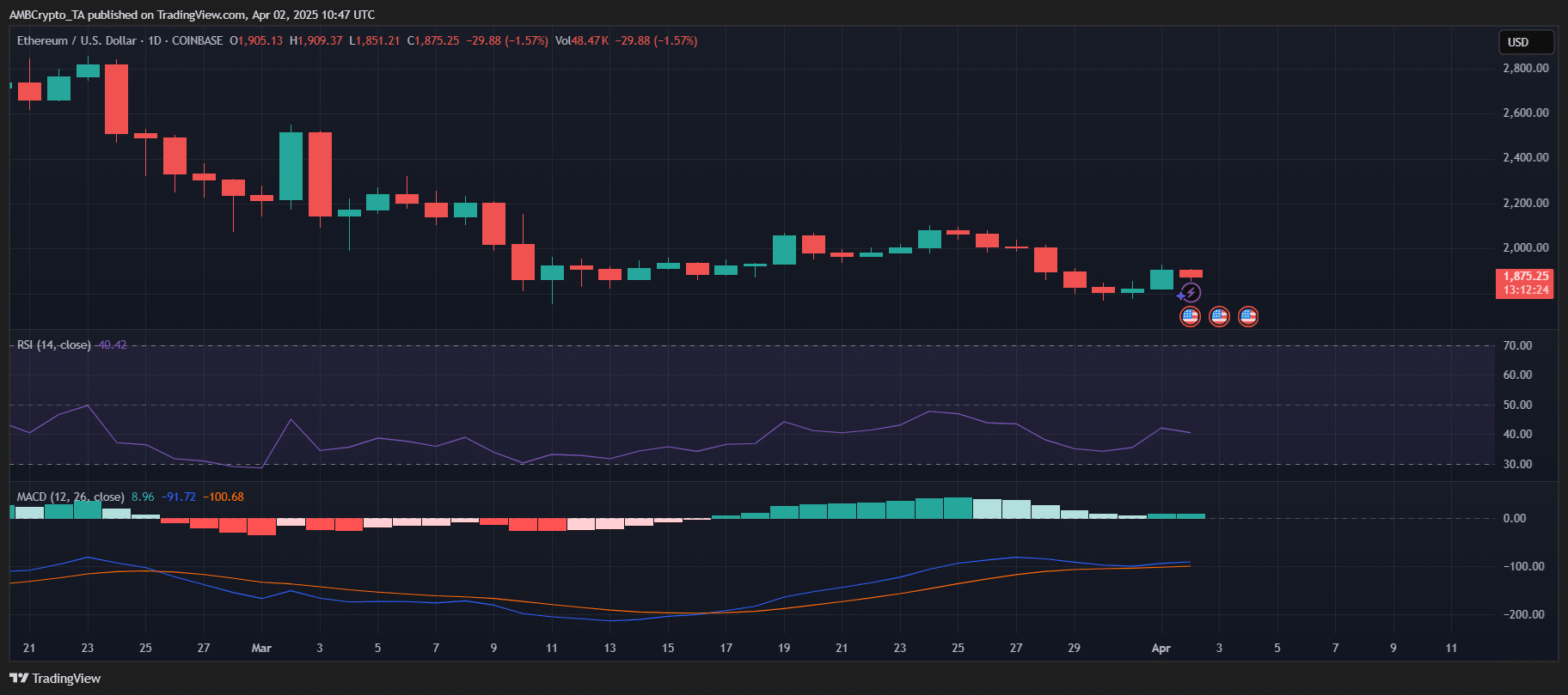

The chart reveals a latest dip after a interval of gradual restoration, suggesting the market is perhaps approaching a tipping level.

Whereas bullish sentiment persists, this MVRV motion hints that profit-taking may quickly outweigh shopping for strain.