- Ethereum falls under its realized worth, signaling potential capitulation and potential market backside.

- Whale accumulation throughout Ethereum’s dip suggests a chance for long-term patrons regardless of market panic.

Ethereum [ETH] has slipped under its realized worth for the primary time since March 2023 – a degree that traditionally indicators investor capitulation and potential market bottoms.

This drop comes amid a wave of altcoin sell-offs, triggered by fading optimism from President Trump’s reciprocal tariff buzz.

With the ETH/BTC ratio at a five-year low and market sentiment tilting bearish, fears are spreading. But whereas retail buyers flee, on-chain knowledge reveals whales quietly accumulating.

Is Ethereum’s collapse a ultimate dip earlier than restoration — or the beginning of a deeper breakdown in altcoin confidence?

Ethereum: An indication of capitulation

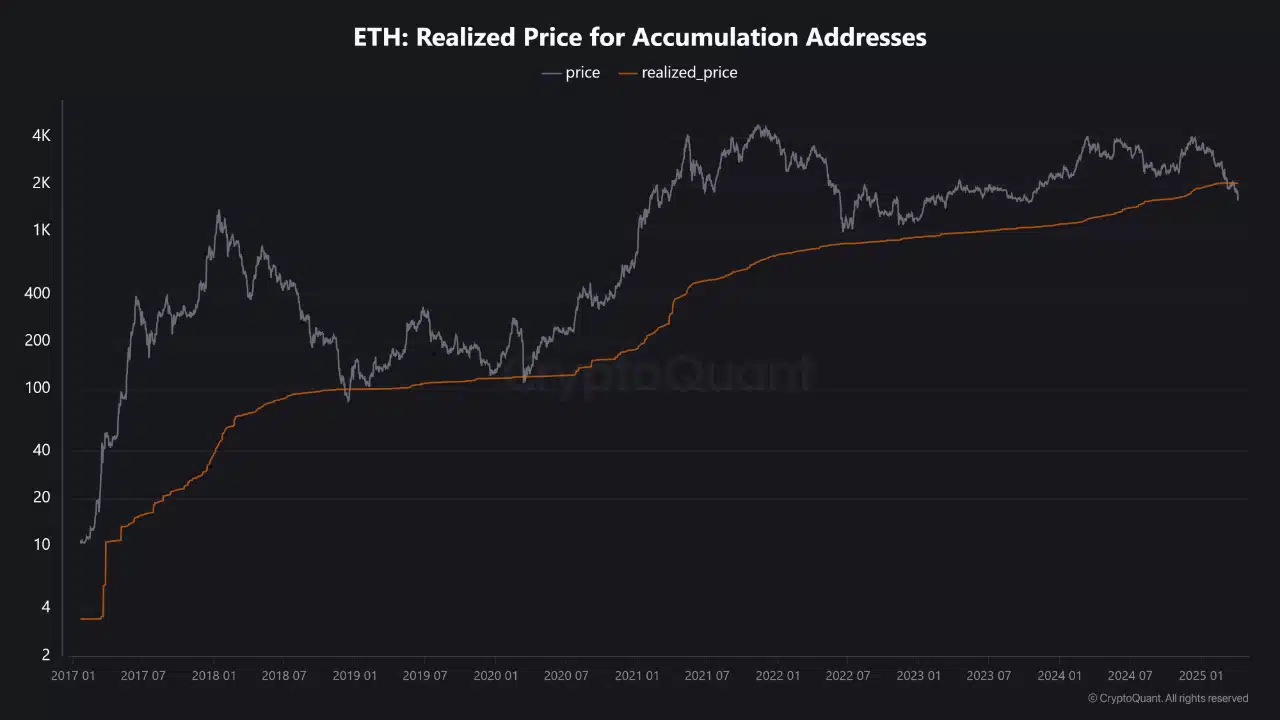

For the primary time in over a yr, Ethereum’s market worth has fallen below the realized price for accumulation addresses — a degree that sometimes indicators deep market stress.

This metric displays the common price foundation of long-term holders recognized for purchasing and holding ETH by volatility.

Such crossovers have traditionally been pivotal moments in Ethereum’s worth cycle, typically coinciding with capitulation zones and long-term bottoms.

The information exhibits ETH dipping below this key assist degree, a improvement that would both set off additional loss-driven promoting — or function a stealth purchase sign for long-term optimists.

The place panic meets alternative

Every time Ethereum has dropped under its realized worth — as seen in 2018, mid-2020, and late 2022 — it has marked the tail-end of brutal downtrends and the start of highly effective recoveries.

These dips typically sign capitulation, the place weaker palms exit and long-term believers quietly re-enter.

Whereas at the moment’s worth motion might really feel like a disaster, previous patterns recommend it may very well be a chance in disguise. Sensible cash has traditionally handled these moments as high-conviction entry factors and never exits.

If historical past repeats itself, Ethereum could also be approaching a type of uncommon accumulation home windows earlier than the following uptrend unfolds.

