- ETH has declined by 6.18% in 24 hours.

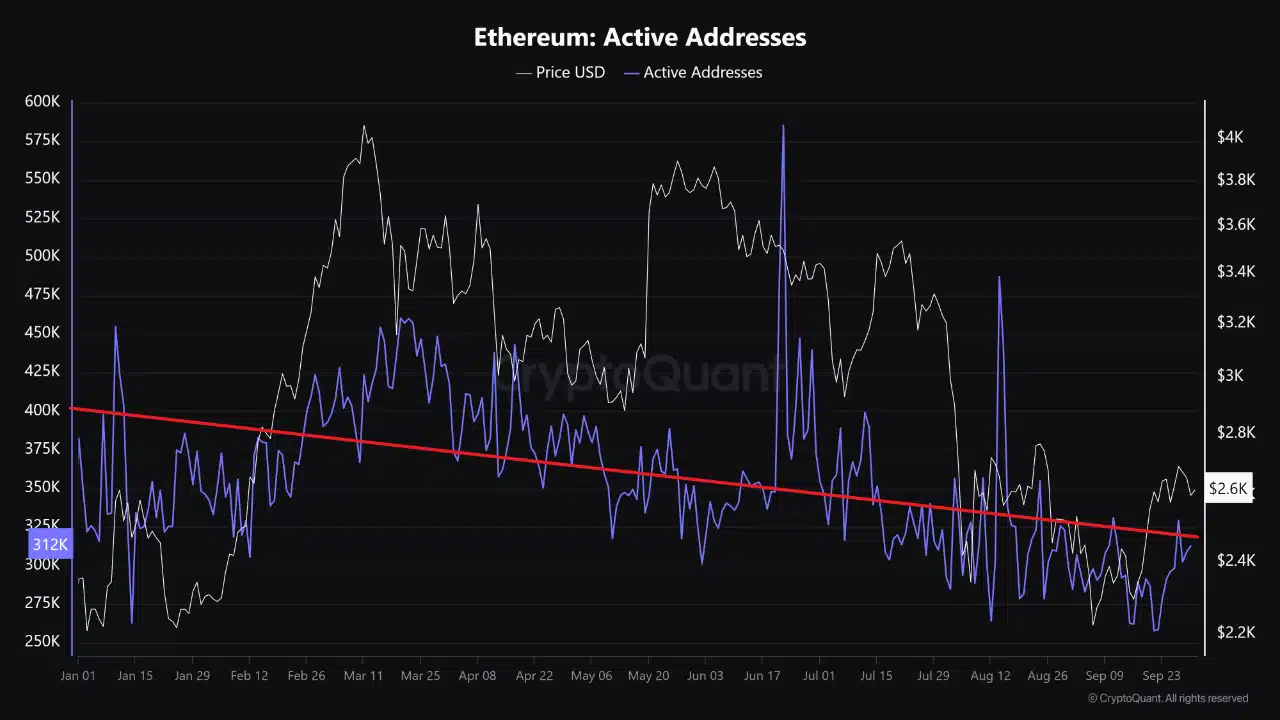

- Ethereum every day energetic addresses have declined by 18.32% from 382k to 312k YTD.

Ethereum [ETH] has skilled a pointy decline over the previous week. Over this era, ETH has declined by 5.46%. In truth, as of this writing, Ethereum was buying and selling at $2480. This marked a 6.18% decline over the previous day.

Previous to this, ETH has been on an upward trajectory climbing by 1.57% on month-to-month charts. Nevertheless, since hitting a excessive of $2729, the altcoin has failed to take care of an upward momentum. Thus, the latest losses are virtually outweighing the month-to-month beneficial properties.

The latest losses on worth charts are usually not an remoted case because the altcoin has additionally declined in different elements particularly energetic addresses.

Ethereum every day energetic addresses decline

In keeping with Cryptoquant, identical to Bitcoin [BTC], Ethereum has skilled a sustained decline in energetic addresses all year long.

Primarily based on this information, Ethereum’s every day energetic addresses have declined from a excessive of 382k to 312k.

The analysts cited the primary reason behind the decline as the shortage of recent buyers. Thus though 2024 has seen liquidity improve following the approval of Ethereum ETFs, on-chain actions doesn’t mirror it.

Equally the anticipated rally following Fed charge cuts has didn’t materialize. This market failure means no new addresses have entered the market.

Implications for ETH worth charts

Notably, a decline in every day energetic addresses as identified above normally results in worth dips.

