As Ethereum (ETH) trades barely above $4,300, some crypto analysts opine that the cryptocurrency’s present pattern reveals sufficient structural well being. Nevertheless, additionally they warning {that a} lack of funding charges throughout exchanges means low demand for ETH, which can restrict its breakout momentum.

Ethereum’s Newest Rally Exhibits Structural Power

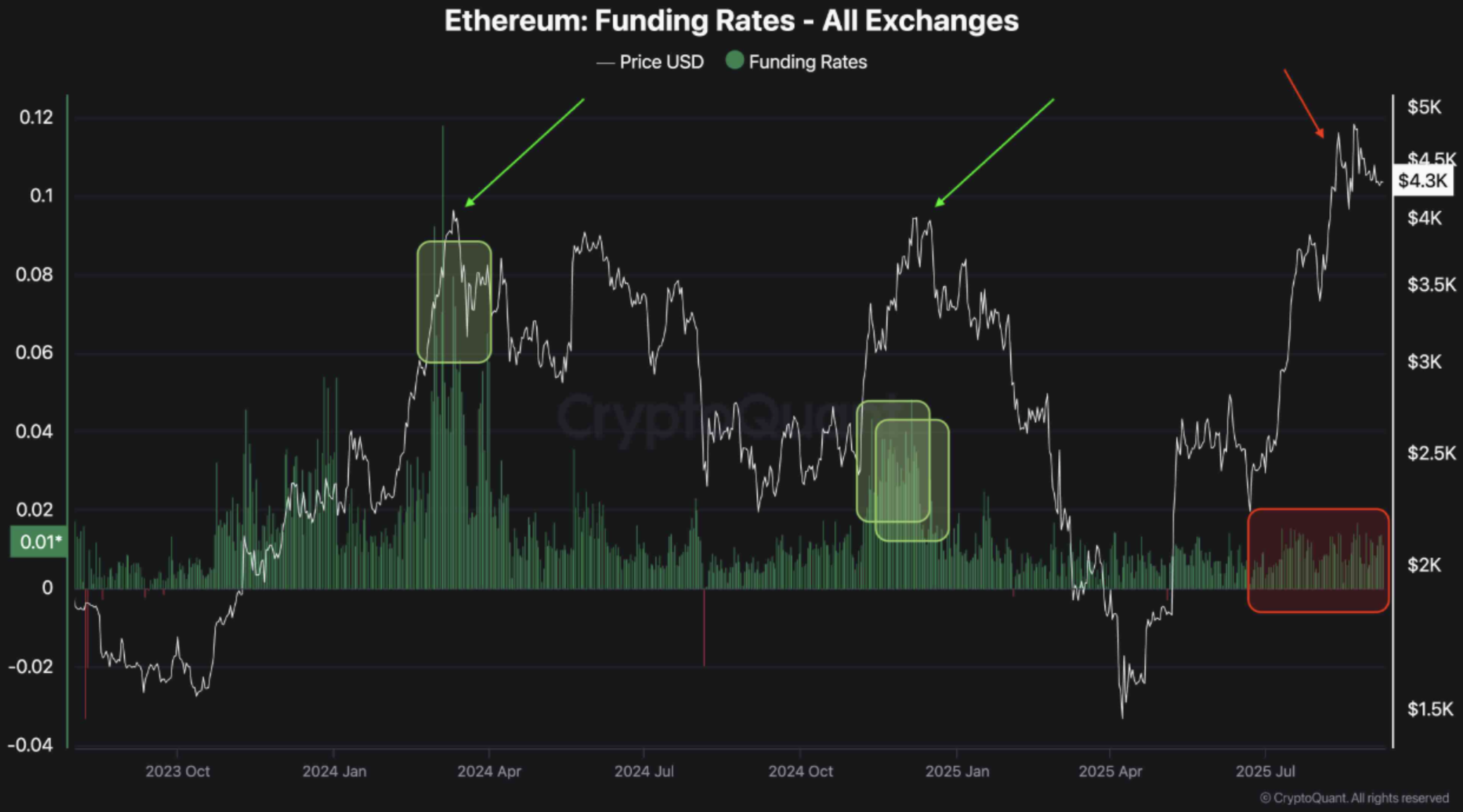

In keeping with a CryptoQuant Quicktake put up by contributor ShayanMarkets, Ethereum’s funding charges throughout exchanges are comparatively muted when in comparison with the digital asset’s final three main highs.

Associated Studying

As an example, in the course of the first main excessive in early 2024, ETH funding charges throughout crypto exchanges had surged to 0.8, suggesting extreme lengthy positioning and speculative demand. Shortly, the worth topped out as overheated leverage took its toll on the digital asset.

Through the second peak in late 2024 – as illustrated within the following chart – ETH reached related worth ranges however this time with far decrease funding charges. Though this hinted at a much less speculative market, the shortage of robust, sustained momentum finally weighed down on ETH’s worth.

In distinction to the above two situations, ETH’s 2025 rally noticed it create a brand new all-time excessive (ATH) of $4,900 – regardless of comparatively muted funding charges. This brings into focus one key divergence – ETH is hitting new highs even within the absence of aggressive lengthy positioning that fueled earlier rallies.

ShayanMarkets states there are two key implications of this new-found divergence. The analyst remarked:

On one hand, the market seems extra spot-driven and structurally more healthy, as worth is just not being pushed by extreme leverage. Then again, the absence of aggressive demand additionally limits breakout momentum, leaving ETH in a slower-moving setting the place new order movement will probably be important for continuation.

Concluding, the CryptoQuant contributor famous that ETH’s greater highs towards declining funding charges present that the present market is extra resilient towards sudden liquidation cascades. Nevertheless, it additionally requires much more conviction from patrons to maintain the following leg greater.

Is ETH Headed For A Correction?

Though ETH is at the moment buying and selling nearly 12% under its ATH, some analysts forecast that the second-largest cryptocurrency by market cap could also be headed for a correction. Crypto analyst Ted Pillows predicted that ETH might drop all the best way all the way down to $3,900 earlier than its subsequent rally.

Associated Studying

That mentioned, there are a number of different knowledge metrics that time towards a possible bullish rally for ETH. As an example, the ETH trade provide ratio on main exchanges like Binance just lately hit a low of 0.037, which can support within the so-called “provide crunch” for the digital asset.

In related information, Ethereum trade stability just lately turned destructive for the primary time, suggesting that extra tokens are being withdrawn from exchanges than deposited. At press time, ETH trades at $4,334, up 0.6% previously 24 hours.

Featured picture from Unsplash, charts from CryptoQuant and TradingView.com