Whales step in

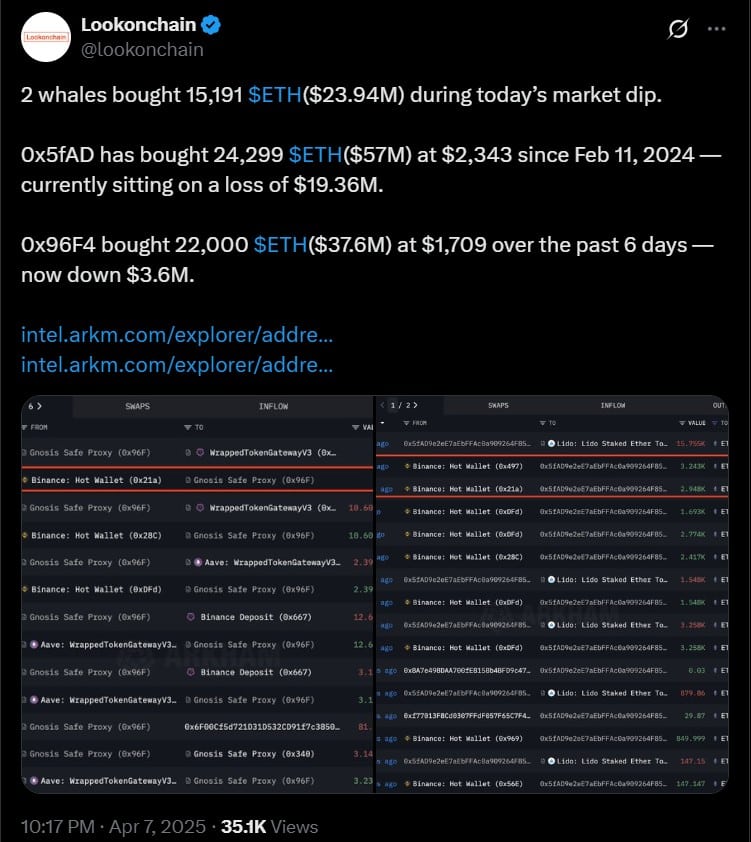

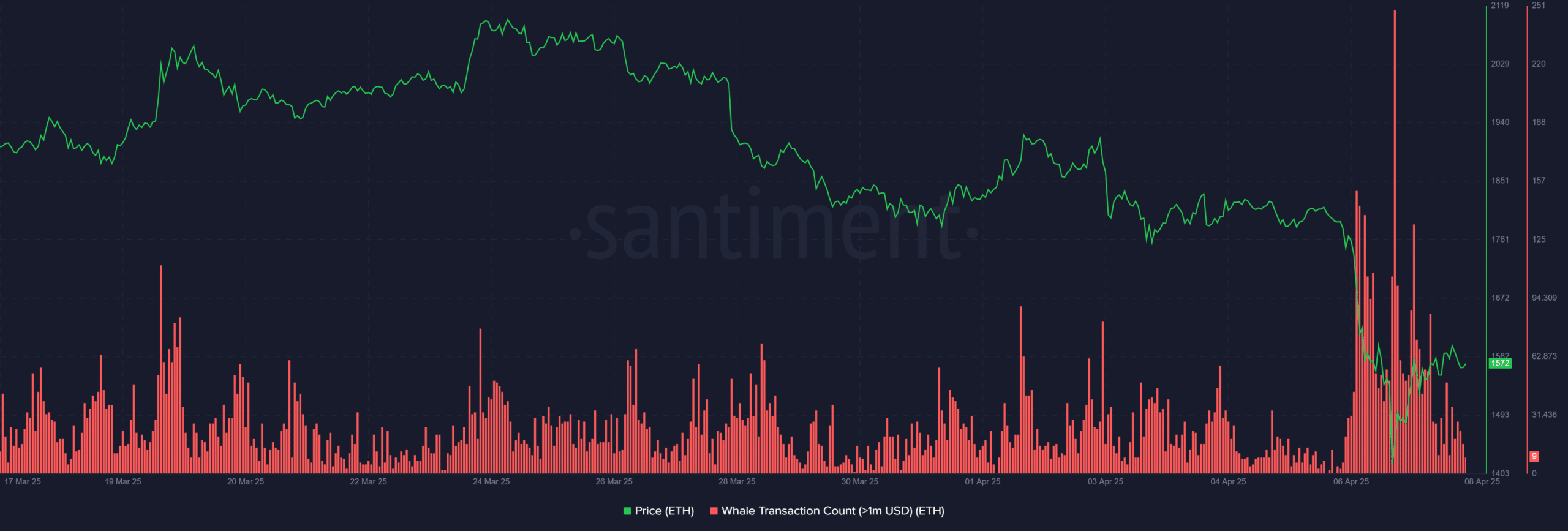

As Ethereum plunged under $1,600 on the seventh of April, whale exercise surged dramatically. On-chain data exhibits two massive entities collected 15,191 ETH — price roughly $23.94 million — amid the dip.

Santiment knowledge revealed a notable spike in whale transactions over $1 million, aligning with the worth backside.

Traditionally, such large-scale buys throughout moments of concern typically precede market stabilization or reversal.

Whereas retail sentiment stays shaky, this sort of conviction from high-cap gamers might trace that Ethereum’s present ranges are being considered as undervalued, and doubtlessly opportunistic.

Market shedding religion in Ethereum?

Ethereum’s weekly ratio towards Bitcoin has plummeted to 0.12 — ranges not seen since early 2020. The sustained downtrend, spanning over two years, indicators a deep erosion of relative energy.

As soon as hailed as Bitcoin’s main rival, ETH is now underperforming amid shifting investor choice towards BTC and newer L1s.

The breakdown suggests a structural lack of confidence in Ethereum’s narrative and utility, with no clear reversal in sight.

Until ETH reclaims key historic ranges quickly, the market might proceed rotating capital away — a sobering sign for Ethereum bulls.