Nevertheless, regardless of the decline in energetic addresses, the present market situation might set Ethereum for a major restoration on worth charts.

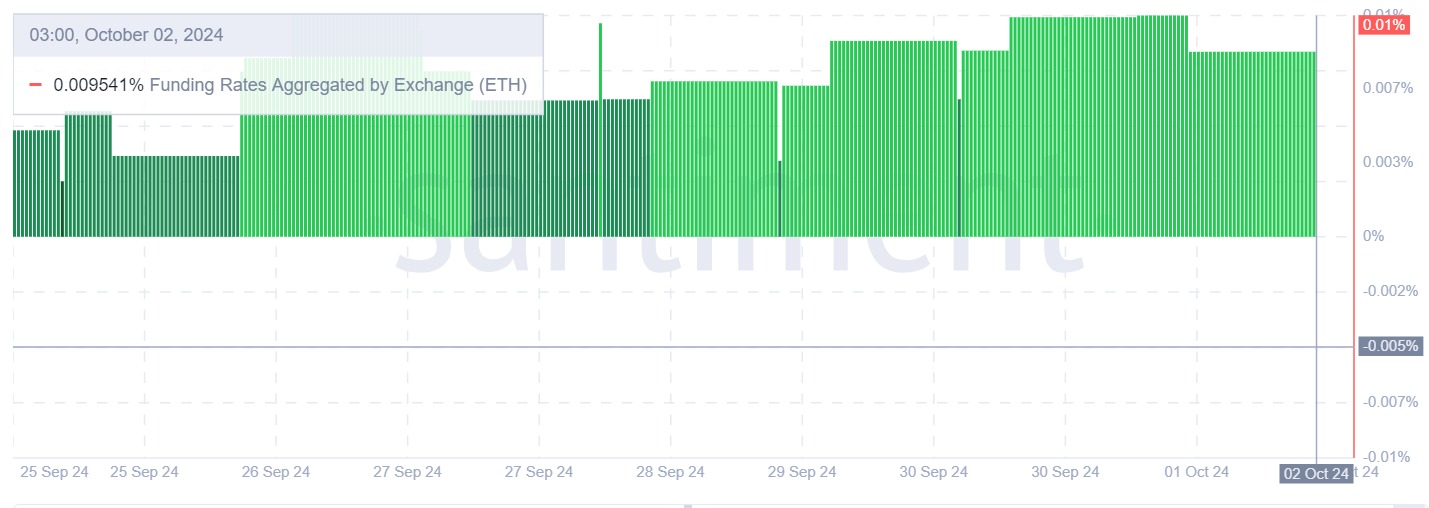

For instance, Ethereum’s funding charge aggregated by change has skilled a sustained rise remaining optimistic over the previous week. This indicators a rising demand for lengthy positions as buyers anticipate additional beneficial properties.

The truth that buyers are holding lengthy positions regardless of the worth decline suggests market confidence.

