- ETH has declined by 47% over the previous 12 months.

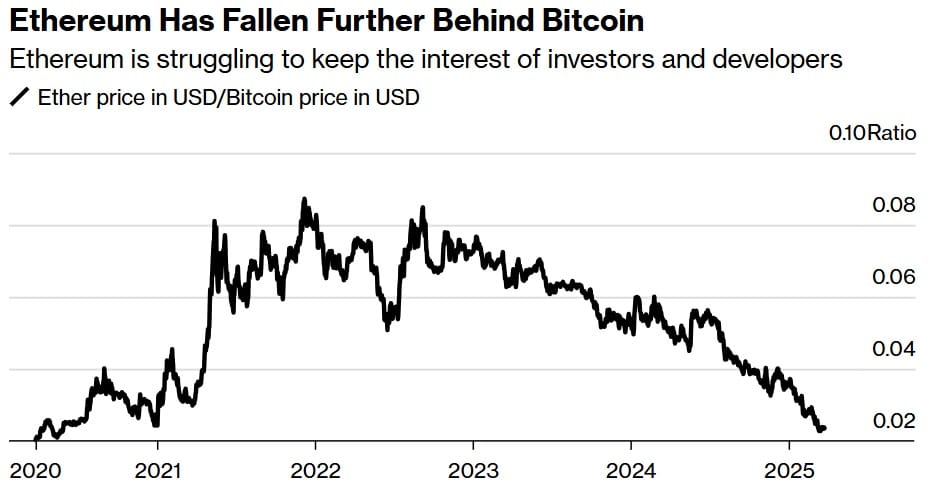

- Ethereum’s poor efficiency has left the altcoin lagging behind BTC because it slowly misplaced its lead.

Because the begin of 2025, Ethereum [ETH] has confronted important struggles. As such, the altcoin that was as soon as offered as a Bitcoin [BTC] challenger is struggling to compete with smaller cash.

This poor efficiency has caught the eye of key stakeholders, and mainstream media. As per a latest Bloomberg report, Ethereum is dealing with probably the most difficult interval because it enters its second decade of operations.

As such, Ethereum builders have been fleeing, early followers are offended, and the token has began lagging behind each BTC and its smaller opponents.

Though Ethereum stays the second-largest crypto with $221 billion in market cap, ETH has declined considerably. ETH has declined by over 44% YTD, dropping from $3.6k in January 2025 to $1.8k.

This decline has poised the altcoin for its worst quarterly drop for the reason that 2022 bear market. Over the previous 12 months, whereas BTC has surged by 30%, Ethereum has declined by 47%, and it’s slowly shedding its lead over opponents.

This has resulted in its market dominance decline to 7.9% from 17% over the previous 12 months. So, its opponents have grown at a quicker and sustained charge.

As an illustration, the variety of energetic builders on Ethereum-related software program declined by 17% in 2024. Nevertheless, its shut rival Solana [SOL] noticed a pointy enhance in energetic builders.

Thus, Solana has turn out to be a well-liked hub for memecoins with the community recording 83% year-to-year development.

That is additionally witnessed towards different cash, resembling Ripple’s XRP. Whereas ETH has declined over the previous 12 months, XRP has risen by 249% on its worth charts, with market cap rising from $30 billion to $127 billion.

