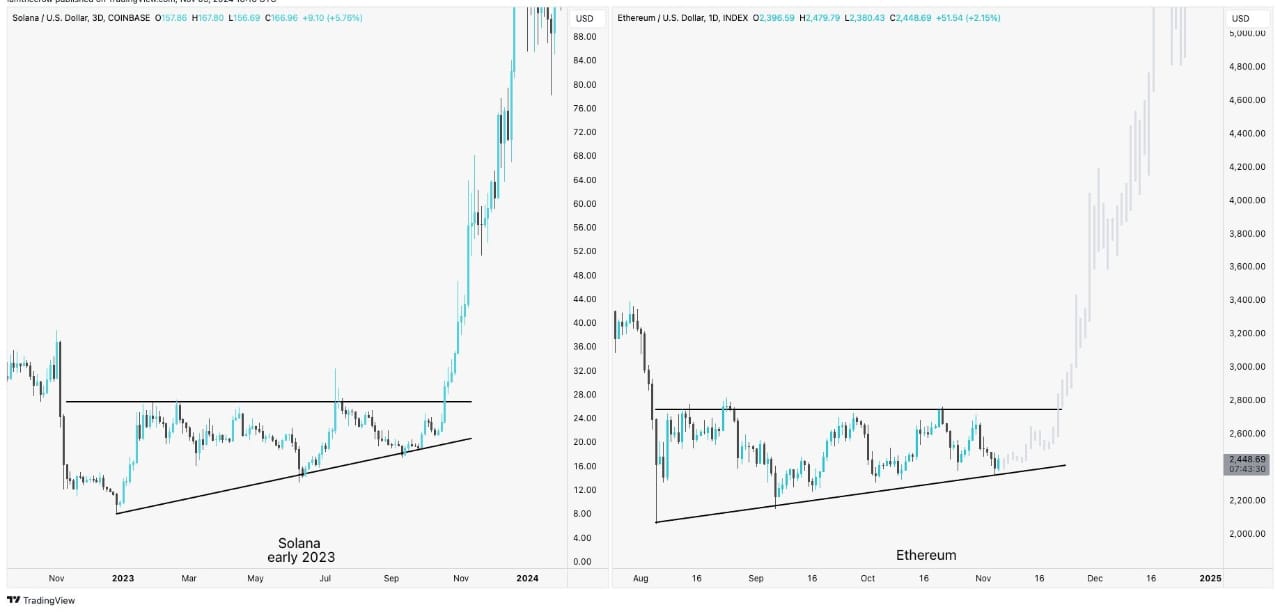

- Ethereum mirroring Solana’s precise construction, a triangle under its resistance degree.