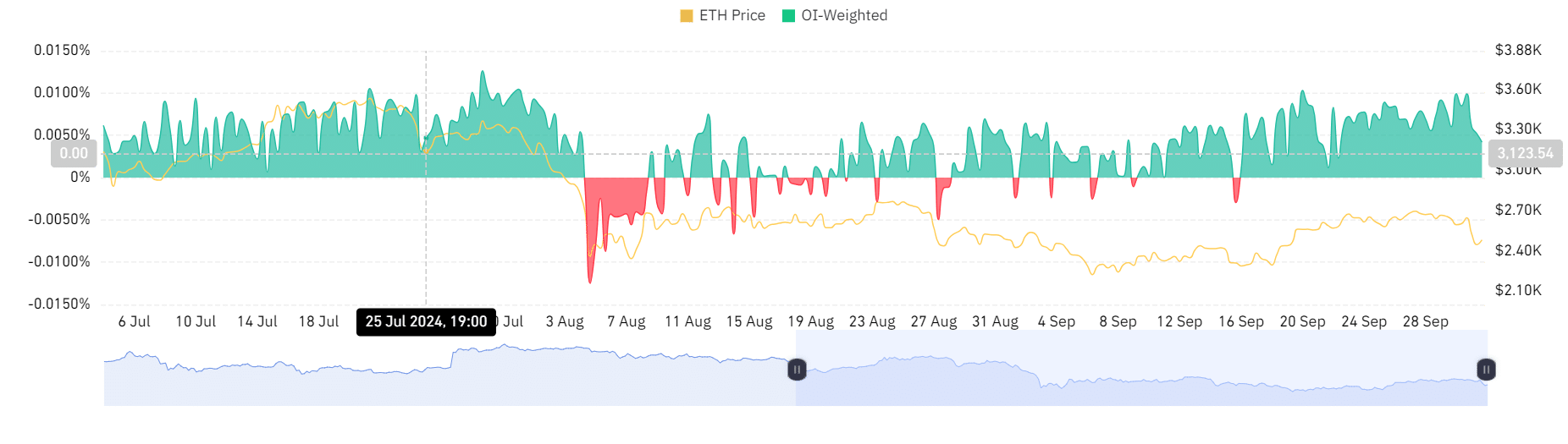

This demand for lengthy positions is additional supported by a optimistic Open Curiosity Weighted funding charge.

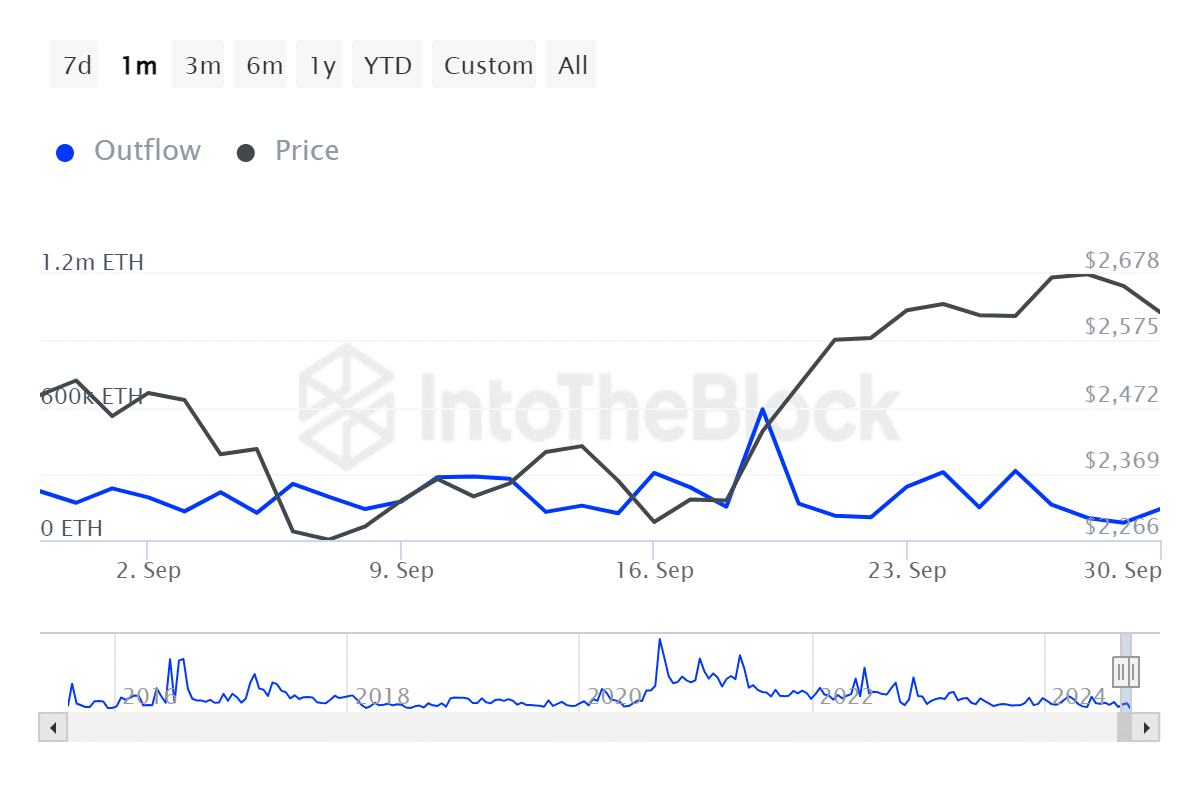

Moreover, Ethereum’s massive holders outflow has declined from a excessive of 311.95k to a low of 139.39k. This counsel that enormous holders are nonetheless accumulating their property and proceed to carry their positions regardless of market downturn.

Such holding conduct counsel confidence with the altcoin’s future.

Learn Ethereum’s [ETH] Price Prediction 2024–2025

Due to this fact, regardless of the decline in energetic addresses, ETH has proven energy on worth charts. This means that the market is having fun with general optimistic sentiment.

As such, ETH might recuperate and reclaim the following vital resistance stage at $2668. Nevertheless, if the present decline persists, ETH will discover its assist at $2728.