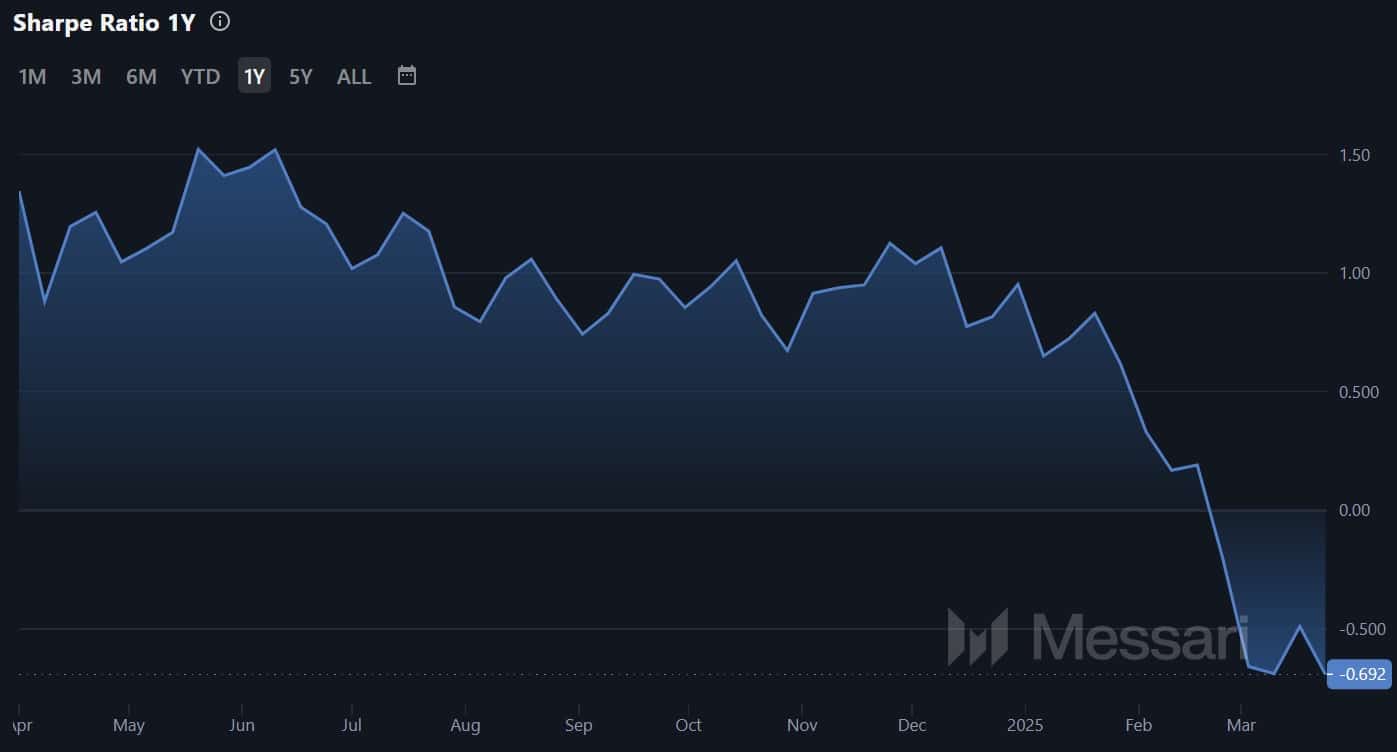

With ETH’s continued poor efficiency, the altcoin has turn out to be extremely unattractive to buyers. Taking a look at ETH’s Sharpe ratio over the previous 12 months, it has declined to -0.69.

This suggests that funding returns haven’t solely declined, but it surely has turn out to be a dangerous funding in comparison with risk-free belongings.

What’s taking place with Ethereum?

Based on key stakeholders, one of many elementary challenges affecting Ethereum is management. In his evaluation, Ryan Watkins famous that Ethereum’s management has did not capitalize on the earlier momentum.

He famous,

“It’s all about development and management — If the Ethereum ecosystem saved tempo with, or outpaced, its friends, none of those above would matter.”

This management concern was additionally famous by Bloomberg, blaming Ethereum’s founder Vitalik Buterin, failure to adapt to vary.

Underneath his management, Ethereum stays caught in early visions of decentralization failing to hitch forces with politicians, and foyer in Washington DC as different gamers be part of a pro-crypto authorities.

Buterin has remained essential of politicians, both endorsing them or any of them having crypto cash. This imaginative and prescient of a totally decentralized blockchain has left Buterin within the chilly as different gamers be part of forces with governments.

What subsequent for ETH

Based on AMBCrypto’s evaluation, Ethereum was dealing with sturdy downward strain at press time. The altcoin was buying and selling at $1839, marking a 2.11% decline over the previous day.

Equally, ETH has declined by 8.39% on weekly charts, implying sturdy unfavorable sentiments.

Taking a look at ETH’s charts, the Stoch RSI signaled a possible continuation of this downtrend. Since making a bearish crossover 5 days in the past, Stoch has dropped to 14.6 reflecting a powerful downward momentum.

Subsequently, if the exterior elements noticed above stay unfavorable, the dip might proceed. An additional drop might see ETH drop to $1761. For a bullish outlook to reemerge, ETH should reclaim and maintain above $2k.