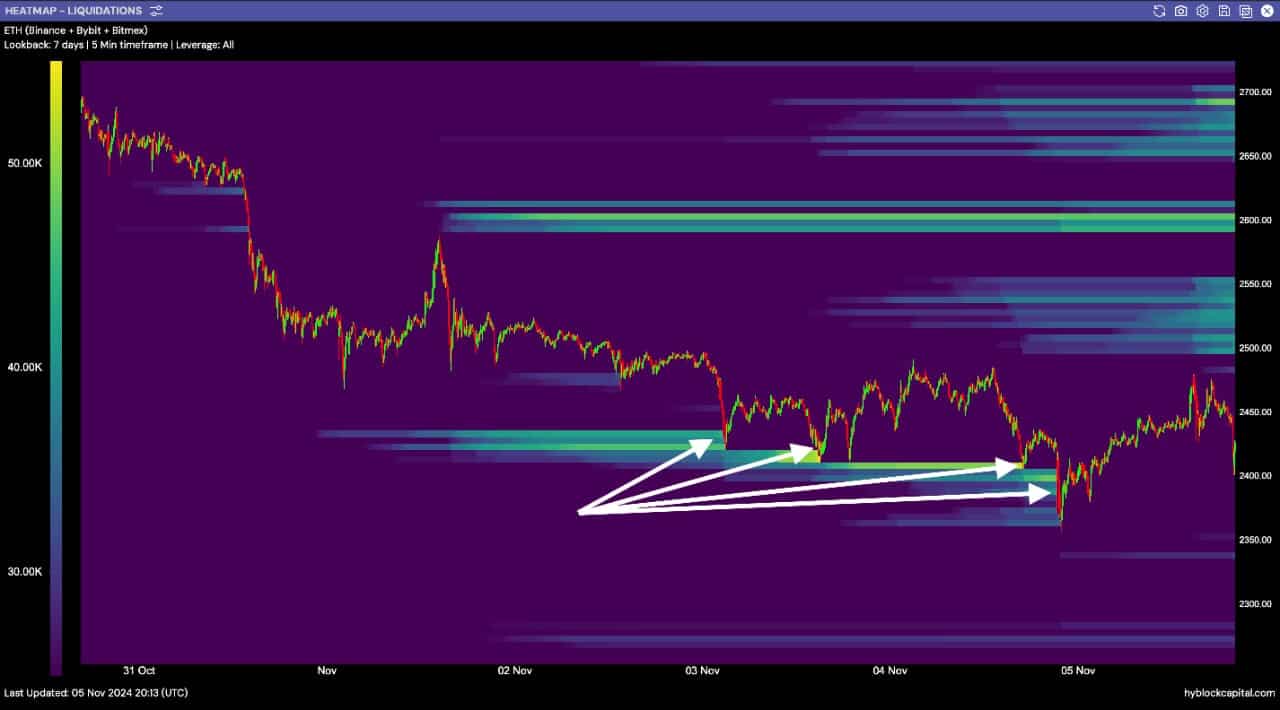

- The a number of liquidity seize that occurred on ETH might spark a rally.

The comparability of Ethereum [ETH] and Solana [SOL] charts reveal a notable similarity between the latest worth motion of ETH and that of SOL in early 2023.

Solana’s worth in early 2023 shaped an ascending triangle, consolidating beneath resistance earlier than finally breaking out, leading to a considerable rally of over 222%.

As of press time, Ethereum was mirroring this precise construction—forming an ascending triangle beneath its resistance degree, displaying comparable buildup and consolidation.

Given this sample alignment, Ethereum might probably be on the cusp of a significant bullish breakout if it follows the identical trajectory as Solana did.

The ascending triangle typically traded as a bullish continuation sample suggests a breakout might propel ETH considerably greater. Momentum indicators and dealer exercise would wish to align for ETH to attain comparable positive aspects.

Ought to Ethereum break above the present resistance zone, it’d result in a powerful rally, focusing on comparable upside percentages, positioning ETH for an additional vital uptrend.

The RSI and MACD indicators counsel…

Moreover, the Ethereum the relative energy index and transferring common divergence convergence indicators factors in direction of potential market energy.

The RSI was hovering close to a impartial to barely bullish territory, suggesting momentum might begin leaning upwards. The histogram for the MACD indicator was displaying diminishing pink bars, hinting that bearish stress could possibly be weakening.

Moreover, the MACD line seems to be nearing a crossover above the sign line, which is a typical bullish sign.

General, these indicators indicate that ETH would possibly expertise some shopping for momentum if extra fundamentals like liquidity seize and on-chain actions surge according to worth patterns.

The affect of the liquidity seize on ETH worth motion

Wanting on the ETH liquidity heatmap clearly indicated a well-recognized sample: one other day marked by a strategic liquidity seize.

Value motion constantly reached down to soak up liquidity, making a collection of wicks that advised market makers and bigger gamers had been shaking out weaker arms.

The state of affairs appeared poised for ETH to rebound after this liquidity seize, particularly as there stays a major cluster of liquidity in shut proximity above the present worth.

Learn Ethereum’s [ETH] Price Prediction 2024–2025

These greater liquidity ranges act as magnets, making it doubtless that Ethereum will purpose to maneuver upward subsequent, focusing on these areas. This might probably lead ETH to gaining comparable 222% positive aspects as SOL.

Merchants can anticipate that ETH, following this liquidity sweep, might leverage the regained momentum to climb and seize the close by liquidity swimming pools, resulting in probably bullish short-term motion.