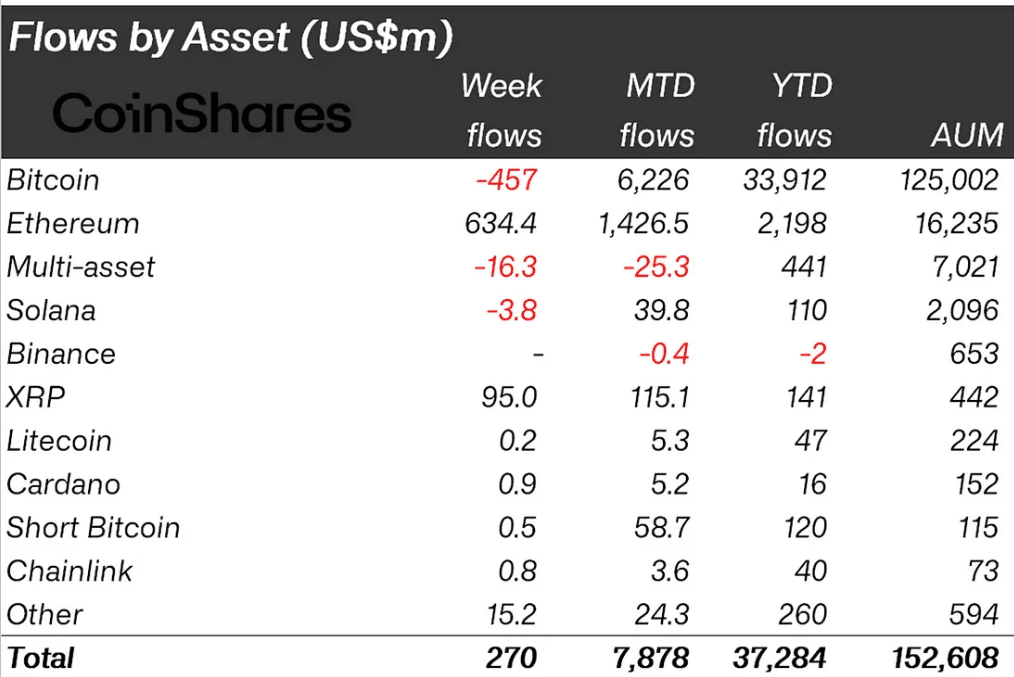

- Ethereum units a brand new year-to-date influx document at $2.2 Billion, beating its 2021 highs.

- ETH might hit $10K within the midterm if extra chain actions proceed to thrive.

Ethereum [ETH] set a brand new document for inflows, reaching $2.2B year-to-date, surpassing its earlier document of 2021.

The current inflows accounted for $634 million, indicating a major increase in investor confidence and market sentiment.

The surge was attributed to Ethereum ETFs’ robust efficiency. These ETFs have change into a most popular automobile for buyers as they provide publicity to ETH with out direct funding within the digital forex.

The rising institutional curiosity was evident as massive sums proceed to be directed in the direction of Ethereum-based funding merchandise.

Regardless of some fluctuations and market volatility, the general pattern for Ethereum appeared bullish, with the elevated institutional backing offering a strong basis for future progress.

These developments coincided with total growing inflows into crypto ETPs, with Ethereum main the way in which alongside Bitcoin.

ETH TVL and Spot ETFs inflows

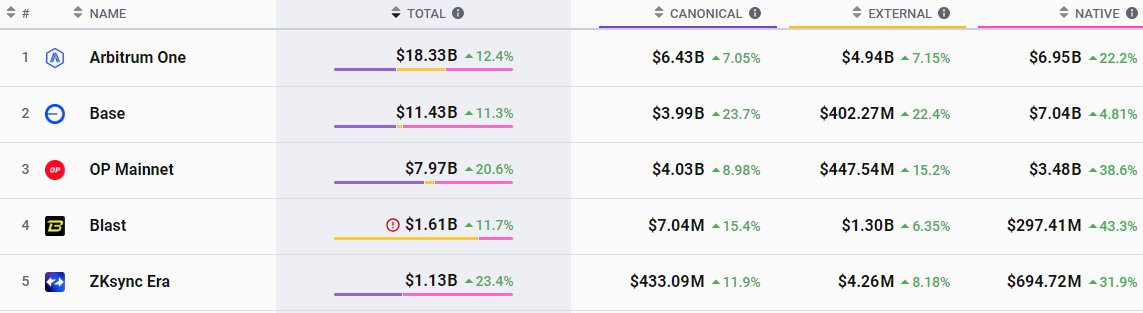

Previously week, Ethereum skilled a major inflow of $4.81 billion, resulting in a notable improve in its complete worth locked (TVL), as reported by Lookonchain.

These inflows have propelled Ethereum’s Layer-2 networks to a brand new excessive, with the mixed TVL reaching a document $51.5 billion—a 205% surge over the 12 months.

Moreover, Base’s TVL rose by $302.02 million, reflecting heightened exercise and scalability enhancements.

This document progress in DeFi TVL has not solely revisited the highs of November 2021 but additionally diversified with elevated liquid staking choices, Bitcoin DeFi integrations, and enhanced contributions from Solana and different Layer-2 networks.

Additionally, Ethereum’s spot ETFs reported a considerable web influx of $24.23 million, marking six consecutive days of constructive influx

Main the surge, BlackRock’s ETHA ETF noticed a exceptional single-day influx of $55.92 million. Equally, Constancy’s FETH ETF confirmed robust efficiency, with a web influx of $19.90 million.

Collectively, the entire web asset worth of ETH spot ETFs has reached $11.13 billion, highlighting a sustained and rising curiosity in Ethereum as a major asset within the digital forex area.

Value motion to hit $10K

These developments might push ETH to new heights, because the chart on a 3-day timeframe reveals a breakout from a consolidation triangle and a pointy surge.

Since early 2021, ETH’s worth has maintained an total bullish pattern, with some durations of corrections and consolidation.

ETH is on the verge of breaking free from a triangular sample, aiming for greater ranges with an anticipated surge in the direction of $10,000.

Learn Ethereum’s [ETH] Price Prediction 2024–2025

The uptrend, reaching barely previous $3600, steered Ethereum might doubtlessly hit $10,000 within the midterm if the chain exercise continues to thrive.

Such motion indicated robust purchaser curiosity and strong market sentiment, probably setting a brand new stage for Ethereum’s progress.