Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

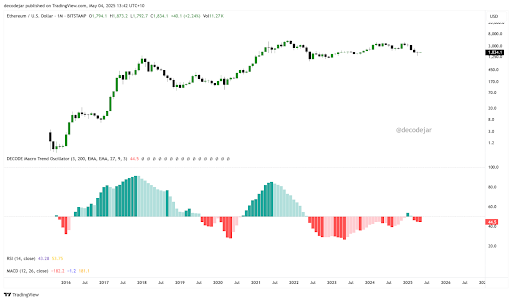

Ethereum’s value motion may have struggled to realize traction in current weeks, however an attention-grabbing long-term macro indicator is displaying signs of early recovery beneath the surface. Notably, a macro pattern oscillator created by a crypto analyst generally known as Decode on social media platform X has begun to exhibit signs of a turnaround after an unusually extended stretch of bearish run. If confirmed, this might mark the start of a brand new part of energy for the second-largest cryptocurrency by market cap.

Shallow Purple Bars Start Turning On Ethereum’s Multi-Timeframe Pattern Evaluation

The oscillator’s month-to-month chart, overlaid with Ethereum’s value information on the month-to-month candlestick timeframe, clearly exhibits how deep and sustained the current bearish momentum has been. The crimson histogram bars reflecting macro weak point endured nicely past typical durations, highlighting the broader financial drag that has weighed on the crypto market.

Associated Studying

Apparently, January of this yr briefly hinted at a return to bullish territory, however the inexperienced print turned out to be a false begin and shortly pale because the cryptocurrency kicked off one other downturn. Nevertheless, the magnitude of current crimson bars is notably shallower in comparison with downturns in 2023 and 2024.

This delicate shift is extra obvious on the decrease timeframes, notably the 3-day chart, which exhibits a clear rejection from the unfavourable territory and the formation of a small inexperienced bar earlier than the present pullback. The analyst, Decode, interprets this as a doable early-stage turnaround. As soon as the oscillator turns inexperienced in a sustained trend, a fast upward transfer in Ethereum and broader crypto costs is more likely to observe, following related transitions prior to now.

Inexperienced Section Will Dominate Quickly

Looking beyond crypto, Decode’s oscillator additionally tracks the S&P 500 and broader macro developments, the place the identical sample holds: inexperienced phases are usually not solely extra extended but additionally steeper and extra sturdy. This uneven distribution of momentum throughout time displays the true bias of belongings towards enlargement over contraction. Decode famous that this isn’t merely an indicator with arbitrary thresholds however a completely built-in macroeconomic index constructed from 17 metrics. These embody equities, bonds, commodities, foreign money flows, central financial institution liquidity (M2), and even sentiment information.

Associated Studying

Translating this into Ethereum, this gradual shift towards the inexperienced zone is seen as a sign of incoming value energy. Though Ethereum has but to completely get better from its current correction to $1,400, the delicate however constant enchancment in Decode’s macro pattern oscillator hints that the cryptocurrency could also be coming into right into a recent uptrend. Proper now, the main focus is on inexperienced bars printing constantly once more, particularly throughout a number of timeframes.

On the time of writing, Ethereum is buying and selling at $1,830. The final 24 hours have been marked by a brief break below $1,800 earlier than bouncing at $1,785. This transfer induced liquidations of roughly $35.92 million in ETH positions, with lengthy positions accounting for $28.38 million of that quantity.

Featured picture from Getty Photos, chart from Tradingview.com